A Hollywood bidding war with massive implications for Netflix (NFLX) stock is entering its final month. Paramount Skydance (PSKY) has extended the deadline for its hostile takeover bid of Warner Bros. Discovery (WBD) to Feb. 20. The new deadline sets up a high-stakes showdown that could reshape the streaming landscape and determine Netflix's competitive position for the next decade.

The drama intensified on Thursday when Paramount pushed back its tender offer deadline while maintaining its $30-per-share, all-cash proposal to acquire all of Warner Bros. Discovery. The move came just days after Netflix sweetened its own bid to $27.75 per share for Warner Bros.' studio and streaming assets, excluding the cable networks that Paramount would absorb in its competing offer.

Warner Bros. Discovery has repeatedly urged shareholders to reject Paramount's approach in favor of the Netflix deal. Notably, more than 93% of WBD shareholders have already voted against Paramount's offer. Warner Bros. Discovery emphasized that Netflix's proposal is superior and expressed confidence in securing regulatory approval despite concerns about market concentration.

The extended deadline suggests Paramount may be preparing an even higher bid, according to industry analysts. With billionaire Larry Ellison backing the Paramount offer and regulatory scrutiny intensifying around Netflix's market dominance, the next month will be critical for determining which media giant emerges victorious.

Netflix Stock Is Down 38% From All-Time Highs

The ongoing acquisition war with Paramount and its less-than-impressive Q4 results have driven Netflix stock down 38% from all-time highs.

- In 2025, Netflix added 23 million subscribers, bringing its total to 325 million. In 2024, the streaming heavyweight added 41 million subscribers.

- Netflix reported revenue of $12.05 billion in Q4, an increase of 18% year-over-year (YoY), and above consensus estimates of $11.97 billion. Its net income of $2.42 billion, or $0.56 per share, marginally beat estimates of $0.55 per share.

- In 2025, Netflix forecasts revenue between $50.7 billion and $51.7 billion, indicating a YoY growth of 14% at the midpoint.

Netflix launched its ad-supported tier in late 2022 and has been working to scale the operation ever since. According to a CNBC report, ad revenue surpassed $1.5 billion in 2025, accounting for about 3% of total company revenue. Management expects that figure to roughly double to approximately $3 billion in 2026.

Co-CEO Greg Peters noted the gap between average revenue from ad-supported plans and standard ad-free subscriptions continues to narrow, creating future growth opportunities as the company improves its advertising technology and capabilities.

The Warner Bros. Discovery acquisition dominated much of the earnings discussion. The company paused share buybacks to fund the transaction. Management defended the deal as a strategic accelerator that would expand content production rather than consolidate it.

Co-CEO Ted Sarandos emphasized the transaction would preserve jobs and bring complementary businesses that Netflix does not currently operate, including theatrical film distribution and third-party television production.

Regulatory approval remains uncertain. President Trump previously commented that Netflix has done a phenomenal job but has a significant market share, raising antitrust concerns. Netflix currently represents about 8% of television viewing hours in the U.S., according to Nielsen data. Combined with Warner Bros., that figure would increase to just 9%, still trailing YouTube at 13%.

Wall Street expressed disappointment that advertising revenue came in below previous forecasts, suggesting the ad business is taking longer to gain traction than expected.

Is NFLX Stock Undervalued?

Analysts tracking NFLX stock forecast revenue to increase from $45.2 billion in 2025 to $74.80 billion in 2030. In this period, adjusted earnings per share are forecast to expand from $2.53 to $5.83. If NFLX stock is priced at 20x forward earnings, which is reasonable, it could trade around $117 in late 2029, indicating an upside potential of 40% from current levels.

