/Uber%20Technologies%20Inc%20logo%20on%20phone-by%20DenPhotos%20via%20Shutterstock.jpg)

Valued at a market cap of $168.8 billion, Uber Technologies, Inc. (UBER) is a technology company that operates a multi-sided platform connecting consumers with independent drivers, couriers, and merchants. The San Francisco, California-based company’s core businesses include mobility, delivery, freight, and retail.

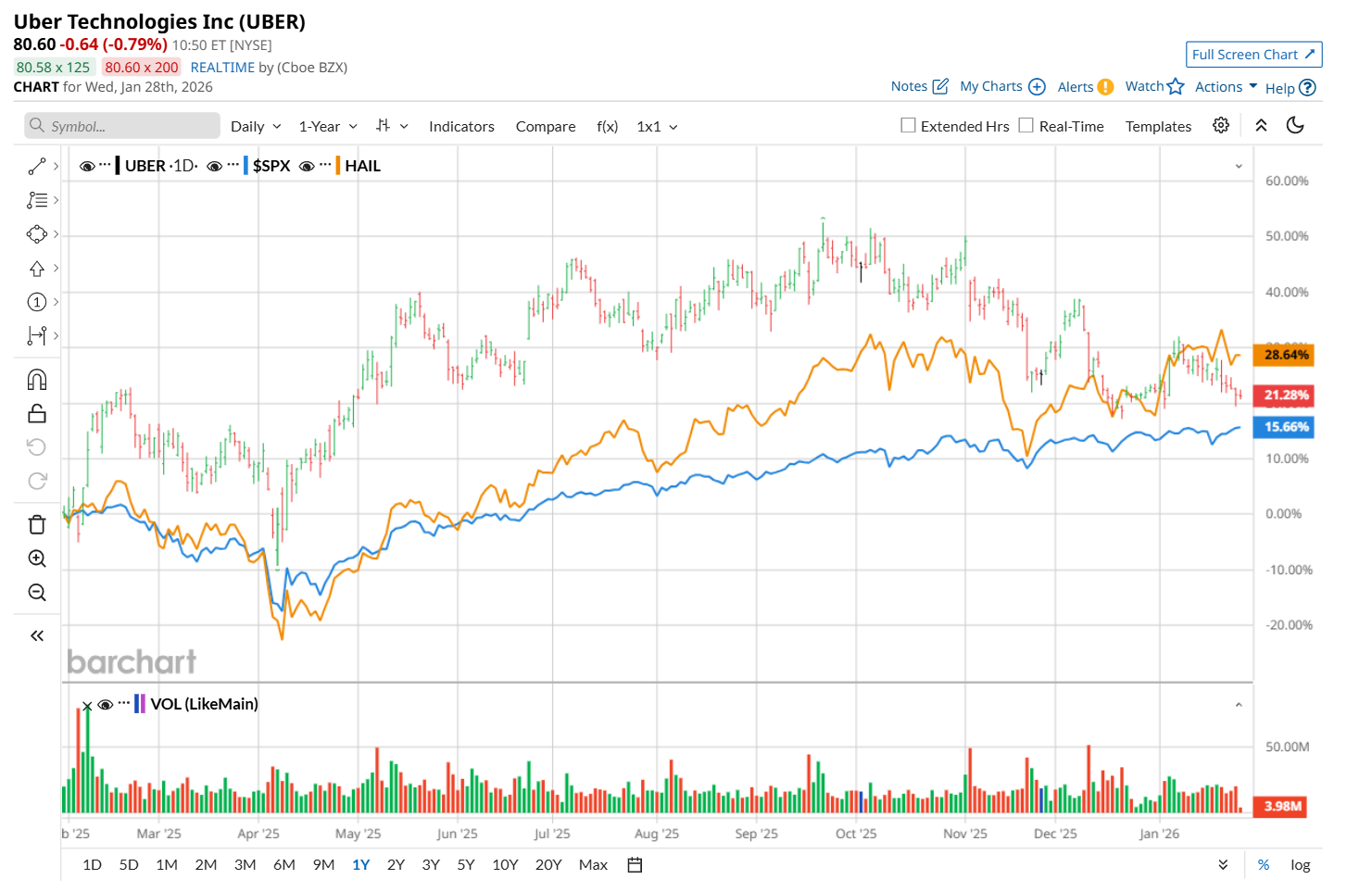

This mobility company has outperformed the broader market over the past 52 weeks. Shares of UBER have surged 19.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. However, on a YTD basis, the stock is down marginally, lagging behind SPX’s 1.9% return.

Narrowing the focus, UBER has trailed behind the State Street SPDR S&P Kensho Smart Mobility ETF (HAIL), which rose 28.3% over the past 52 weeks and 9.3% on a YTD rise.

