BitMine Immersion Technologies (BMNR) has mirrored the pioneering crypto treasury strategy blazed by Strategy (MSTR), formerly known as MicroStrategy, which transformed corporate balance sheets by amassing Bitcoin (BTCUSD) as a reserve asset. However, BMNR diverged by focusing on Ethereum (ETHUSD), leveraging its proof-of-stake network for potential yields through staking and DeFi applications.

This shift propelled BMNR’s stock in 2025, surging over 600% in just six months amid Ethereum’s rally and broader crypto enthusiasm. Yet, despite remaining 250% above its pre-transition trading levels, the shares have plummeted 83% from their 52-week high of $161, reflecting the brutal crypto downturn.

As Ethereum's price continues to tank, down nearly 7% in the last day to around $2,735, BMNR continues its aggressive accumulation, betting on a rebound while exposing itself to heightened volatility.

About BitMine Immersion Stock

BitMine Immersion Technologies, headquartered in Las Vegas, operates as a blockchain technology company specializing in Ethereum treasury management. The firm acquires, holds, and manages ETH as its core reserve asset, while providing digital ecosystem services like consulting, advisory, and staking solutions. It also engages in BTC-related activities, such as equipment leasing and hosting, but is winding down self-mining to focus on treasury optimization.

BMNR’s ETH-centric strategy could outshine MSTR’s BTC focus due to Ethereum’s utility beyond mere store-of-value. ETH enables staking for yields (currently around 2.8%) and participation in DeFi, potentially generating recurring revenue streams that are absent in Bitcoin.

In 2026, BMNR’s stock is down 6.7% year-to-date, lagging the S&P 500 Index’s ($SPX) 1.4% gain. However, it is down less than Ethereum’s sharper 7.5% drop, highlighting BMNR’s resilience amid market headwinds.

BitMine trades at a price-to-sales ratio of 2,211x, significantly above its historical average and dramatically exceeding industry norms for financial tech firms (typically 5x to 10x). This elevated P/S suggests euphoria for future revenue growth from staking but also signals extreme overvaluation amid ongoing losses.

Conversely, its price-book ratio of 1.11x is well below the U.S. software industry average of 3.4, indicating undervaluation relative to assets, primarily its ETH holdings. With a negative P/E due to unprofitability, BMNR appears overvalued overall. Undervalued on balance sheet strength but overvalued on sales multiples, making it a speculative play tied to crypto recovery.

BitMine Keeps Betting Big on Ethereum

BitMine Immersion recently executed its largest Ethereum purchase of 2026, acquiring 40,302 ETH valued at approximately $116 million. This addition boosted its total holdings to 4,243,338 ETH, worth about $12.05 billion at current prices, representing 3.52% of Ethereum’s total supply of 120.69 million tokens. The firm has staked over 2 million ETH, aiming to launch its Made-in-America Validator Network (MAVAN) in Q1 2026 for enhanced yields. This aggressive buying persists despite ETH’s price tumbling below $3,000, as BitMine aims to account for 5% of the total supply.

Crypto treasury companies like BMNR and MSTR embody high-risk investments. They amplify exposure through leverage, often funding purchases via debt or equity issuance, which can lead to dilution -- as seen in BMNR's recent share authorization expansion.

Shareholders also face amplified volatility; if crypto prices crash, the stock suffers more than the underlying asset due to operational costs and premium pricing. Investors might fare better buying ETH directly, avoiding corporate overhead and governance risks. Direct ownership provides pure price exposure, staking rewards without intermediary fees, and liquidity unhindered by stock market dynamics.

The ongoing crypto winter, marked by regulatory scrutiny, macroeconomic pressures, and waning retail interest, poses existential threats. Ethereum’s price has slumped amid broader market fatigue, with no quick rebound in sight. BMNR’s survival hinges on its cash reserves ($887 million recently) and staking income potential ($374 million annually at full scale). However, prolonged downturns could erode its holdings’ value, force fire sales, or trigger insolvency if funding dries up.

Unlike diversified firms, BMNR’s fate is tethered to ETH, meaning a multi-year bear market might outlast its runway, rendering it a cautionary tale for crypto-tied equities.

What Do Analysts Expect For BitMine Immersion Stock?

