/Unitedhealth%20Group%20Inc%20%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

UnitedHealth Group (UNH), a health insurance and managed care sector company, has rarely looked as vulnerable as it did in 2025. Long viewed as a dependable compounder within the Dow Jones Industrial Average ($DOWI), the stock instead slid into crisis mode.

A sharp rise in Medicare Advantage costs caught management off guard, while a Department of Justice criminal investigation into Medicare practices added pressure. The turmoil deepened after the sudden loss of CEO Brian Thompson in late 2024, followed by earnings misses and a disappointing full-year outlook. Shares quickly fell below the $600 mark, turning UNH stock into the Dow’s worst-performing stock of 2025.

Against this bruised backdrop, Evercore ISI sees a different arc forming. Analyst Elizabeth Anderson argues the damage is largely understood and, more importantly, priced in. Initiating coverage with an “Outperform” rating, the analyst sees 2026 as a year of stabilization rather than growth, with elevated medical utilization now built into pricing. As margins begin to normalize and execution improves, Evercore expects a clearer recovery to take shape in the upcoming years.

With sentiment still fragile, is this the moment to buy UNH while the stock is still down?

About UnitedHealth Stock

Founded in 1974 and headquartered in Minnesota, UnitedHealth Group has evolved into a global healthcare leader with a market value of about $309.5 billion. The company operates through two core segments—UnitedHealthcare and Optum.

UnitedHealthcare forms the foundation, providing health insurance coverage to millions and delivering scale and stable revenue. Optum complements this with growth-driven capabilities across healthcare services, data analytics, technology, and pharmacy solutions, strengthening UnitedHealth’s position in an increasingly complex healthcare ecosystem.

UnitedHealth’s share price traced a steep descent through 2025, collapsing to five-year lows of $234.60 in August as selling pressure overwhelmed sentiment. Since then, the stock has staged a measured recovery, rebounding nearly 46.7% from those depths, though it remains down about 34% over the past year.

Momentum has gradually turned steady, with shares advancing almost 12% over six months and 6% in the past month. From a technical standpoint, the 14-day RSI has climbed from near-oversold conditions in December to around 56, signaling stabilizing momentum. Trading volumes remain subdued, suggesting the rebound is driven more by cautious accumulation than speculative excess.

UNH stock is priced at 22.8 times forward earnings and 0.69 times forward sales, trading in bargain territory, sitting well below both the sector medians and its own five-year averages.

Despite the stock’s bruising decline, UnitedHealth signaled confidence where it counts: dividends. In December, the company paid a quarterly dividend of $2.21 per share, marking 16 consecutive years of growth and 24 years of dividend payments. Its annual yield of 2.59%—more than double the S&P 500 SPDR’s (SPY) 1.06% yield—is a steadying signal in turbulent times.

A Closer Look at UnitedHealth’s Mixed Q3 Results

UnitedHealth Group delivered mixed third-quarter 2025 results on Oct. 28, offering a clearer view of both the pressures weighing on the business and management’s confidence in the road ahead. The company generated revenue of $113.2 billion, up 12% year-over-year (YoY) and in line with Wall Street’s expectations. Growth was broad-based, spanning both UnitedHealthcare and Optum, underscoring the strength of its diversified model even in a difficult operating environment.

UnitedHealthcare, the core insurance engine, led the charge with revenue rising roughly 16% to $87.1 billion, reflecting continued membership growth and pricing actions. Optum revenue increased about 8% to $69.2 billion, with Optum Rx standing out as the fastest-growing unit, supported by pharmacy volume and service expansion.

Profitability, however, remained strained. Adjusted EPS fell sharply to $2.92 from $7.15 a year earlier, though the result exceeded market expectations. Earnings from operations declined nearly 50% to $4.3 billion as elevated medical utilization and reimbursement pressures compressed margins. Net margin narrowed to 2.1%, down from about 6% last year.

The consolidated medical care ratio came in at 89.9%, reflecting cost trends consistent with prior guidance, including higher utilization, Medicare funding reductions, and Part D changes under the Inflation Reduction Act. Still, management struck a confident tone, raising full-year 2025 guidance to at least $14.90 in EPS and $16.25 in adjusted EPS, signaling faith in execution despite a demanding environment.

