/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Intel (INTC) shares surged more than 7% Tuesday after KeyBanc Capital Markets upgraded the chipmaker to “Overweight.” It also set a Street-high price target of $60, given Intel is making "significant progress" in its manufacturing turnaround and AI-driven chip sales.

According to a Yahoo Finance report, the upgrade comes as Intel appears to be breaking out of a years-long slump that saw it lose market share to rivals AMD (AMD) and ARM (ARM) while struggling to revive its manufacturing operations.

KeyBanc analyst John Vinh cited supply chain checks showing Intel is "almost sold out for the year" in data center server CPUs, driven by Big Tech's voracious demand for chips to power artificial intelligence workloads.

A key catalyst, however, may be Intel's rumored manufacturing deal with Apple (AAPL). Vinh said his Asia supply chain checks indicate Intel has signed the iPhone maker as a customer to produce low-end PC chips using its next-generation 18A-P process, marking what he called Intel's "first big whale design win" for its struggling foundry business.

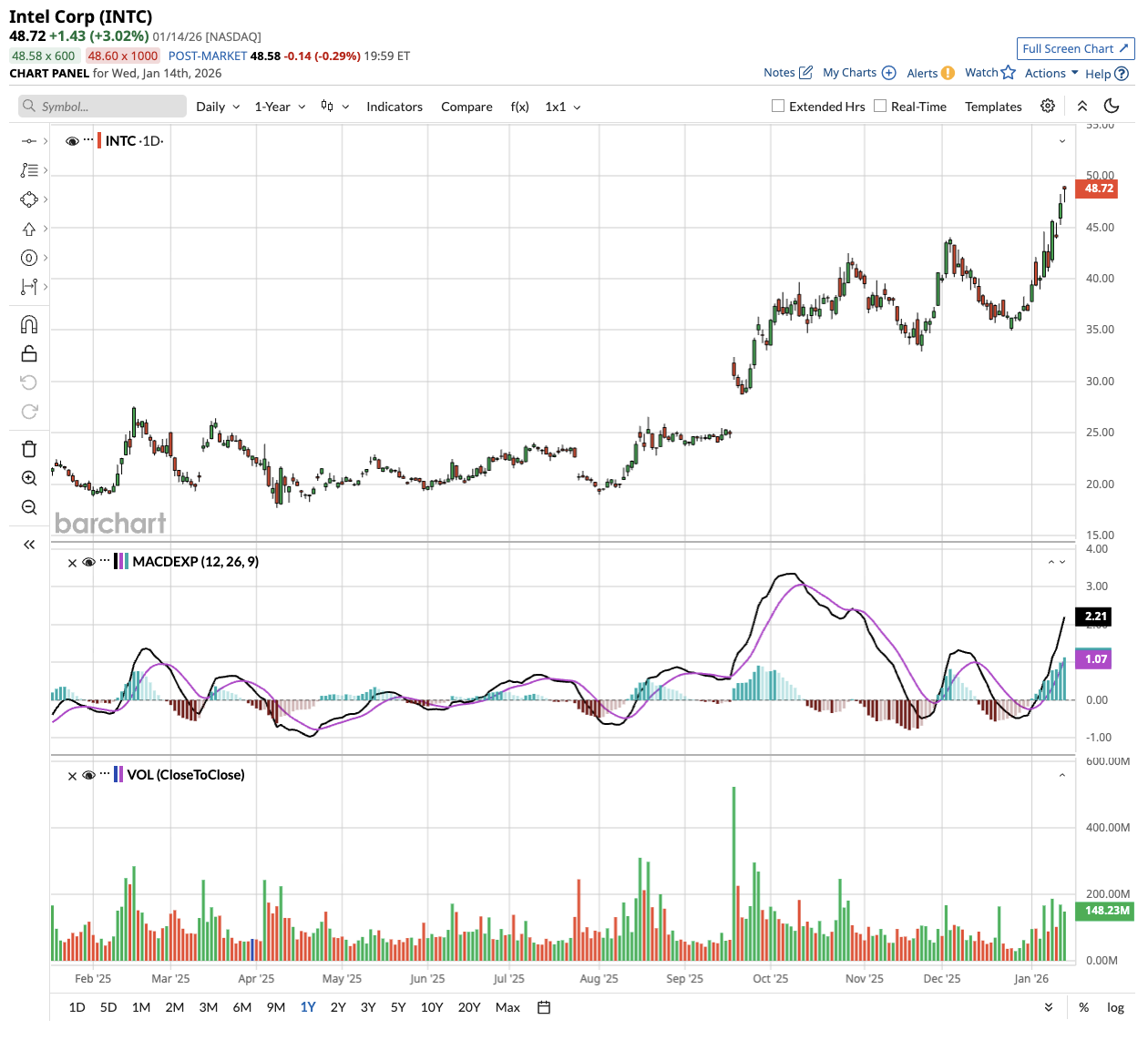

With Intel shares up nearly 150% over the past year and trading around $49 right now, investors are betting the chipmaker's manufacturing revival is finally gaining traction.

The question now is: Does INTC stock have more room to run?

Is Intel Stock Still a Good Buy Right Now?

Intel is navigating a critical transition period under CEO Lip-Bu Tan's leadership. In Q3 of 2025, the chipmaker reported revenue of $13.7 billion and gross margins of 40%, both above estimates.

The semiconductor giant finds itself in an unusual position:

- Supply-constrained across both its PC and server businesses.

- Management indicated that Intel 10 and Intel 7 manufacturing nodes remain particularly tight, limiting the company's ability to fully meet customer demand.

- This supply shortage has forced Intel to make strategic choices, prioritizing server shipments over entry-level PC products to capture higher-margin opportunities.

