/Globe%20Life%20Inc%20field-by%20Dorti%20via%20Shutterstock.jpg)

Valued at $11.3 billion by market cap, Globe Life Inc. (GL) is a Texas-based financial services holding company that provides individual life insurance, supplemental health insurance, annuities, and related products through its wholly owned subsidiaries. It serves primarily middle- and lower-middle-income Americans and has more than 17 million policies in force, making it one of the larger life insurers in the United States.

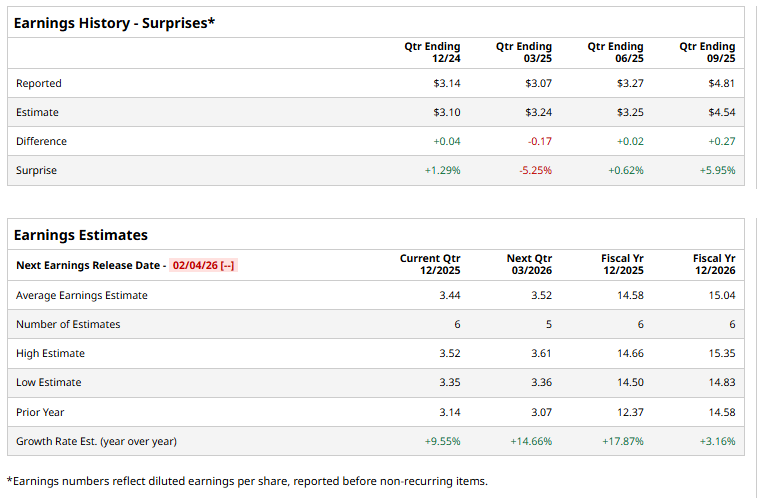

The insurance giant is expected to announce its fiscal fourth-quarter earnings for 2025 soon. Ahead of the event, analysts expect GL to report a profit of $3.44 per share on a diluted basis, up 9.6% from $3.14 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For FY2025, analysts expect GL to report EPS of $14.58, up 17.9% from $12.37 in fiscal 2024. Its EPS is expected to rise 3.2% year over year to $15.04 in fiscal 2026.

GL stock has gained 24.4% over the past year, outpacing the S&P 500 Index’s ($SPX) 17.7% gains and the Financial Select Sector SPDR Fund’s (XLF) 14.9% gains over the same time frame.

Shares of Globe Life climbed 2.7% on Dec. 11, after TD Cowen raised its price target to $199 from $182, reiterated a “Buy” rating, and added the stock to its Best Ideas 2026 list. Analysts highlighted Globe Life’s scalable business model, which supports consistent sales and earnings growth while carrying lower underwriting and market risk than peers.

Analysts’ consensus opinion on GL stock is somewhat bullish, with a “Moderate Buy” rating overall. Out of 13 analysts covering the stock, eight advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and four give a “Hold.” GL’s average analyst price target is $167, indicating a potential upside of 17.6% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)