With a market cap of $39.9 billion, Vulcan Materials Company (VMC) produces and supplies construction aggregates in the United States. Founded in 1909, the Birmingham, Alabama-based company operates through Aggregates, Asphalt, and Concrete segments. The company is expected to report its Q4 earnings on Feb. 17, before the markets open.

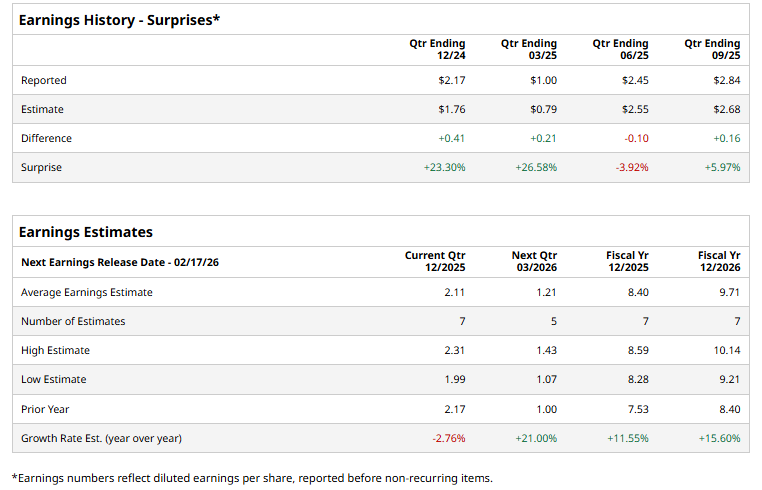

Ahead of the event, analysts expect VMC to report a profit of $2.11 per share on a diluted basis, down 2.8% from $2.17 per share in the year-ago quarter. The company beat consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For FY2025, analysts expect VMC to report EPS of $8.40, up 11.6 from $7.53 in fiscal 2024. Its EPS is expected to rise 15.6% year over year to $9.71 in fiscal 2026.

VMC stock has gained 12.5% over the past year, trailing the S&P 500 Index’s ($SPX) 16.3% gains but matching the Materials Select Sector SPDR Fund’s (XLB) 12.5% surge over the same time frame.

On Oct. 30, Vulcan Materials shares plunged 1.7% after the company released its third-quarter earnings. The company posted $2.29 billion in revenue, up 14.4% year over year, with adjusted EBITDA rising 26.5% to roughly $735 million as margins expanded. Aggregates shipments climbed around 12% to 64.7 tons, supported by robust demand from public infrastructure projects, while pricing improved and unit cash costs declined. Management highlighted solid operational performance and reaffirmed full-year guidance, projecting adjusted EBITDA between $2.35 billion and $2.45 billion.

Analysts’ consensus opinion on VMC stock is somewhat bullish, with a “Moderate Buy” rating overall. Out of 22 analysts covering the stock, 14 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and seven give a “Hold.” VMC’s average analyst price target is $328.01, indicating a potential upside of 8.7% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)