On Jan. 6, shares of UBER surged almost 6% after the company announced the renewal of its strategic mapping partnership with TomTom and introduced its new robotaxi service. Under the renewed agreement, Uber will continue to leverage TomTom’s maps and location technology across its global platform to enhance routing efficiency, fare calculations, and the accuracy of pickup and drop-off locations.

For the current fiscal year, ending in December, analysts expect UBER’s EPS to grow 18.6% year over year to $5.41. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

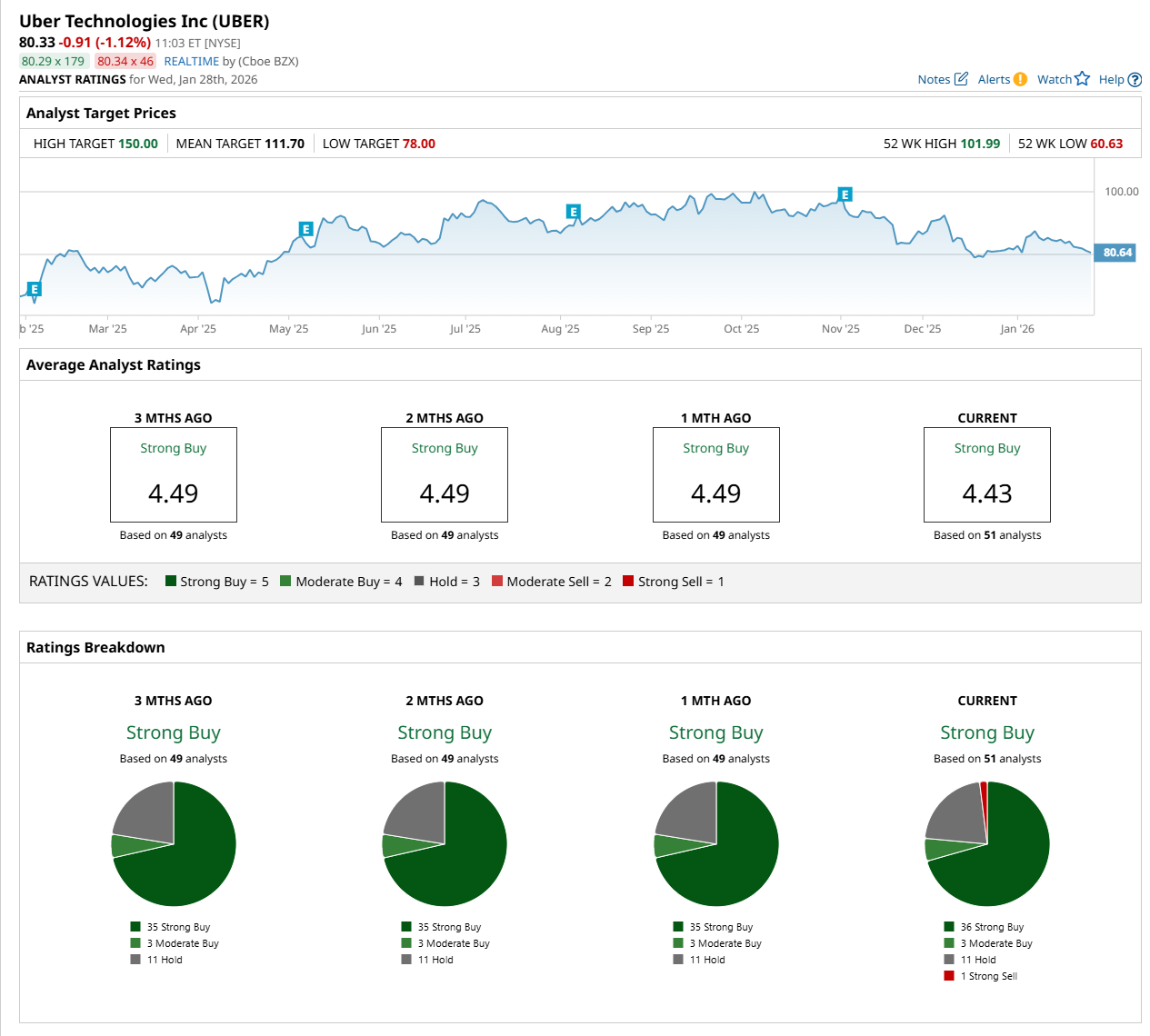

Among the 51 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 36 “Strong Buy,” three "Moderate Buy,” 11 “Hold,” and one “Strong Sell” ratings.

The configuration is slightly more bullish than a month ago, with 35 analysts recommending a “Strong Buy” rating.

On Jan. 27, Piper Sandler Companies (PIPR) analyst Thomas Champion maintained a "Buy" rating on UBER and set a price target of $110, indicating a 36.9% potential upside from the current levels.

The mean price target of $111.70 represents a 39.1% premium from UBER’s current price levels, while the Street-high price target of $150 suggests an ambitious 86.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)