/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Shares of the financial technology company SoFi (SOFI) have been under significant pressure ahead of its fourth-quarter earnings release on Jan. 30. The stock has slipped well below the $30 mark and is now trading about 21.6% below its 52-week high.

Several factors have contributed to the recent weakness. The company’s $1.5 billion capital raise has raised concerns about potential shareholder dilution, while some investors appear to be locking in gains following the stock’s earlier rally. At the same time, valuation considerations have weighed on sentiment, leading to a pullback in its price.

Even so, SoFi’s underlying business remains strong. The company continues to report solid operating metrics, supported by steady growth in both its member base and products. The momentum in SoFi’s business will likely sustain, and the company could once again deliver solid financial results, potentially restoring investor confidence.

SoFi Q4 Outlook: Momentum to Continue

SoFi enters the fourth quarter with strong operating momentum, building on a series of solid financial results. A key growth driver for SoFi remains its rapidly expanding member base. In the third quarter, the company added 905,000 new members, up 35% year-over-year (YoY). The growth reflects the continued appeal of SoFi’s platform and indicates that fourth-quarter member additions could remain robust.

The company’s integrated financial services model continues to encourage cross-buying, with existing members opening a greater share of new products. In Q3, approximately 40% of new products were opened by current members, marking the highest cross-buy rate since 2022. This trend highlights increasing engagement within the platform and provides a strong foundation for sustained revenue growth.

SoFi’s emphasis on diversification and fee-based revenue is another factor supporting its growth outlook. Fee-based revenue reached a record $408.7 million in the third quarter, representing a 50% increase YoY and translating to more than $1.6 billion on an annualized basis. Much of this growth has been driven by the Loan Platform Business (LPB), which originates loans for third parties and generates high-margin, capital-light revenue. By the end of Q3, this segment was operating at an annualized pace of more than $13 billion in originations and approximately $660 million in fee-based revenue, a trajectory that is expected to continue into Q4.

At the same time, SoFi’s core lending operations are accelerating. Total loan originations reached $9.9 billion in the third quarter, up 57% from a year earlier. Personal loans led the way, rising to an all-time high of $7.5 billion, while student loan originations increased 58% to $1.5 billion. Home lending also set new records, with nearly $945 million in originations, including a notable $352 million in home equity loans. These results reflect strong demand across product categories, supported by ongoing innovation, including new step-up repayment options for student loans, interest-only periods for personal loans, and expanded home equity offerings.

Overall, strong top-line growth, stable credit performance, and a growing deposit base, which is a growing source of low-cost funding for the company, should provide meaningful leverage to SoFi’s bottom line.

SoFi has exceeded analysts’ earnings forecasts in each of the past four quarters, including a notable 22.2% beat in the most recent report. For the fourth quarter, analysts are projecting earnings of $0.12 per share, representing year-over-year growth of approximately 140%. In short, SoFi appears well-positioned to deliver another solid quarter.

Is SOFI Stock a Buy Ahead of Q4 Earnings Report?

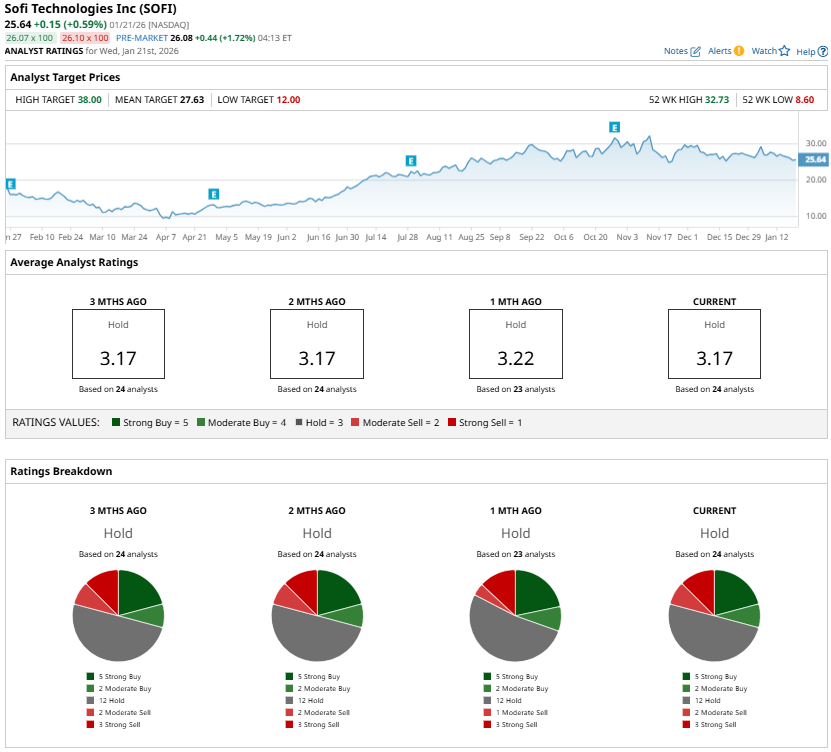

Wall Street currently assigns SOFI stock a “Hold” consensus rating. However, SoFi is rapidly expanding its member base and effectively monetizing them, which augurs well for growth. Further, higher engagement across products, accelerating growth in capital-light businesses, and a solid deposits position set SoFi well for continued growth.

With valuation pressures easing after the pullback, the stock may appeal to investors willing to look beyond short-term uncertainty and focus on SoFi’s longer-term growth trajectory.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)