When short sellers circle a stock, it usually signals more than routine skepticism. These investors make money by betting a share price will fall, often publishing sharply worded reports to expose what they see as hidden risks, governance cracks, or outright misconduct. The confidence is shaken, scrutiny rises, and gravity does the rest.

This time, the spotlight is back on AppLovin (APP), a mobile ad-tech powerhouse. CapitalWatch has fired the latest salvo, alleging the company has turned into a channel for illicit money, linking its ownership structure and advertising ecosystem to money laundering networks spanning China and Southeast Asia. The report paints AppLovin as a sophisticated financial laundromat, where questionable funds are allegedly washed clean through digital ad spend and opaque transactions.

The market reacted swiftly, and shares of APP stock slid as investors digested the claims and braced for potential regulatory aftershocks. With allegations piling up and volatility returning, how should investors play APP stock from here? Let's take a closer look.

About AppLovin Stock

AppLovin is a Palo Alto, California–based technology company founded in 2012 that has steadily reinvented itself within digital advertising. What began as a mobile-focused business has grown into a global ad platform built around data, automation, and machine learning. At the core is Axon, the company’s proprietary artificial intelligence (AI) engine that helps advertisers place, price, and optimize ads in real time. AppLovin’s product suite includes MAX for in-app monetization, AppDiscovery for user acquisition, Adjust for measurement and analytics, and Wurl for connected-TV distribution.

Together, these tools connect brands with developers and publishers across mobile apps, games, and streaming platforms. By operating across both sides of the ad marketplace and embedding AI deeply into its workflow, AppLovin has created a scalable ecosystem designed to improve ad performance, boost publisher returns, and adapt quickly as digital marketing continues to evolve.

APP stock’s price performance story over the past years has been impressive, with a sharp twist in the final chapter. Driven by its AI-powered Max 2.0 ad tech, the company morphed from a roughly $13 billion name in 2023 to a market capitalization of $176.4 billion now. That transformation sent AppLovin’s shares soaring higher, delivering a staggering 1,080% rally in just two years and a solid 46% gain over the past 52 weeks.

The momentum peaked in September, when APP stock hit an all-time high of $745.61 and earned its long-awaited seat in the S&P 500 Index ($SPX). However, APP is currently 29% off that peak, down 27% over the past month alone.

Late 2025 marked the shift. APP stock slipped into a losing streak, and the new year has proven unkind. Shares dropped 8.2% in the first trading session of the year and fell below the 50-day moving average, a level many traders view as a line between calm and caution. The stock is still struggling to reclaim it.

Adding to the pressure, short sellers have stepped back into the frame, questioning whether past growth was flattered by aggressive download tactics. From a technical lens, momentum has clearly softened. The 14-day RSI has fallen from overbought territory in December to around 32, pointing to waning strength.

Meanwhile, the MACD oscillator signals growing bearish momentum. The MACD line has slipped below the signal line, with both trending lower. At the same time, the histogram has turned negative, indicating that selling pressure outweighs buying interest and suggesting the near-term trend remains tilted to the downside.

By valuation, APP shares do not come cheap. The stock trades at about 35 times forward adjusted earnings and 28 times sales, way above the sector averages and historical medians. Still, with advertising revenue surging and margins staying strong, the business is scaling at speed. For a fast-moving AI ad leader, that growth may eventually soften today’s premium.

Inside AppLovin’s Q3 Earnings Report

Released on Nov. 5, AppLovin’s fiscal 2025 third-quarter earnings report was stellar, as numbers surged past Wall Street expectations. Strong demand across its gaming ad business and software tools kept the momentum rolling, pushing revenue up 68% year-over-year (YOY) to $1.4 billion.

The biggest driver was the Software Platform segment, where Axon 2.0 continues to do the heavy lifting. Better ad targeting helped AppLovin make a lot more money from each app install, with net revenue per installation jumping 75%, all while keeping user volumes steady.

Profits were also solid. Adjusted EBITDA climbed 79% annually to $1.16 billion, with margins widening to a hefty 82%. Earnings nearly doubled, with EPS coming in at $2.45 and beating estimates. Just as crucial, cash flow was strong. AppLovin pulled in $1.05 billion in net cash from operating activities, and free cash flow also came in at $1.05 billion — nearly twice what the firm generated in the same quarter last year.

AppLovin is all set to release its Q4 and full-year 2025 earnings report after the bell on Feb. 11, and expectations remain high. Management says the momentum is not slowing, guiding revenue to land between $1.57 billion and $1.6 billion for the quarter. Adjusted EBITDA is projected to be between $1.29 billion and $1.32 billion, with margins holding strong in the 82% to 83% range, signaling the continued profitability of its AI-powered ad machine.

Meanwhile, analysts tracking AppLovin are upbeat, anticipating revenue to surge to $1.61 billion. Meanwhile, EPS is estimated to rise 67% YOY to $2.89. For fiscal 2025, the bottom line is expected to more than double to $9.32 per share, then rise by another 62% YOY to $15.14 per share in fiscal 2026.

Why the Market Is on Edge Over the Allegations Against AppLovin

CapitalWatch’s report pulls no punches. At its core, the short seller claims AppLovin has evolved far beyond a mobile advertising platform, instead operating as a financial passageway for illicit money flowing out of Asia and into U.S. markets. The report zeroes in on AppLovin’s largest shareholder, Hao Tang. CapitalWatch describes Tang as a fugitive tied to the $36 billion collapse of Chinese P2P lender Tuandai.com, and argues that his equity stake carries the “blood and tears of victims of illegal fundraising."

