/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

Netflix (NFLX) shares have been under sustained pressure, sliding more than 29% over the past three months. Even a stronger-than-expected fourth-quarter earnings report failed to alter the stock’s downward trajectory, with shares declining further in pre-market trading.

A key factor weighing on sentiment is management’s outlook on expenses. While Netflix continues to emphasize disciplined spending and margin expansion, it has signaled that expense growth will accelerate modestly this year compared with last year. The company plans to increase investment in content, product development, and commerce capabilities to strengthen and expand its entertainment offering. Although these investments are intended to support sustained revenue growth, the prospect of higher costs has unsettled investors focused on near-term profitability.

Uncertainty Weighs on Netflix

Adding to the uncertainty is Netflix’s amended agreement related to its pending acquisition of Warner Bros. Discovery (WBD), which has been restructured as an all-cash transaction. Strategically, the deal could significantly enhance Netflix’s content library and should strengthen its global competitive position. However, the path to completion remains complex. The transaction requires Warner Bros. Discovery to first spin off its Global Networks division into a separate publicly traded company, a step that could extend the timeline.

Regulatory scrutiny represents another potential hurdle. Given broader concerns about consolidation and market dominance in the media and streaming industries, regulators may closely examine the deal. Approval delays are a risk, and in a more adverse scenario, the transaction could fail to materialize. Competitive dynamics further complicate matters, as Paramount (PSKY) has previously expressed interest in Warner Bros. Discovery, raising the possibility of a bidding contest.

From a financial standpoint, investors are also evaluating the balance sheet implications. Netflix reported total debt of approximately $14.5 billion at the end of 2025. While its strong cash position strengthens the balance sheet, integrating Warner Bros. Discovery’s operations would likely require additional leverage, which could pressure future earnings and reduce financial flexibility in an increasingly competitive streaming environment.

Over the long term, the acquisition could meaningfully strengthen Netflix’s market position and unlock new growth opportunities. In the near term, however, regulatory uncertainty, balance sheet considerations, and execution risk introduce some unpredictability. Combined with intensifying competition, these factors have limited any meaningful recovery in the stock.

That said, Netflix’s core business outlook remains constructive. Management is projecting another year of double-digit revenue growth alongside further margin expansion.

Moreover, after the recent sell-off, the stock appears to have priced in a significant amount of risk and is trading at a more reasonable valuation relative to its earnings growth potential.

Is NFLX Stock a Buy Now?

Fundamentally, Netflix continues to perform well. Subscriber growth remains solid across key markets, and Netflix’s advertising business is gaining traction. The expansion of its ad-supported tier is meaningfully contributing to revenue, strengthening the company’s competitive positioning, and diversifying its top line.

Netflix’s biggest advantage is content. The company continues to invest in improving its core series and film offerings, spanning both original productions and second-run titles. Looking ahead, Netflix has a broad slate of original content planned for 2026, which should help sustain engagement and subscriber momentum.

With a strong content pipeline and improving advertising monetization, Netflix appears well-positioned to sustain its momentum into 2026. Management forecasts 2026 revenue of $50.7 billion to $51.7 billion, representing year-over-year (YoY) growth of 12% to 14%, with advertising revenue expected to roughly double to $3 billion. Operating margin is projected to reach 31.5%, an improvement of 200 basis points.

Analysts expect this operational strength to translate into robust earnings growth, with its bottom line projected to rise by 26.5% in 2026 and more than 21% in 2027. At roughly 27.4 times forward earnings, Netflix shares appear reasonably valued given that growth outlook.

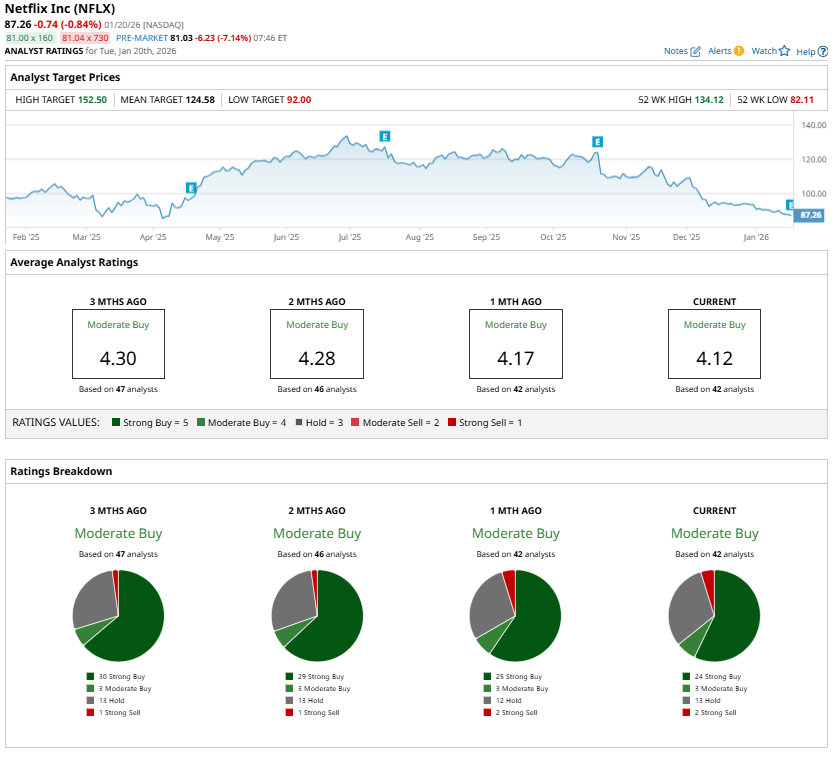

Reflecting this balance of risks and opportunities, analysts currently assign Netflix a “Moderate Buy” consensus rating. For investors with a longer-term horizon and a tolerance for near-term volatility, the recent pullback in NFLX represents an attractive buying point.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)