/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Tesla (TSLA) shares rose slightly on Jan. 5, but it was not easy to overlook the company's fourth-quarter deliveries reported on Jan. 2. The company was responsible for 418,227 units delivered during the December quarter, missing Wall Street expectations and experiencing a 16% year-over-year (YOY) decline. For a company valued for flawless execution, another mishap was bound to increase investor attention.

Taking a wider view, the story was much the same for 2025. Tesla produced around 1.65 million units, lower than the 1.78 million produced in 2024 and the peak in 2023. This represents the second successive fall in production, which in itself represents a departure for a company that has previously rewritten the rule book on defining growth in the automotive sector. Increasingly tough competition, particularly from China, looms large in the background.

This dichotomy was made vividly apparent this past week. BYD (BYDDY) saw a YOY increase of 27% for battery EV vehicles in 2025, surpassing Tesla and becoming the world’s largest EV seller. Meanwhile, the United States has experienced a slowing EV market. Fellow EV maker Rivian (RIVN) also experienced another YOY decline.

About Tesla Stock

The leader among pure EV plays, with its $1.4 trillion in market capitalization, remains Tesla (TSLA). Headquartered in Austin, Texas, Tesla still holds massive mindshare in the industry but appears to be struggling in its stock performance due to slowing fundamental drivers.

During the last 12 months, TSLA stock’s price action has been remarkably broad, ranging from about $214 to almost $500. Although TSLA stock has been experiencing weaknesses lately, it still represents a considerable gain since the 2024 bottom. Meanwhile, the overall market as tracked by the S&P 500 ($SPX) has shown much more steady performance.

On a forward-looking basis, Tesla is trading at 251 times earnings and 16.6 times sales, with margins of safety that loom large over traditional car companies and, in some cases, growth-oriented technology equities. The profitability-focused data is encouraging, with margins remaining strong by any car company measure, but with return on equity and asset values having declined sharply with mounting pricing pressures.

The bottom line is that TSLA stock is priced for a change in trajectory rather than for a continuation of the present situation.

Tesla Misses on Deliveries

TSLA stock suffered from the missed delivery targets, but it's worth noting that Tesla's Q4 earnings report had some positive aspects as well. For one thing, the company's production outpaced delivery for the period, with energy storage units reaching a record level of 14.2 gigawatts-hours for the quarter. This business seems to be one of Tesla's most steady growth drivers.

Still, vehicle deliveries remain the principal earnings enabler for Tesla and, in this respect, things are less clear. Delivery of Models 3 and Y decreased YOY while lower-priced models were unable to compensate for the difference. Cost discipline and efficiency have been heavily emphasized by management, although it does become increasingly difficult to maintain margins with declining volumes.

Looking ahead, it won’t take long for the investment community to gain more clarity. Tesla is set to share full financial results for Q4 on Jan. 28, when it will announce guidance and provide commentary related to issues like pricing, autonomy, and capital allocation.

What Do Analysts Expect for Tesla Stock?

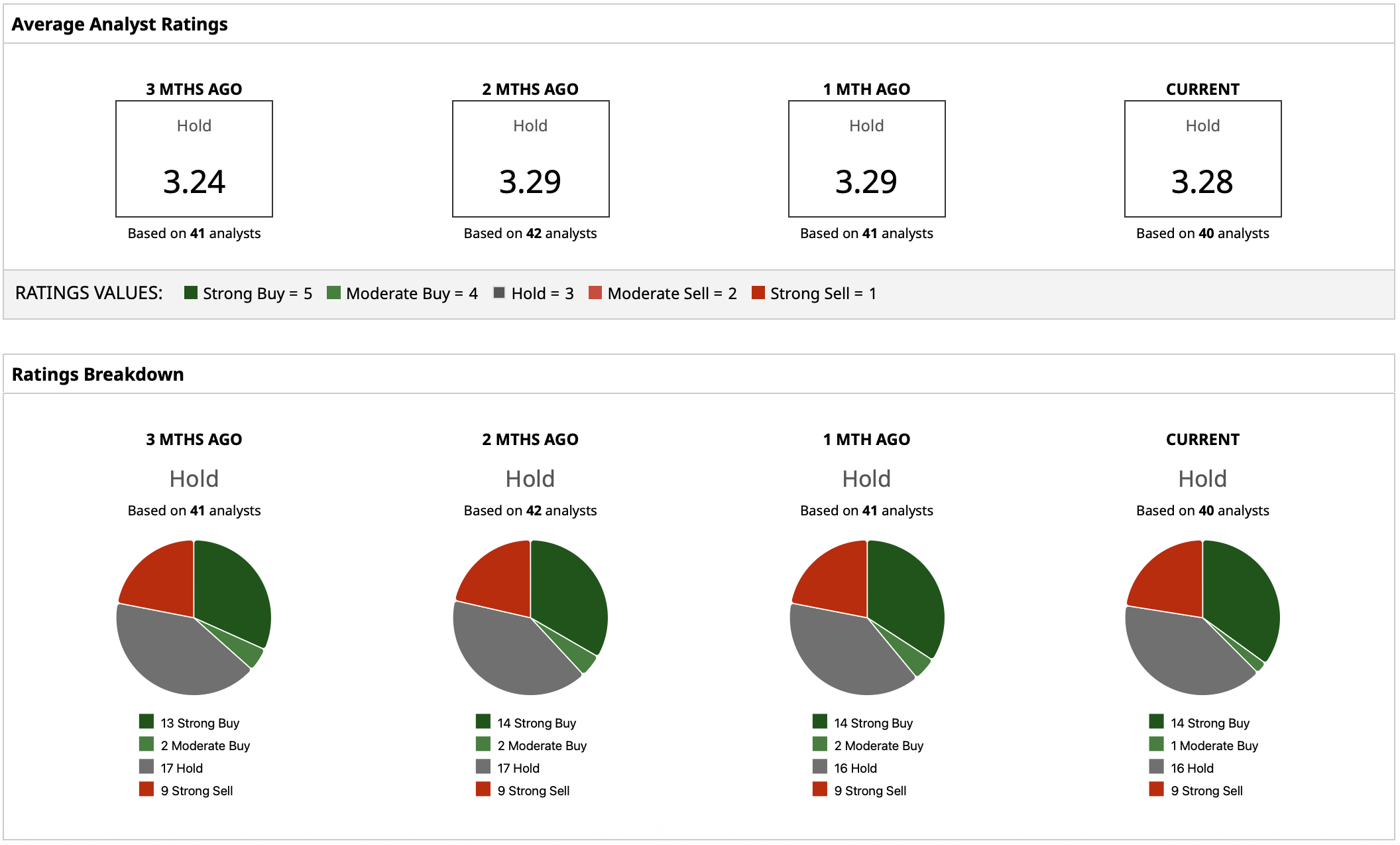

Wall Street is still very split on TSLA stock with a current “Hold” consensus rating. The price targets for Tesla range from a low of $120 to a high of $600, with a mean target of approximately $395. The mean price target forecasts a downside move for TSLA from the current price, which is a very unusual situation for a stock that has historically been associated with a very positive outlook.

This split reflects two different stories. The bulls believe in long-term call options regarding autonomy, AI, and energy storage, which supports rich valuations.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)