Dublin, Ireland-based Smurfit Westrock Plc (SW) manufactures, distributes, and sells containerboard, corrugated containers, and other paper-based packaging products. Valued at a market cap of $22.3 billion, the company primarily serves food and beverage, e-commerce, retail, consumer goods, industrial, and foodservice markets. It is expected to announce its fiscal Q4 earnings for 2025 soon.

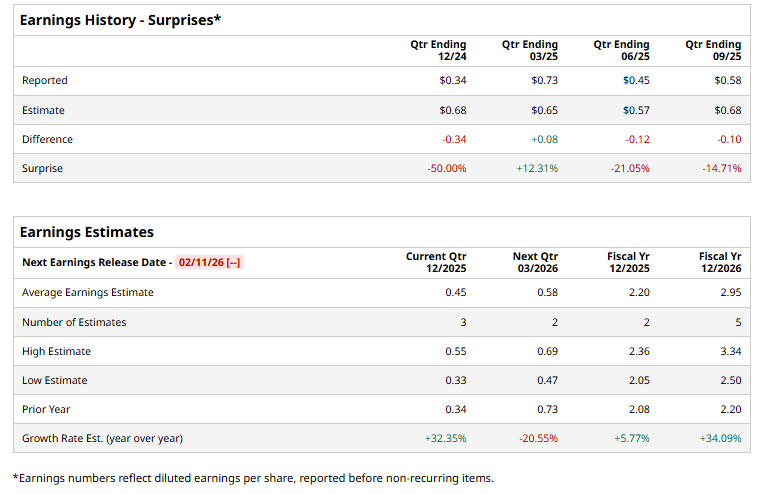

Ahead of this event, analysts expect this packaging company to report a profit of $0.45 per share, up 32.4% from $0.34 per share in the year-ago quarter. The company has missed Wall Street’s earnings estimates in three of the last four quarters, while topping on another occasion.

For fiscal 2025, analysts expect SW to report a profit of $2.20 per share, up 5.8% from $2.08 per share in fiscal 2024. Furthermore, its EPS is expected to grow 34.1% year over year to $2.95 in fiscal 2026.

SW stock has gained 2.4% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 18.3% rise and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 24.5% return over the same time frame.

Smurfit Westrock has lagged the broader market over the past year amid a challenging demand backdrop for packaging and containerboard products. Weaker consumer packaging shipments, coupled with persistent headwinds in North American and European corrugated markets, have pressured volumes and margins, prompting the company to pursue cost-rationalization measures and selective asset closures, which have weighed on investor sentiment.

Nevertheless, Wall Street analysts are highly optimistic about SW’s stock, with an overall "Strong Buy" rating. Among 17 analysts covering the stock, 14 recommend "Strong Buy," two indicate "Moderate Buy," and one advises “Hold.” The mean price target for SW is $51.93, indicating a 21.5 potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.