The Williams Companies, Inc. (WMB), headquartered in Tulsa, Oklahoma, stands as a premier energy infrastructure provider across the U.S. It specializes in operating vast networks of interstate natural gas pipelines, gathering systems, processing plants, and storage facilities that connect prolific supply basins to high-demand markets.

Serving a wide array of customers, from producers to utilities, the company ensures reliable transportation and midstream services essential for energy needs. The company has a market capitalization of $75.17 billion.

Williams Companies is expected to report its fourth-quarter results for fiscal 2025 soon. Ahead of the earnings release, Wall Street analysts expect its bottom line to grow.

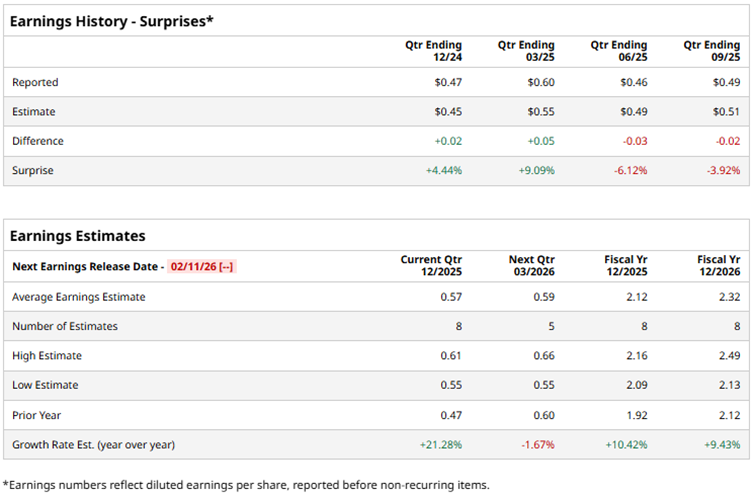

Analysts expect WMB to report a profit of $0.57 per share on a diluted basis for Q4, up 21.3% year-over-year (YOY). The company has a mixed track record of exceeding consensus estimates, topping them in two of the four trailing quarters and missing them in two instances. For the full fiscal year 2025, Wall Street analysts expect WMB’s diluted EPS to grow by 10.4% annually to $2.12, followed by a 9.4% improvement to $2.32 in fiscal 2026.

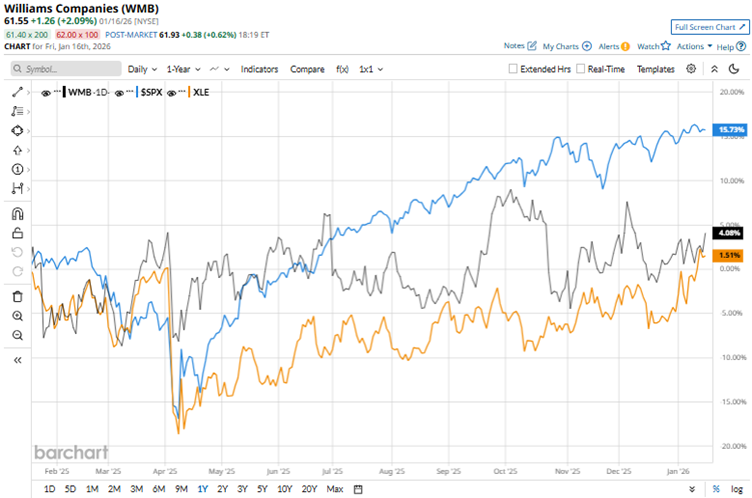

Strong demand for natural gas infrastructure supports steady performance, as the company's extensive pipeline network benefits from stable energy demand. Over the past 52 weeks, the stock has gained 4%, and over the past six months, 5.3%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 16.9% and 10.8% over the same periods, respectively. Therefore, the stock has underperformed the broader market.

We now compare WMB’s performance with that of its sector. The State Street Energy Select Sector SPDR ETF (XLE) has increased 2.3% over the past 52 weeks and 10.7% over the past six months. Therefore, while WMB’s stock has outperformed its sector over the past year, it has underperformed over the past six months.

On Nov. 3, WMB reported its third-quarter results for fiscal 2025. While the company reported growth, its results missed Wall Street analysts’ estimates. Hence, the stock dropped 4.3% intraday on Nov. 4. WMB’s total revenues increased by 10.2% YOY to $2.92 billion, while its adjusted EPS climbed 14% from the prior-year period to $0.49.

On Nov. 7, WMB announced that it had secured key permits for its Northeast Supply Enhancement (NESE) project, which aims to expand access to vital natural gas infrastructure while replacing high-emission, expensive fuel oil.

Wall Street analysts are positive about Williams Companies’ prospects. Among the 22 analysts covering the stock, the consensus rating is “Moderate Buy.” The stock now has one “Strong Sell” rating, up from none a month ago. It also has 13 “Strong Buys,” two “Moderate Buys,” and six “Holds.” The mean price target of $69.35 implies a 12.7% upside from current levels, while the Street-high price target of $83 implies 34.8% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)