/International%20Paper%20Co_%20sign%20by-%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

International Paper Company (IP) is a leading pulp and paper manufacturer and one of the world’s largest producers of renewable fiber-based packaging and pulp products. Headquartered in Memphis, Tennessee, the company operates globally with a focus on sustainable packaging solutions and fiber products. International Paper’s product portfolio includes containerboard, linerboard, recycled paper, and specialty pulps used in various applications from shipping and industrial packaging to personal care products. Its market cap is around $20.6 billion.

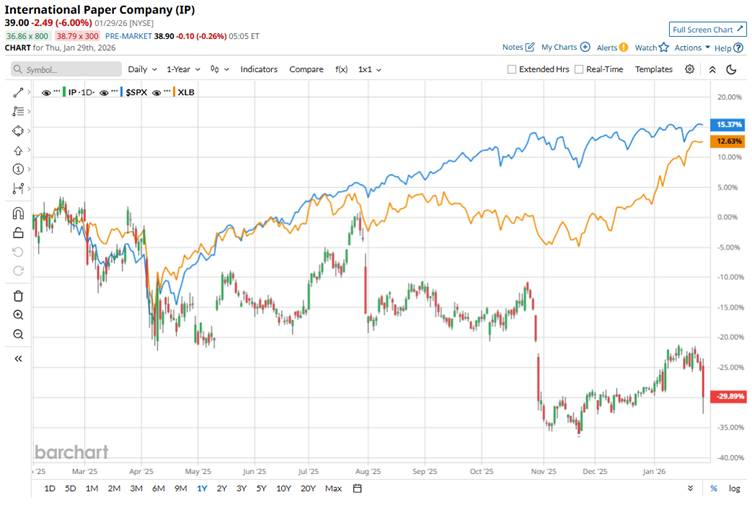

Shares of this global leader in sustainable packaging solutions have underperformed the broader market over the past year. IP has slumped 32.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. In 2026, IP is down marginally, compared to the SPX’s 1.8% gain on a YTD basis.

Zooming in further, IP’s underperformance is also apparent compared to the State Street Materials Select Sector SPDR ETF (XLB). The exchange-traded fund has gained about 12.9% over the past year and 10.3% this year.

International Paper’s share price has weakened largely due to a series of earnings disappointments and strategic challenges. The company has reported several earnings per share (EPS) misses that triggered investor sell-offs. Additionally, the announcement of a planned split into two independent public companies, while intended to sharpen focus, has also introduced short-term uncertainty and execution risk that weighed on sentiment. These factors, alongside broader market softness in packaging demand and cost pressures, have contributed to the stock’s decline.

For the current fiscal year, ending in December, analysts expect IP’s EPS to grow substantially to $2.15 on a diluted basis. However, the company’s earnings surprise history is disappointing. It missed the consensus estimate in each of the last four quarters.

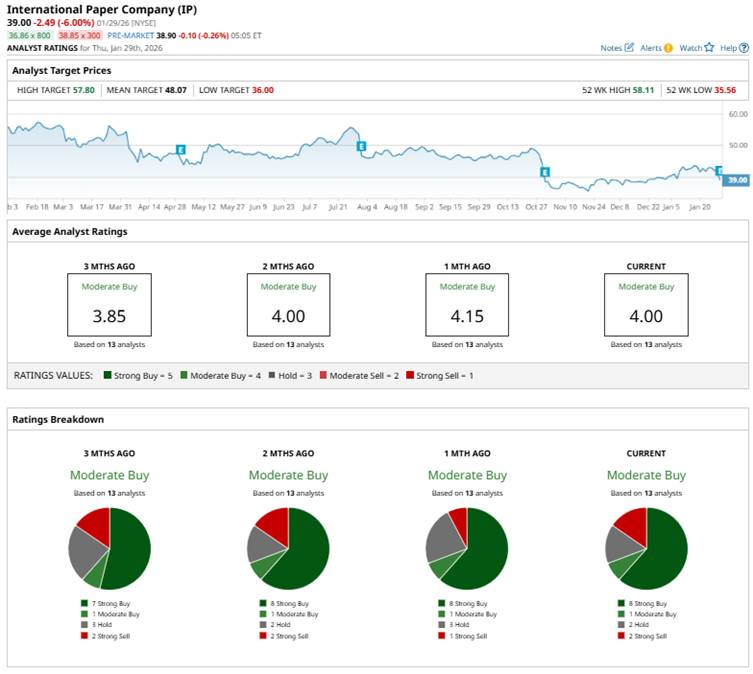

Among the 13 analysts covering the stock, the consensus is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” two “Holds,” and two “Strong Sells.”

This configuration is more bullish than three months ago, when there were seven analysts suggesting a “Strong Buy.”

Recently, RBC Capital trimmed its price target on International Paper to $54 from $55 but reiterated an “Outperform” rating.

The mean price target of $48.07 represents a 23.3% premium to IP’s current price levels. The Street-high price target of $57.80 suggests an ambitious upside potential of 48.2%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)