It’s Friday, which means not only is it the last trading day of the week, but we’re only a day away from more NFL playoff games. Given there’s no obvious favorite to win the Super Bowl, I’m going with the Seattle Seahawks to go all the way. Call it a hunch.

On to the business at hand.

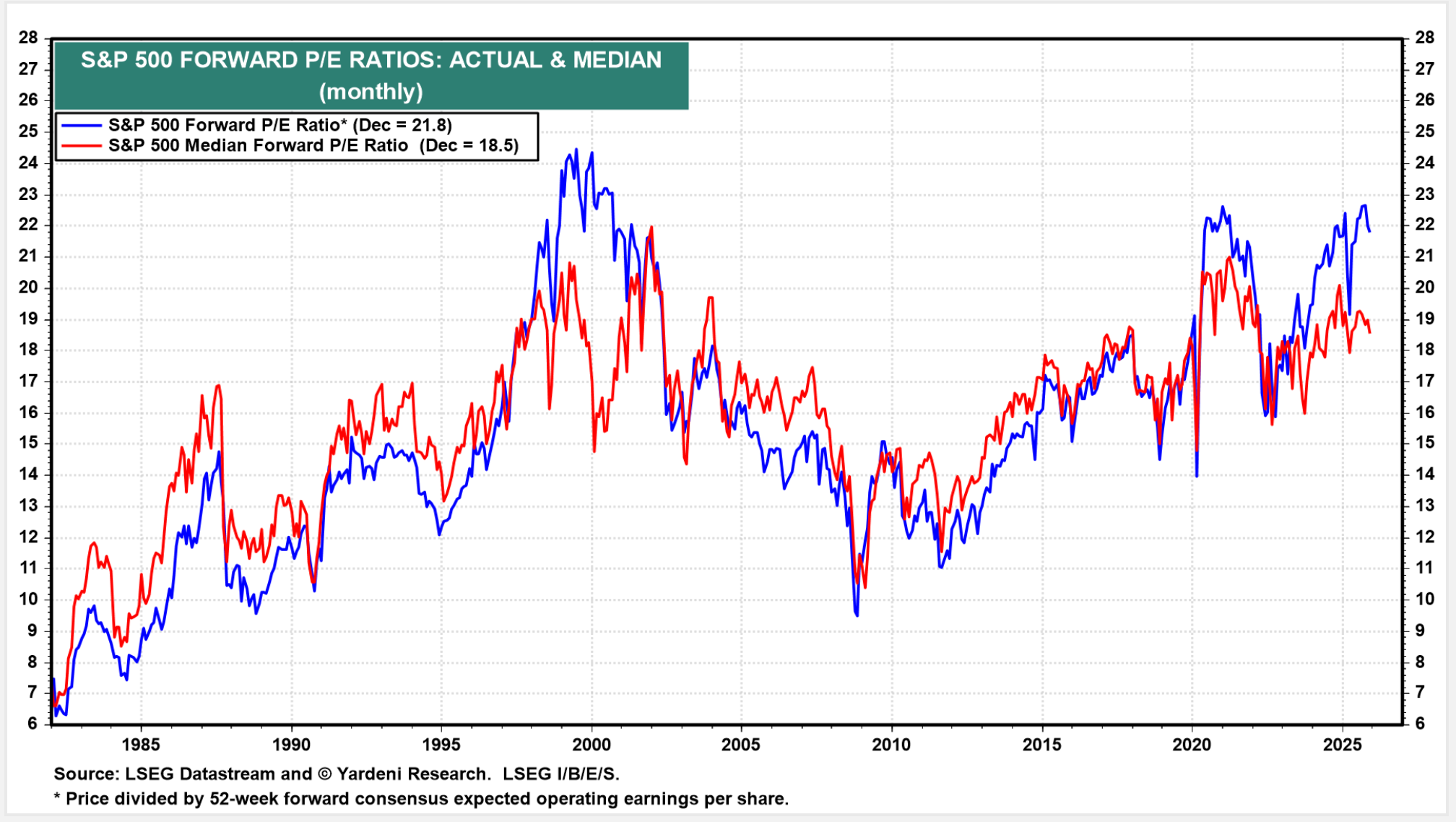

In Thursday’s options trading, there were 2,340 unusually active options, which included 1,396 calls and 944 puts. That’s a bullish indicator, which leads me to the subject of today’s commentary: valuations. They’re relatively pricey--the S&P 500 forward P/E ratio is 22.1x, according to Yardeni Research.

