/Northern%20Trust%20Corp_%20magnified%20by-Casimito%20PT%20via%20Shutterstock.jpg)

Valued at a market cap of roughly $26.8 billion, Northern Trust Corporation (NTRS) is a global financial powerhouse serving corporations, institutions, and high-net-worth individuals through its integrated wealth management, asset servicing, asset management, and banking platforms. Founded in Chicago in 1889, the firm has grown into a truly international franchise, with operations across 24 U.S. states and Washington, D.C., and 22 locations in Canada, Europe, the Middle East, and the Asia-Pacific region.

As of September 30, 2025, Northern Trust oversaw a massive $18.2 trillion in assets under custody and administration and $1.8 trillion in assets under management, underscoring its scale and influence in global finance. The company is planning to lift the curtains on its fiscal 2025 fourth quarter earnings report before the market opens on Jan.22, 2026. And ahead of this event, Wall Street appears optimistic about the company’s earnings potential.

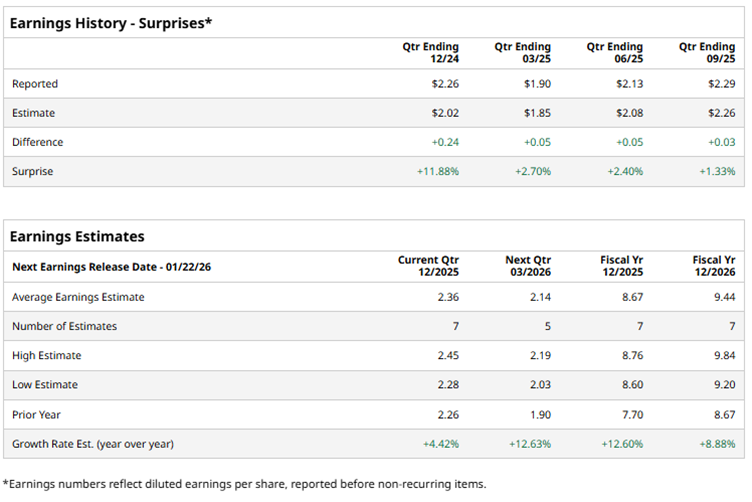

Heading into the upcoming quarter, Wall Street expects the company to deliver earnings of $2.36 per share, marking a 4.4% year-over-year increase. The company has also built an impressive momentum streak, beating bottom-line estimates in each of the past four quarters, reinforcing confidence in its execution.

Looking further ahead, analysts see earnings power continuing to build, with fiscal 2025 EPS projected to climb 12.6% to $8.67, followed by another 8.9% jump to $9.44 in fiscal 2026, signaling a clear runway for sustained profit growth.

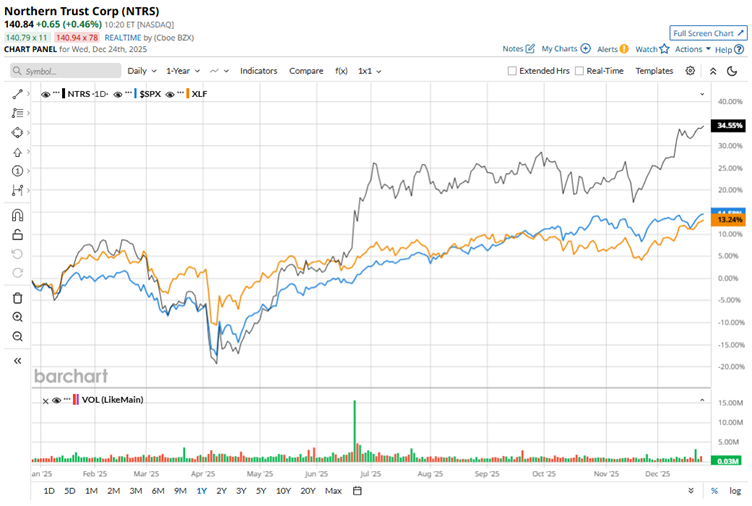

The shares have delivered a standout performance, jumping 35.8% over the past year, more than doubling the S&P 500’s ($SPX) 14.5% gain over the same period. Northern Trust has also pulled well ahead of its financial-sector peers, comfortably beating the Financial Select Sector SPDR Fund (XLF), which rose 13.5% over the past year.

Northern Trust shares slipped 2.4% after the firm delivered a mixed set of third-quarter results on Oct. 22. While strength across trust fees, capital markets revenue, and net interest income highlighted solid underlying momentum, a sharp drop in other non-interest income took some shine off the quarter. Overall revenue climbed 2.8% year over year to $2.03 billion, but still came in slightly short of Wall Street’s expectations. On the bright side, earnings told a better story. EPS rose 3.2% to $2.29, topping the consensus estimate of $2.26 and signaling that profitability remains resilient despite the revenue miss.

Wall Street’s view on Northern Trust remains measured rather than enthusiastic, with the stock earning a consensus “Hold” rating. Among the 17 analysts covering the name, two rate it a “Strong Buy,” one calls it a “Moderate Buy,” 10 sit on a “Hold,” one leans “Moderate Sell,” and three go as far as “Strong Sell,” highlighting how divided sentiment remains.

Even so, while the shares are already trading above the average price target of $136.50, the Street-high target of $155 implies about 9% upside if the most bullish analysts are right.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)