Server demand has shown unexpected strength, driven by multiple factors. Hyperscale customers have resumed refreshing their installed base after years of focusing primarily on AI infrastructure buildout.

Additionally, power constraints are driving upgrades, as newer processors deliver roughly 80% better power efficiency than five-year-old servers. Perhaps most significantly, the shift toward agentic AI and inference workloads is creating sustained demand for traditional compute infrastructure beyond just GPU-focused training systems.

Intel's 18A manufacturing node represents a pivotal milestone for the company's turnaround strategy. The first Panther Lake processors began shipping in late 2025, and yields are now improving at a predictable monthly rate after an inconsistent start earlier in the year.

Management expects to achieve industry-standard yields by late 2026, with Arizona's Fab 52 now fully operational for high-volume production. The company plans to leverage the 18A family across at least three generations of client and server products.

On the foundry front, Intel continues to pursue external customers for its 14A node, with the definitional phase benefiting from earlier customer engagement compared to 18A development.

The company expects customer decision windows to open in the second half of 2026 through early 2027.

Intel continues to strengthen its balance sheet via strategic partnerships with Nvidia (NVDA), SoftBank (SFTBY), and the U.S. government. In recent months, the chipmaker has collected $20 billion to support operations and reduce debt.

Despite progress, gross margins remain under pressure from multiple factors, including early 18A ramp costs, increased Lunar Lake volumes with embedded memory challenges, and competitive pricing dynamics as Intel works to stabilize market share.

What Is the INTC Stock Price Target?

Intel is projected to increase adjusted earnings from $0.34 per share in 2025 to $2.84 per share in 2029, representing a compounded annual growth rate of nearly 70%. If INTC stock is priced at 25 times forward earnings, it could gain another 50% over the next three years.