UnitedHealth is all set to unveil its Q4 earnings report on Tuesday, Jan. 27, before the market opens. Analysts predict EPS for the quarter to decline by 69.3% YoY to $2.09 and be around $16.30 for fiscal 2025, down 41% annually. Yet, in fiscal 2026, profit is expected to rise 8% annually to $17.60.

What Do Analysts Expect for UNH Stock?

Evercore ISI initiates coverage on UNH with a clear vote of confidence, framing the healthcare giant as a long-duration turnaround rather than a swift recovery story. The firm assigns an “Outperform” rating and a $400 price target, implying roughly 17.1% upside from current levels, and anchors its view in UnitedHealth’s scale, diversification, and durable fundamentals.

Evercore is clear-eyed about the backdrop. The managed care sector continues to grapple with elevated medical utilization following the post-Covid-19 surge, a trend the firm expects to persist through 2026. UnitedHealth has lagged profit expectations in recent quarters as higher utilization pressured costs.

Still, analyst Elizabeth Anderson argues the industry has largely adapted, with most plans now pricing for these realities. She names UNH among her top picks in managed care, citing improving Medicare Advantage margins, disciplined pricing for the 2026 plan year, and management’s credible turnaround strategy. The firm frames 2026 as a transition year, one requiring patience and execution. More meaningful progress, Evercore believes, should surface in the upcoming years, opening the door to earnings upside and multiple expansion as the recovery becomes clearer.

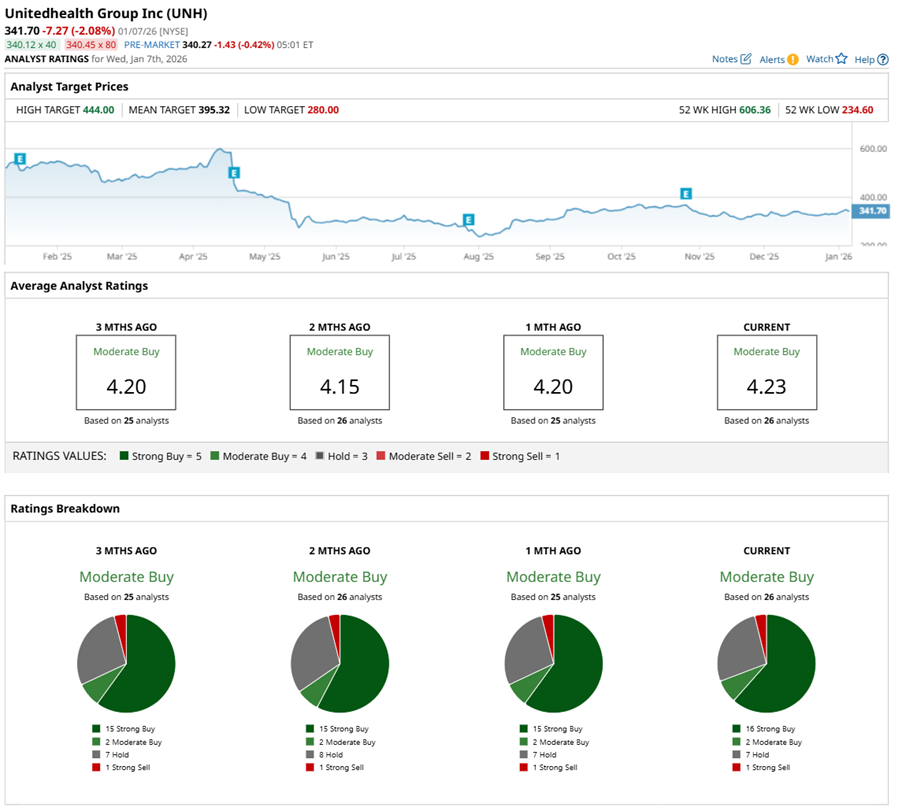

There’s still optimism in the air, but with a touch of caution. UNH has a “Moderate Buy” consensus overall. Of the 26 analysts covering the stock, 16 advise a “Strong Buy,” two suggest a “Moderate Buy,” seven analysts are playing it safe with a “Hold,” and the remaining one analyst has a “Strong Sell” rating.

The mean price target of $395.32 implies the stock could rise as much as 15.7%. The Street-high target of $444, way below last year’s highs, signals that UNH has upside potential of 29.9% from the last closing price.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)