With a market cap of $197.5 billion, The Walt Disney Company (DIS) is a global entertainment leader operating across the Americas, Europe, and the Asia Pacific through its Entertainment, Sports, and Experiences segments. It creates and distributes film, television, streaming, sports content, and immersive experiences through iconic brands, platforms, and theme parks worldwide.

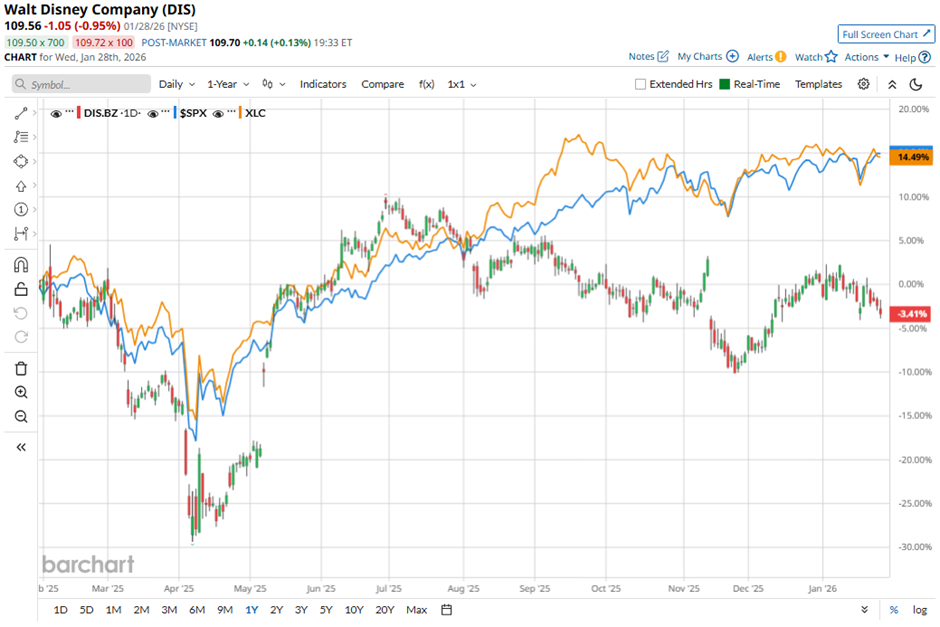

Shares of the Burbank, California-based company have lagged behind the broader market over the past 52 weeks. DIS stock has dropped 2.3% over this time frame, while the broader S&P 500 Index ($SPX) has returned 15%. In addition, shares of the company are down 3.7% on a YTD basis, compared to SPX’s 1.9% rise.

Moreover, shares of the entertainment company have underperformed the State Street Communication Services Select Sector SPDR ETF’s (XLC) 15.1% increase over the past 52 weeks.

Despite posting better-than-expected Q4 2025 adjusted EPS of $1.11, Disney shares tumbled 7.8% on Nov. 13, 2025, as the company missed revenue expectations with $22.46 billion. Investors were alarmed by the YouTube TV blackout, which threatens a major distribution channel with about 10 million subscribers, and Morgan Stanley estimated a 14-day outage could cost Disney $60 million in revenue.

Ongoing weakness in the traditional TV unit, where profit fell 21% to $391 million, along with a one-third drop in entertainment operating income, overshadowed strength in streaming and parks.

For the fiscal year ending in September 2026, analysts expect DIS' adjusted EPS to grow nearly 11% year-over-year to $6.58. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

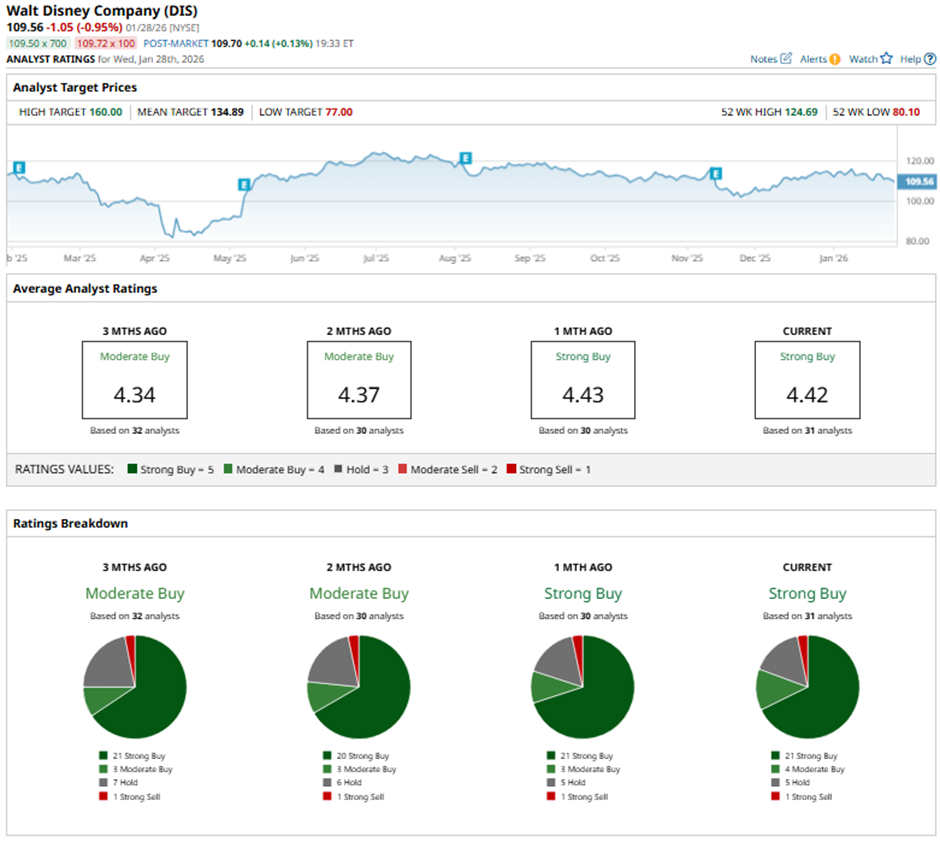

Among the 31 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 21 “Strong Buy” ratings, four “Moderate Buys,” five “Holds,” and one “Strong Sell.”

On Jan. 27, David Karnovsky of J.P. Morgan reiterated a “Buy” rating on Disney with a price target of $138.

The mean price target of $134.89, representing a premium of 23.1% to DIS' current price. The Street-high price target of $160 suggests a 46% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)