/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Cathie Wood is best known for her choice in disruptive stocks with exceptional growth potential, so any move by ARK Invest naturally grabs investor attention. Last week, Wood trimmed her exposure to Tesla (TSLA), sparking fresh debate about whether the electric vehicle and AI giant is still a buy at current levels or if it's time to dump the stock.

What Exactly Did Cathie Wood Do?

According to disclosures, Wood sold 23,110 shares of Tesla through ARK Invest’s flagship ARK Innovation ETF (ARKK), generating roughly $11.2 million. The sale came shortly after Tesla shares pulled back from record highs earlier in the week. Importantly, this was not a wholesale exit. ARK remains a major Tesla shareholder, with Tesla holding 11.9% weightage, and the transaction appears to be a partial profit-taking move rather than a change in Wood’s long-term thesis. Even after the sale, TSLA stock is up 18% year-to-date (YTD), slightly outperforming the broader market.

Tesla has been unusually volatile in recent weeks. The stock surged to new highs soon after its Q3 earnings as optimism around full self-driving (FSD), robotaxis, AI chips, and humanoid robots intensified. At the same time, concerns about valuation have grown, making investors and analysts skeptical as Tesla’s core business continues to struggle.

Tesla continues to frame itself less as a carmaker and more as a real-world AI platform. In the third quarter, CEO Elon Musk emphasized several long-term drivers. Tesla is expanding robotaxi operations and expects broader deployment as regulatory approvals come through. Second, the Optimus humanoid robot remains a high-risk, high-reward bet, but one Tesla believes could redefine its future revenue mix.

Despite enthusiasm around Tesla’s AI roadmap, investors cannot ignore the challenges facing its core businesses. In the third quarter, revenue rose roughly 12% year-over-year (YoY) to about $28.1 billion, while vehicle deliveries increased 7.4% to just over 497,000 units. Growth is still present, but it is slowing. Adjusted earnings per share fell 31% YoY, and gross margin declined to 18% as continued price cuts weighed heavily on results. Competition is intensifying, particularly from low-cost Chinese EV manufacturers that are rapidly improving technology while undercutting Tesla on price. Nonetheless, Tesla continues to generate substantial free cash flow ($4 billion in Q3) and maintains a large cash balance ($41 billion) to fund aggressive expansion.

Should You Follow Cathy Wood’s Move?

For most investors, this move should be considered portfolio management, not a bearish signal. Wood did not abandon Tesla. Her portfolio simply reduced exposure after a strong rally. The fact that Tesla shares continued to climb even as ARK sold suggests broader market demand remains strong.

That said, Tesla’s stock price already reflects a lot of optimism. Trading at 221 times forward earnings, TSLA stock is expensive. Expectations around autonomy, AI, and robotics are high, and any delays or regulatory setbacks could lead to sharp pullbacks. Long-term investors who believe Tesla will successfully monetize autonomy, AI, and robotics might find any pullbacks as buying opportunities.

What Does Wall Street Say About TSLA Stock?

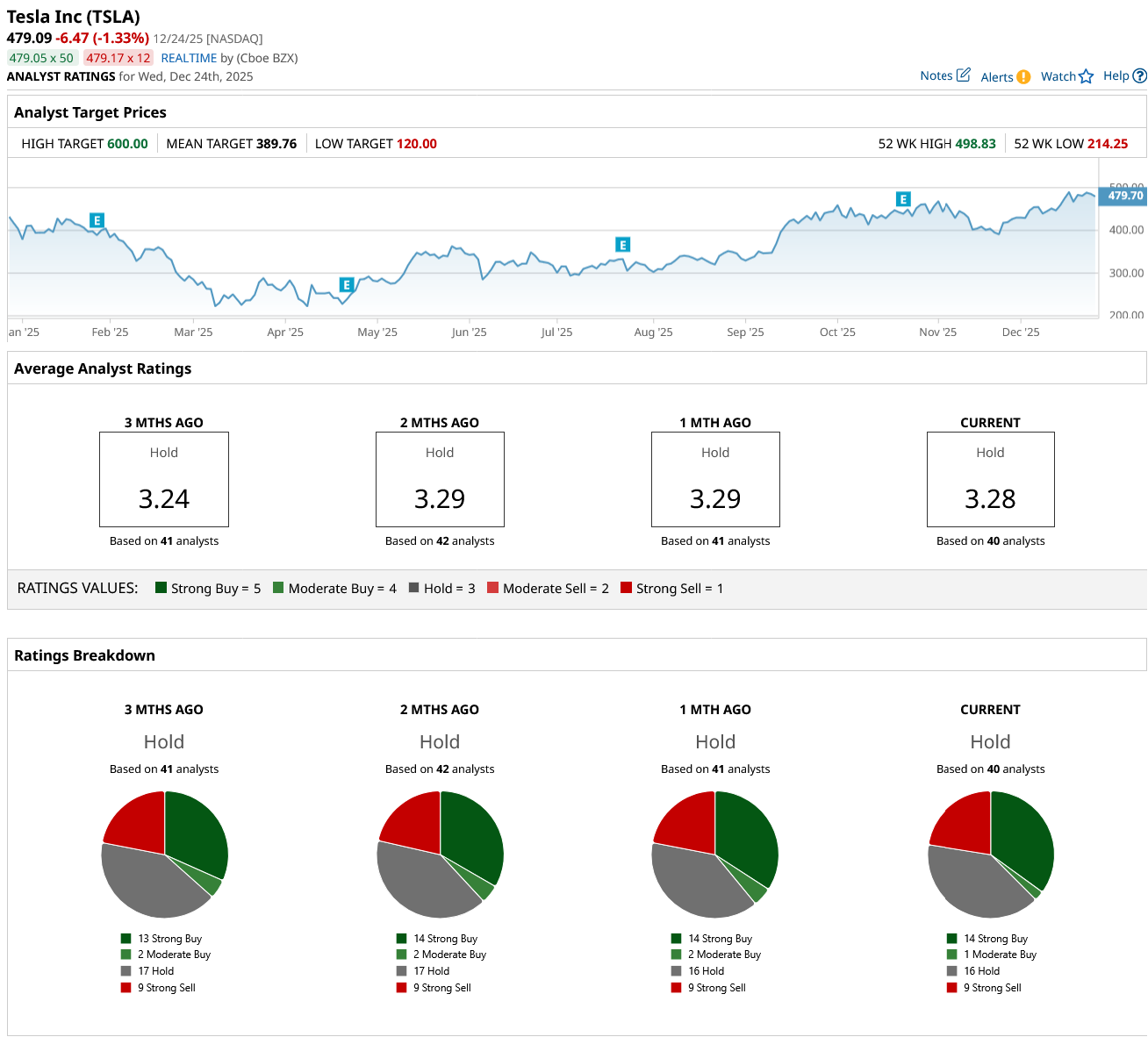

Wall Street’s stance on Tesla is mixed, with an overall “Hold” rating. Of the 40 analysts covering the stock, 14 rate it a “Strong Buy,” one assigns a “Moderate Buy,” 16 recommend a “Hold,” and nine advise “Strong Sell.” Tesla has already moved above its average analyst price target of $389.76, while the high price target of $600 implies upside of about 25% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)