/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)

Nio (NIO) stock closed more than 3.5% higher on Dec. 30 after Beijing confirmed plans of offering consumer trade-in subsidies worth up to $8.92 billion next year.

The announcement comes as China seeks to counter deflationary pressures and economic softness. According to its National Development and Reform Commission (NDRC), the program will help “optimize the implementation of new economic and social organizations” as well.

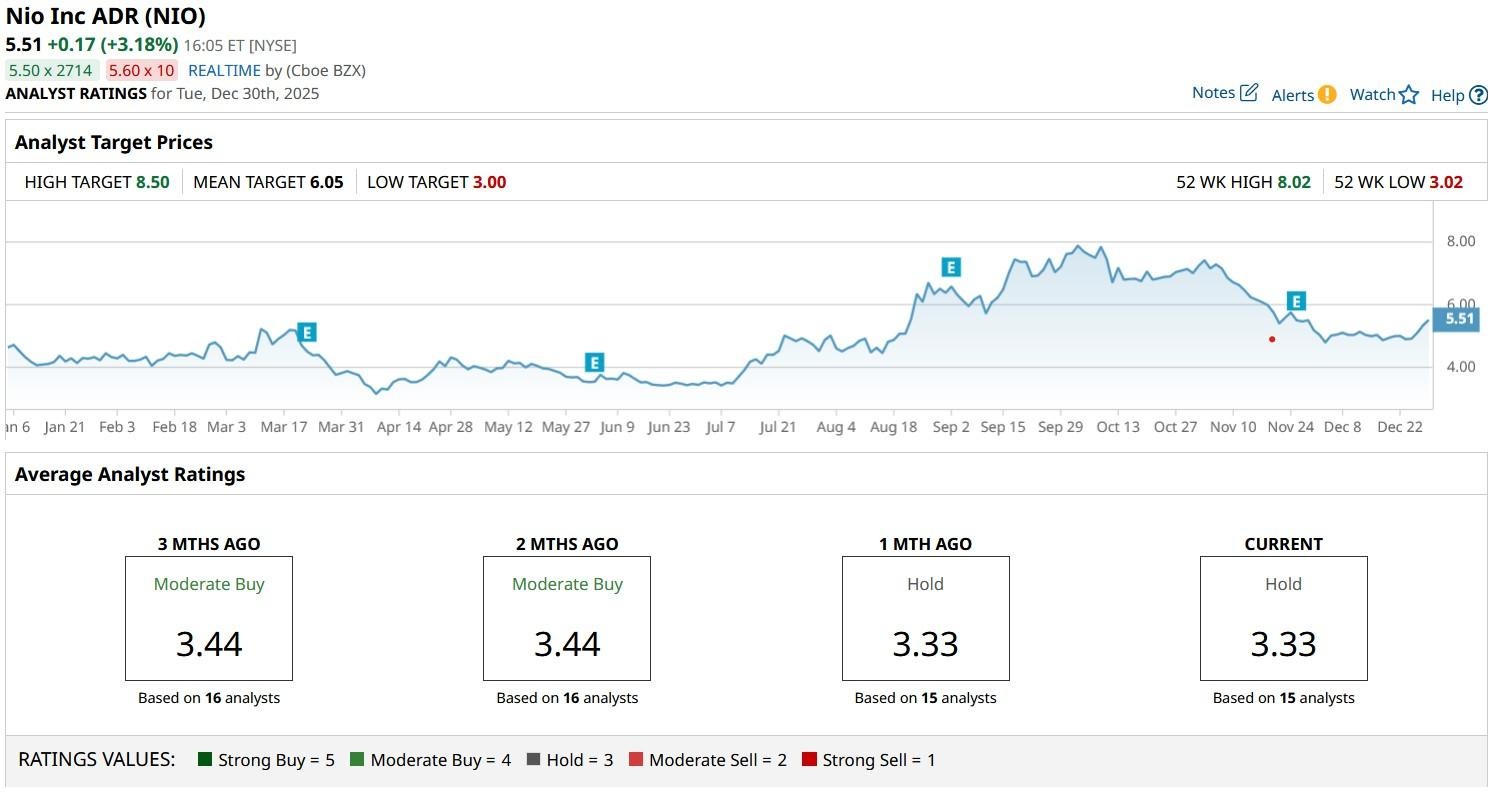

Nio shares have been in a sharp downtrend over the past three months. At the time of writing, they are down more than 30% versus their year-to-date high on Oct. 2.

Why Is China’s Stimulus Package Bullish for Nio Stock?

China’s latest stimulus package is largely constructive for NIO stock.

Why? Because nearly $9 billion in trade-in subsidies mean the government is directly incentivizing consumers to upgrade to new vehicles – including EVs.

The initiative also signals Beijing’s commitment to a country-wide transition to electric vehicles, even amid broader economic challenges.

For Shanghai-headquartered Nio, this could mean stronger sales, reduced inventory risk, and better investor sentiment heading into 2026, especially since it relies heavily on domestic demand to drive future growth.

Where Options Data Suggests NIO Shares Are Headed

NIO shares remain attractive also because the management recently guided for over $4 billion in vehicle sales for the fourth quarter, a massive growth from last year’s $2.7 billion.

Additionally, options data is largely skewed to the upside as well. According to Barchart, contracts expiring mid-May currently suggest Nio could be trading at north of $7 within the next five months with a low put/call ratio another bullish indicator.

The NYSE-listed firm has expanded its product lineup to both premium SUVs and affordable EVs (Onvo), while aggressive investments in battery-swapping tech continues to differentiate it from rivals.

Importantly, at a price-sales (P/S) ratio of about 1.18x, this EV stock is more attractively valued compared to its larger U.S. rivals like Tesla (TSLA) and Rivian (RIVN).

Wall Street Sees Further Upside in Nio Next Year

Wall Street estimates also suggest NIO stock will push higher from here in the calendar year 2026.

While the consensus rating on Nio shares remains at “Hold” only, price targets currently go as high as $8.50, indicating potential upside of another 55% in the coming year.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.