/AI%20(artificial%20intelligence)/AI%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

The artificial intelligence (AI) boom isn’t being slowed by chips, software, or demand. It’s being slowed by something far more basic: a thirst for water.

In this Market on Close clip, Barchart’s Senior Market Strategist John Rowland, CMT, explains why the next phase of AI infrastructure investing won’t be about who builds the fastest model — but who can actually get data centers approved, cooled, and sustained in the real world.

That’s where water and waste management quietly move from “boring utilities” to critical AI infrastructure.

The Problem Big Tech Didn’t Price In

As AI data centers expand, local communities are pushing back. The NIMBY (“Not In My Backyard”) movement has become a real obstacle, with concerns around water usage, environmental impact, and long-term strain on local infrastructure.

Microsoft (MSFT) acknowledged this reality earlier this month, publicly committing to being a “better partner” to communities. That includes responsible water usage, infrastructure investment, and direct financial support to gain approval for new builds.

This matters because AI data centers cannot operate without massive water usage for cooling. The chips may be ready — but without water access, the projects stop.

Why This Shifts the Investment Opportunity

Rather than chasing mega-cap tech or broad indexes, John’s approach focuses on who benefits from this forced spending.

Instead of buying a generic water utility, the focus is on companies whose revenue growth is tied directly to filtration, recycling, and waste systems — the equipment data centers actually need to operate under tighter community and environmental scrutiny.

This is the “picks and shovels” framework applied to AI infrastructure.

1 Etf with Diversified Exposure to the Theme

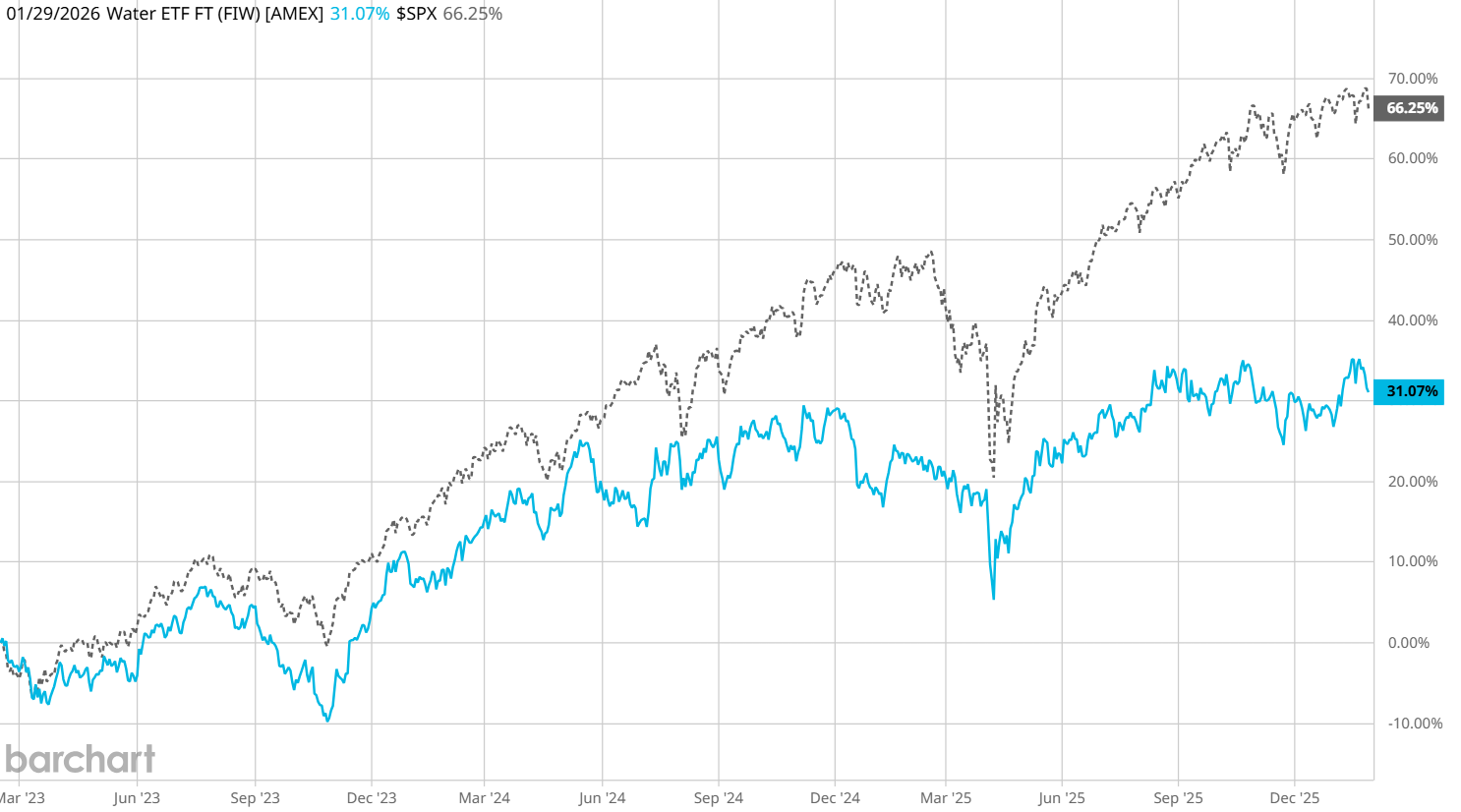

One investment John highlighted to express this theme is the First Trust Water ETF (FIW).

FIW isn’t a local water distributor ETF. Its holdings focus on companies involved in water treatment, filtration, recycling, and waste management — exactly the areas under pressure as data centers scale.

Technically, FIW has been range-bound relative to the S&P 500 Index ($SPX), but has recently turned positive. John notes that a breakout above the $116 area would further strengthen the case, but even before that, it offers diversified exposure to a theme the market is only beginning to price in.

Watts Water: A Direct Beneficiary

Within FIW’s constituents, Watts Water Technologies (WTS) stands out.

These are not “AI stocks” in the headline sense. Watts makes the valves, filtration systems, and flow-control equipment that enable large-scale industrial and data center operations to function efficiently and sustainably.

On a long-term weekly chart, WTS shows the kind of structural strength John looks for — a stock that has compounded quietly for years, largely outside the major indexes, and tied to unavoidable infrastructure demand.

This is exactly the type of leadership John is targeting as mega-cap indexes stall and capital looks for new homes.

The Bigger Takeaway

This isn’t about predicting AI demand. That part is already obvious.

The edge comes from understanding what must be built next for AI to keep growing, and who gets paid to make that possible.

Water, recycling, and waste management aren’t optional. If data centers can’t solve those issues, they don’t get built.

That’s why this trade sits at the intersection of AI growth, infrastructure spending, and mid-cap leadership — far away from crowded narratives and index concentration.

Watch the clip to hear John’s thesis:

- Stream the full episode of Market on Close

- Read the original analysis from John Rowland

- Sign up to be notified when Market on Close goes live

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)