The chart below compares the index’s monthly forward P/E ratio to the median forward P/E. As you can see, the last time there was this big a gap was in 2000, smack dab in the middle of the dot.com bubble.

While we can argue until the cows come home about why this time is different, I think we can all agree that generating the returns achieved over the past three years in the next three will be difficult, if not impossible.

On Monday, Morningstar.com published 33 Newly Overvalued Stocks This Week, highlighting 33 stocks based on its proprietary valuation methodology that have become expensive.

Of the 33 stocks, four had unusually active put options yesterday, which caught my eye and offer investors an opportunity to buy shares at a better entry point.

Have an excellent weekend.

Costco (COST)

Costco’s (COST) shares are up 11% year-to-date in 2026. Its forward P/E, according to S&P Global Market Intelligence, is 46.6x.

I’m a big believer in Costco’s business model. It’s a great company, one that Charlie Munger so liked that he owned $100 million of its stock as recently as 2023.

In March 2025, I discussed seven options strategies to make money from Costco.

“I won’t explain why I like Costco except to say that despite its steep valuation, its return on capital is higher than it has been in the past decade, which indicates that the company is doing a lot of things right in its business,” I wrote last March.

Notably, Costco’s forward P/E has declined slightly since my article, but it’s still well above its 2016 multiple of 27x.

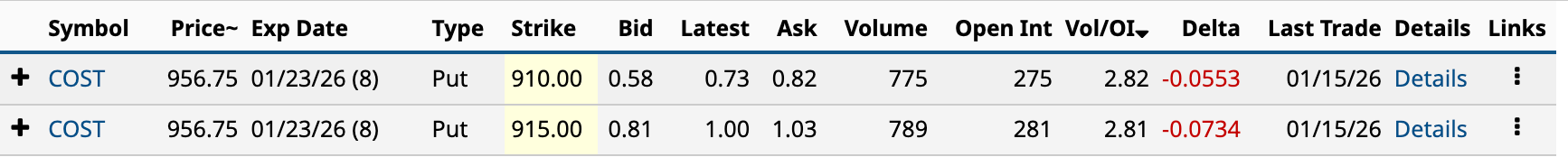

Yesterday, Costco had two unusually active put options.

Typically, when seeking a better entry point, whether for a one-off or the first move in a Wheel strategy, I look for put strike prices 10-20% below the current share price. That would be between $765 and $865, well below the two above.

The annualized returns on the income generated by selling the $910 and $915 puts are 2.7% [$0.58 bid price / $910 strike price - $0.58 bid price * 365 / 8] and 4.1% [$0.81 bid price / $915 strike price - $0.81 bid price * 365 / 8], respectively. Those aren’t great returns if you’re hoping to get a better entry point. The breakeven for the former is $909.42, 4.9% below yesterday’s closing price, while the latter is $914.19, 4.4% below yesterday's closing price.

Given the expected move is 1.85% to $939.07 on the downside, you would likely be able to keep the income from both the $910 and $915 strike prices. If you’re aggressive, go with the latter.

However, if you’re risk-averse, you’ll want to push the DTE (days to expiration) out to 30-60 days, and try to get a strike price in the mid-800s or lower.

Valero (VLO)

Valero (VLO) shares are up over 13% year-to-date in 2026. Its forward P/E is 14.13, about double what it was three years ago.

Valero is one of the oil and gas companies expected to benefit from the U.S. invasion of Venezuela and the resulting oil production that will need to be refined for sale. Its refineries are designed to process the thick, heavy oil from Venezuela.

As a result, its shares are trading less than $10 from an all-time high. In April 2025, its shares traded as low as $99. It would be nice for long-term investors to be able to buy some shares at $140-$150.

Yesterday, Valero had one unusually active put shown below.

The Jan. 23 $170 put isn’t that low, but it is 8% OTM (out-of-the-money) with an annualized return of 2.1%. That’s not a great return, but it’s something, rather than nothing. Think of it as a reasonable dividend replacement.

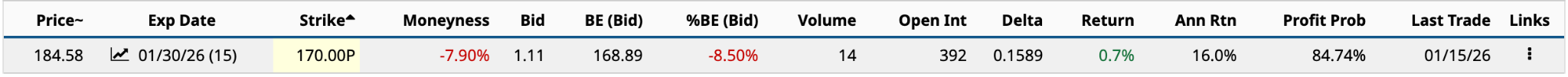

However, if you go out one week to Jan. 3o, you could get yourself a better return, although the risk of assignment is higher.

