SoFi Technologies (SOFI) has been a game-changer in personal finance, particularly for millennials and Gen Z, starting with innovative student loan refinancing that offered lower rates and flexible terms. From there, it expanded into a full-spectrum digital bank, adding services like high-yield savings, investing platforms, credit cards, mortgages, and insurance, drawing in millions of users seeking seamless, app-based money management.

This diversification has fueled explosive growth, turning SoFi into a one-stop financial hub with over 12 million members. In the process, its stock has become a wealth-building powerhouse, surging 245% over the past three years amid rising adoption and profitability. Now, with fiscal Q4 earnings slated for Friday, Jan. 30, investors are eyeing the report after SoFi beat expectations in each of the last four quarters. Yet the question is, should you buy shares before the release?

About SoFi Technologies Stock

SoFi Technologies is a digital finance company that provides a wide array of services through its mobile app and website, including banking, lending, investing, and financial planning tools. Originally focused on student loan refinancing, it now boasts over 12.6 million members as of the third quarter, up 35% year-over-year (YoY).

The company offers more than 10 products, ranging from personal loans and credit cards to robo-advising and home mortgages, with product adoption growing rapidly—members added a record number in recent quarters, reflecting cross-selling success. Over the years, membership has exploded from about 1 million in 2019 to its current level, driven by tech-savvy users and expansions like acquiring a banking charter.

So far this year, SoFi's stock is down 3%, underperforming the S&P 500 ($SPX), which has gained approximately 2% over the same period. Shares trade at 87x trailing earnings and 44x next year's estimates, higher than the banking industry average of about 12 but aligned with high-growth fintech peers like Block (XYZ) or Upstart (UPST), which often trade at 30 to 50 times forward earnings. The forward price-to-sales ratio is 7.46, elevated compared to SoFi's historical average of around 5 during its loss-making years but reasonable given its shift to profitability and expected revenue growth of over 20% annually.

Overall, the stock appears fairly valued, not overly inflated but priced for continued expansion, suggesting it's neither a screaming bargain nor overvalued in the fintech space.

Is SOFI a Stock to Buy Now?

SoFi's long-term potential remains compelling, positioning it as a disruptive force in fintech with ambitions to become the "Amazon of finance." By integrating banking, investing, and lending into one platform, it fosters high user engagement and cross-selling, leading to sticky relationships and recurring revenue.

With membership surpassing 12 million and products expanding, SoFi is on track for sustained growth, especially as it leverages AI for personalized advice and enters new markets like Latin America. Analysts project earnings per share to more than double in the coming years, supported by cost efficiencies and deposit growth following its bank charter acquisition. This could drive the stock higher, making it a solid hold for growth-oriented investors.

However, buying before Friday's Q4 earnings carries risks. SoFi has consistently beaten estimates recently, but the market is pricing in perfection, and any miss could trigger volatility. Notably, this is the first time in recent years SoFi is reporting on a Friday—historically, it has released results on Mondays or Tuesdays.

Companies sometimes choose Friday announcements to bury bad news, as media attention and trading volumes are lower heading into the weekend, potentially muting immediate reactions. While not always the case—plenty of firms deliver strong numbers on Fridays—it often raises yellow flags for investors, signaling possible underwhelming results or guidance.

If Q4 shows robust member additions and profitability, the stock could rally, but caution is warranted. For risk-tolerant buyers, dipping in now might pay off if SoFi extends its beat streak, but waiting for the report could avoid downside surprises.

What Do Analysts Expect for SOFI Stock?