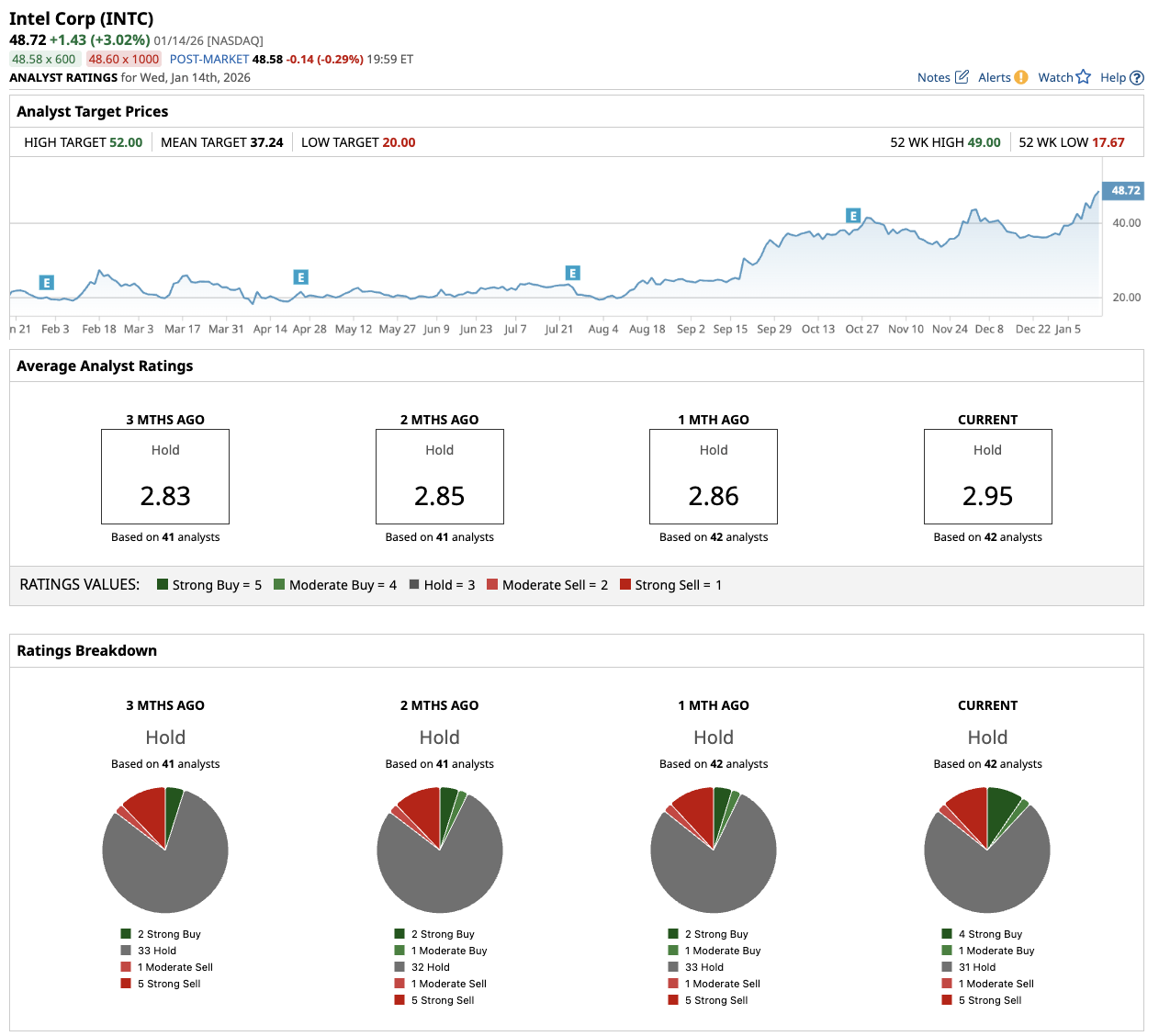

Out of the 42 analysts covering Intel stock, four recommend “Strong Buy,” one recommends “Moderate Buy,” 31 recommend “Hold,” one recommends “Moderate Sell,” and five recommend “Strong Sell.” The average INTC stock price target is $37.24, below the current price of $49.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)