Remember the “Sell America” trade? Well, it’s back. The only question is…will it stick?

The term refers to a market where US assets are being sold across the board – stocks, bonds, and the dollar. Simultaneously, safe haven assets like gold and silver are getting bid.

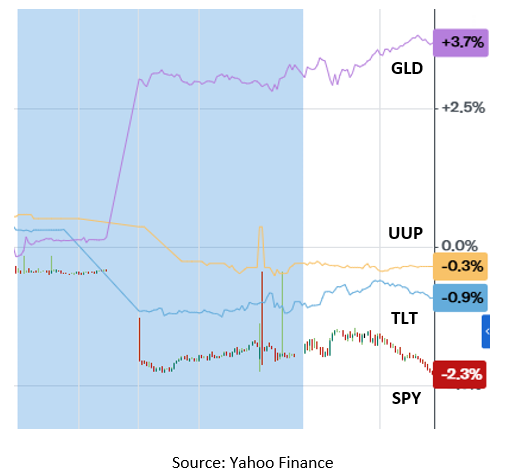

That’s what we saw yesterday, as you can see in the MoneyShow Chart of the Day. It shows the 24-hour performance of the SPDR S&P 500 ETF Trust (SPY), the iShares 20+ Year Treasury Bond ETF (TLT), the Invesco DB US Dollar Index Bullish Fund (UUP), and the SPDR Gold Shares (GLD) through mid-afternoon. GLD was the big standout to the upside with a 3.7% gain, while SPY was the big loser with a 2.3% drop.

(To get a FREE copy of our MoneyShow 2026 Top Picks Report, click here.)

Stocks, Bonds, and the Dollar Drop, While Gold Pops

We saw Round One of this back in early 2025, when President Trump’s “Liberation Day” policy announcements fueled significant market turmoil. Now, we’re seeing Round Two thanks to the push to acquire Greenland – and the associated trade and tariff threats out of Washington. Tremors in the Japanese bond market only served to amplify the move out of debt and into precious metals.

Political and business leaders have gathered in Davos, Switzerland this week for the annual World Economic Forum. Trump is headed there soon as well. Depending on what is said and done there, markets could see more volatility – and the Sell America trade could intensify.

But even if it doesn’t, I STILL think the longer-term trends I’ve been talking about for quite some time remain intact (and are worth trading). They include a falling dollar, rising precious metals prices, and relative outperformance for foreign stocks and funds that own them.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)