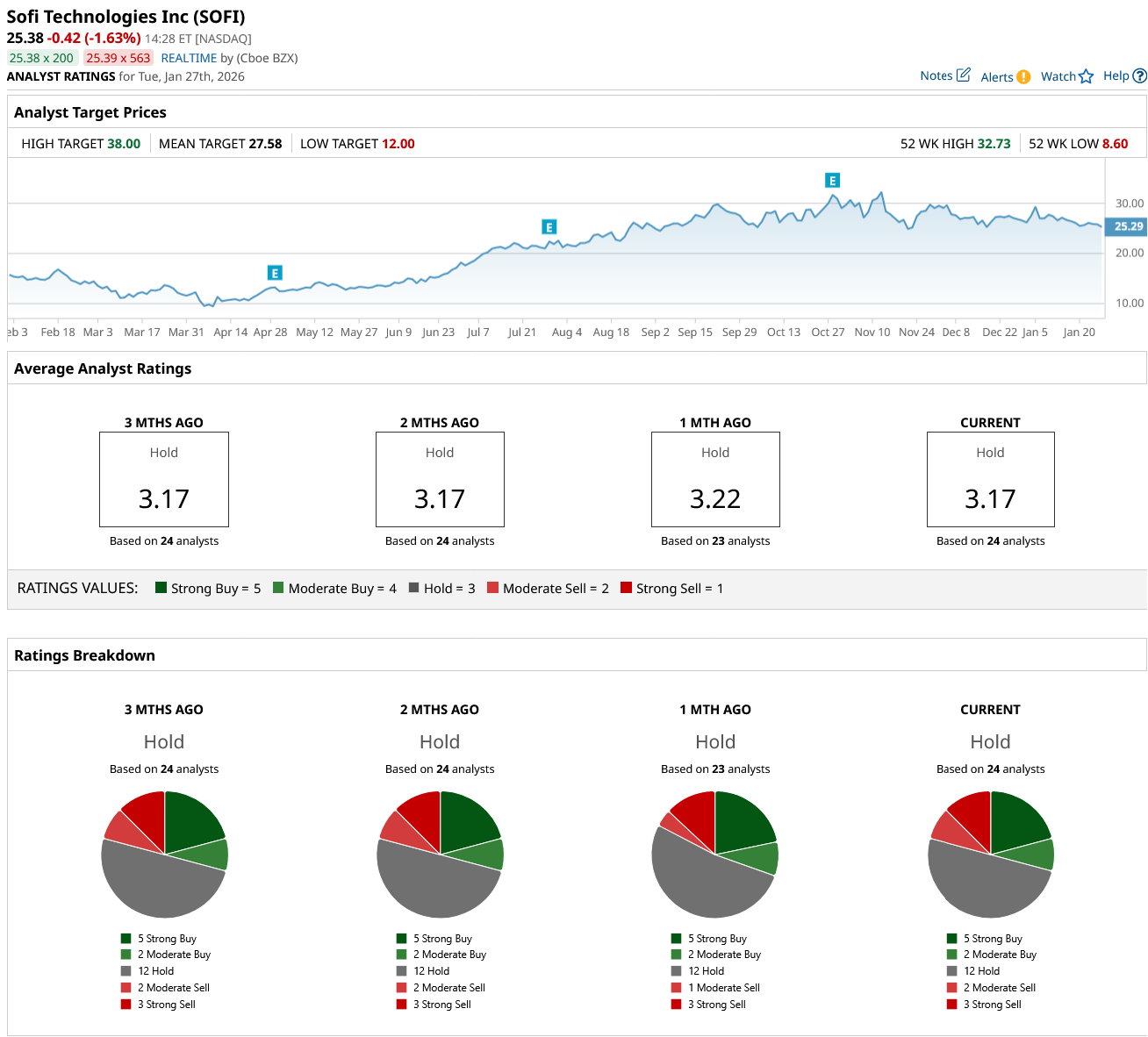

Consensus among analysts leans toward a "Hold" rating for SOFI stock, based on coverage from 24 firms as per Barchart data. The breakdown includes five "Strong Buy," two "Moderate Buy," 12 "Hold," two "Moderate Sell," and three "Strong Sell" ratings, reflecting a cautiously optimistic view amid growth prospects but valuation concerns.

There have been no notable changes in the consensus opinion over recent months, with the rating stable. The mean price target stands at $27.58, representing a potential upside of 9% from the current share price of about $25.38. This suggests moderate growth expectations, aligned with forecasts for earnings expansion but tempered by competitive pressures in fintech.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)