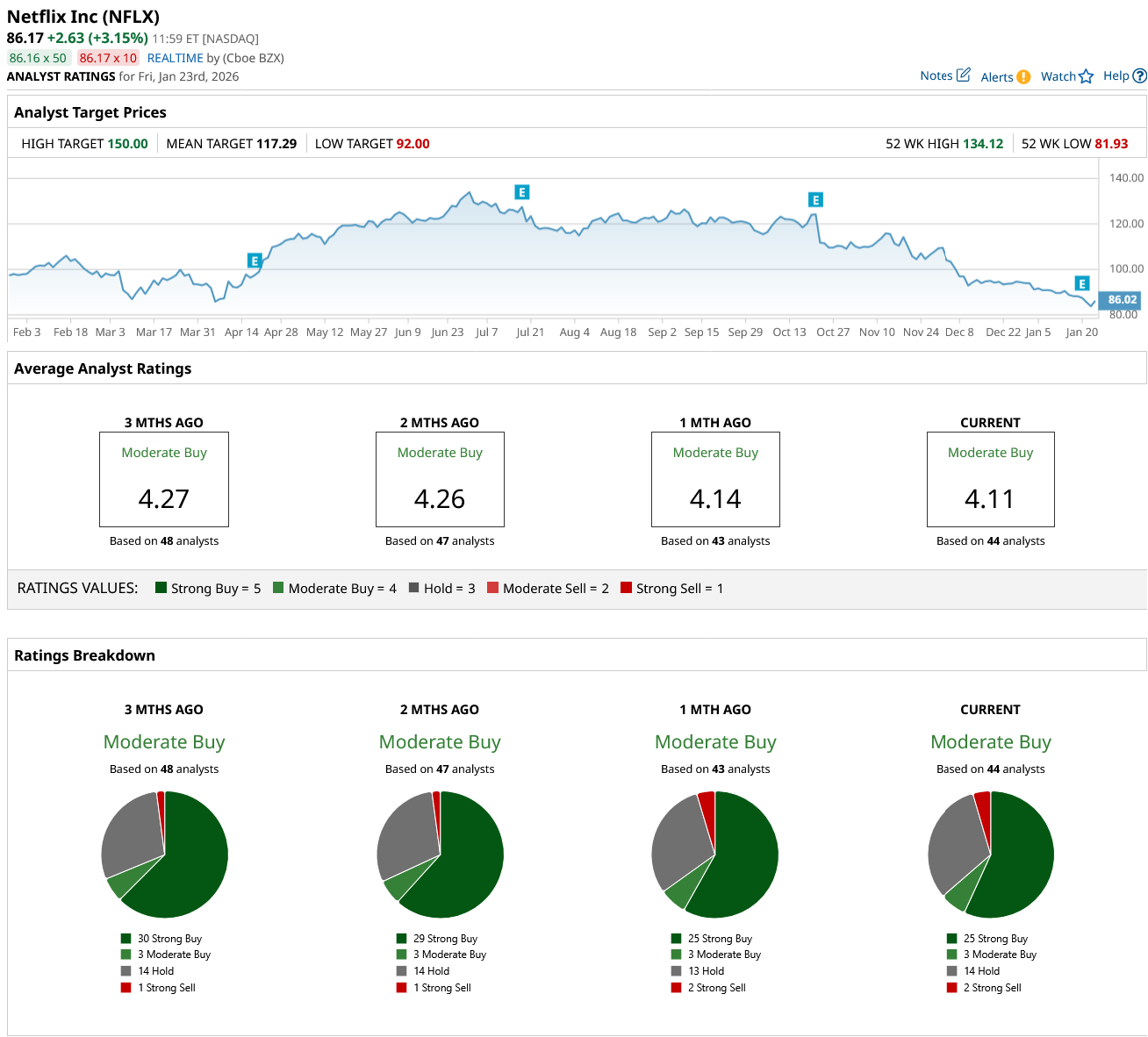

Out of the 44 analysts covering Netflix stock, 25 recommend “Strong Buy,” three recommend “Moderate Buy,” 14 recommend “Hold,” and two recommend “Strong Sell.” The average NFLX stock price target is $117, above the current price of $86.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)