As shown above, the strike price is the same, but the annualized return is eight times higher at 16.0%. With an expected move to $174.44 on the downside, your profit probability is high at 84.74%.

In the worst case, you have to buy 100 shares of Valero.

Southwest Airlines (LUV)

Southwest Airlines (LUV) shares are up 4% year-to-date in 2026. Its forward P/E is 15.0x. It just got a two-star rating from Morningstar, which means it’s not ridiculously expensive. That’s reserved for one stars. However, compared to a decade ago, the multiple is 50% higher.

Among airlines, I favour Delta (DAL) over the rest, including Southwest. I most recently discussed Southwest hitting a 52-week high in mid-December. “Better operationally -- not to mention CEO Ed Bastian is one of America’s finest executives -- Delta is the better airline stock to own for the long haul in my opinion,” I wrote.

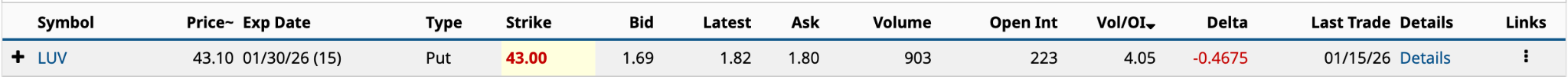

If you like Southwest, it had one unusually active option yesterday, but you have to believe that Morningstar and I are wrong about its valuation.

Its annualized return based on the above is 99.5% [$1.69 bid price / $43 strike price - $1.69 bid price * 365 / 15]. Now that’s a good return. However, the expected move by Jan. 30 is $3.13, up or down. Working in your favor: the Barchart Technical Opinion is a 100% Strong Buy in the near term, which means its momentum gained since November lows should continue.

Its annualized return based on the above is 99.5% [$1.69 bid price / $43 strike price - $1.69 bid price * 365 / 15]. Now that’s a good return. However, the expected move by Jan. 30 is $3.13, up or down. Working in your favor: the Barchart Technical Opinion is a 100% Strong Buy in the near term, which means its momentum gained since November lows should continue.

I wouldn’t own Southwest, but that doesn’t mean you shouldn’t.

Dick’s Sporting Goods (DKS)

Dick’s Sporting Goods (DKS) shares are up 7.5% year-to-date in 2026. Its forward P/E is 16.09x. It hasn’t been this high since March 2024 and before that, September 2016.

Analysts are lukewarm about its stock. Of the 20 that cover it, 11 rate it a Buy (3.95 out of 5), with a $242.88 target price that is 14% above its current share price.

The biggest question about Dick’s, yet to be answered, is whether it bit off more than it could chew when it acquired Foot Locker last year for $2.4 billion. Former Ulta (ULTA) CEO Mary Dillon couldn’t breathe new life into the global sports footwear and apparel retailer. I guess we’ll see.

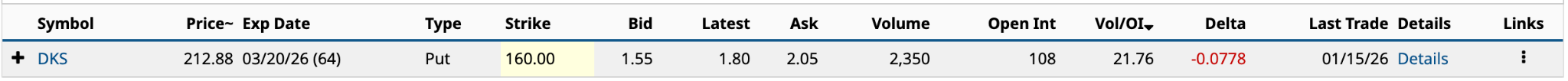

As for Dick’s unusual options activity, it had one put yesterday.

Although I have mixed feelings about Dick’s acquisition of Foot Locker, I recommended DKS options in August 2023, long before the September 2025 acquisition. Unfortunately, not long after, the share price fell 30%, and the call options expired worthless.

Although I have mixed feelings about Dick’s acquisition of Foot Locker, I recommended DKS options in August 2023, long before the September 2025 acquisition. Unfortunately, not long after, the share price fell 30%, and the call options expired worthless.

My rationale for owning Dick’s at the time: “The sporting goods industry historically experiences consistent, if not spectacular, growth. Between now and 2026, the industry’s expected to grow by 7.5% annually to $239 billion worldwide,” I wrote in August 2023.

While I still feel this way, the combination of a questionable acquisition and a bloated valuation has me holding back on recommending it.

However, if you’re bullish, yesterday's put option is a perfect combination of time decay, income generation, and a lower entry point. Currently, 24.8% OTM (anything above 20% is ideal for starting a wheel strategy), the annualized return is 5.6% [$1.55 bid price / $160 strike price - $1.55 bid price * 365 / 64].

Do I like DKS over $200? No. Do I like it at $160? Absolutely.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)