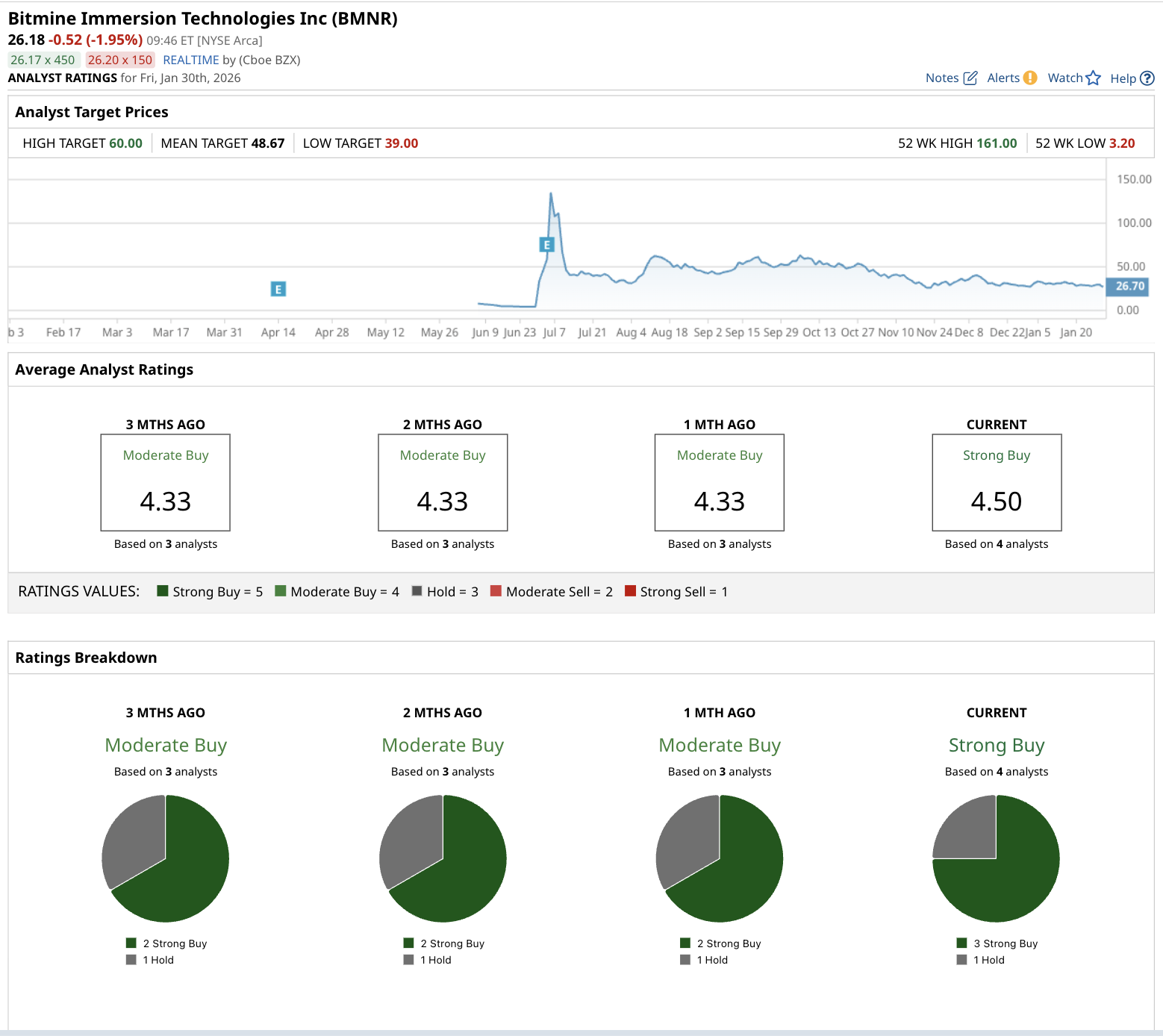

Consensus analyst ratings for BMNR, however, stand at “Strong Buy,” albeit based on coverage from just four analysts. Still, three analysts rate it a “Strong Buy” and one has a “Hold” rating.

This marks a notable upgrade in recent months as three months ago, the consensus was a “Moderate Buy” from three analysts, improving as an additional analyst joined and sentiment strengthened amid BMNR’s staking progress and holdings growth.

Its mean target of $48.67 represents potential upside of 95% from the current share price of around $25. This optimistic outlook reflects expectations for Ethereum’s recovery and BMNR’s revenue from staking, though risks like crypto volatility temper projections.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)