As per the report, proceeds from Chinese Ponzi schemes and Southeast Asian “pig butchering” scams allegedly converge inside AppLovin’s ad ecosystem. CapitalWatch claims illicit funds allegedly reenter the system as advertising budgets, transforming ad spend into a laundering tool. This “functional symbiosis,” as the report frames it, purportedly benefits criminal syndicates seeking clean exits and a U.S.-listed company booking legitimate revenue.

Much of the concern centers on AppLovin’s technology stack. CapitalWatch argues that the firm’s software enables a “silent install” process in which apps are allegedly pushed onto devices without clear user consent, bypassing traditional app store safeguards. In that light, products like Axon and Array are portrayed not as growth engines, but as digital instruments that can be misused to distribute illegal gambling and fraudulent applications at scale.

The report also questions transparency. It accuses AppLovin of omitting material details from regulatory filings, particularly around operations in mainland China, and claims internal measures — including an alleged options-related shakeup — were used to maintain silence. AppLovin has pushed back, rejecting the allegations and denying any wrongdoing, while emphasizing its compliance framework and data protections.

CapitalWatch is not alone. Muddy Waters, Fuzzy Panda, and Culper Research have all targeted AppLovin in the past, raising concerns about data-scraping practices, app store violations, and the durability of its AI-driven growth. AppLovin has rejected the allegations, calling them false and self-serving. CEO Adam Foroughi has gone a step further, commissioning an independent probe and openly challenging the motives of short sellers. Still, the steady drumbeat of reports has investors wondering how much smoke it takes before regulators come knocking.

What Do Analysts Expect for AppLovin Stock?

Despite the noise stirred by CapitalWatch, Piper Sandler is not buying into the panic. The brokerage firm said the short report levels serious accusations but offers little in the way of hard evidence to back them up. In Piper’s view, investors are likely to look past the claims rather than react emotionally. Reflecting that confidence, the firm reiterated its “Overweight” rating on APP and held firm on its $800 price target, signaling continued optimism around the longer-term growth story.

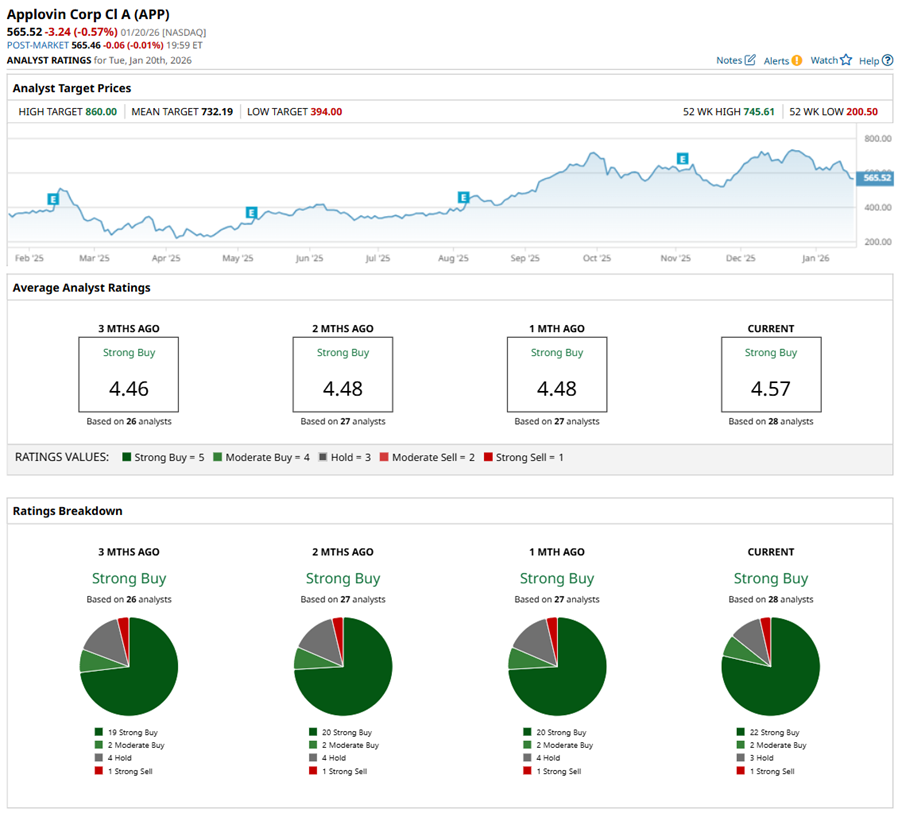

Despite the recent stock price dip and critical reports from short-selling firms, APP stock has a solid “Strong Buy” consensus rating, reflecting analysts’ bullish sentiment. Out of the 28 analysts with coverage, 22 recommend a “Strong Buy,” two advise a “Moderate Buy,” three analysts have a "Hold" rating, and one analyst is outright skeptical with a “Strong Sell.”

Meanwhile, APP stock’s mean price target of $732.19 suggests potential upside of 39% from current price levels. Further, the Street-high target of $860 implies the stock could rally as much as 63% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)