/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

With a market cap of $294.2 billion, UnitedHealth Group Incorporated (UNH) is a diversified health care company operating in the United States and internationally through four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The company provides health benefits, care delivery, data-driven health services, and pharmacy care solutions to individuals, employers, governments, and health care organizations.

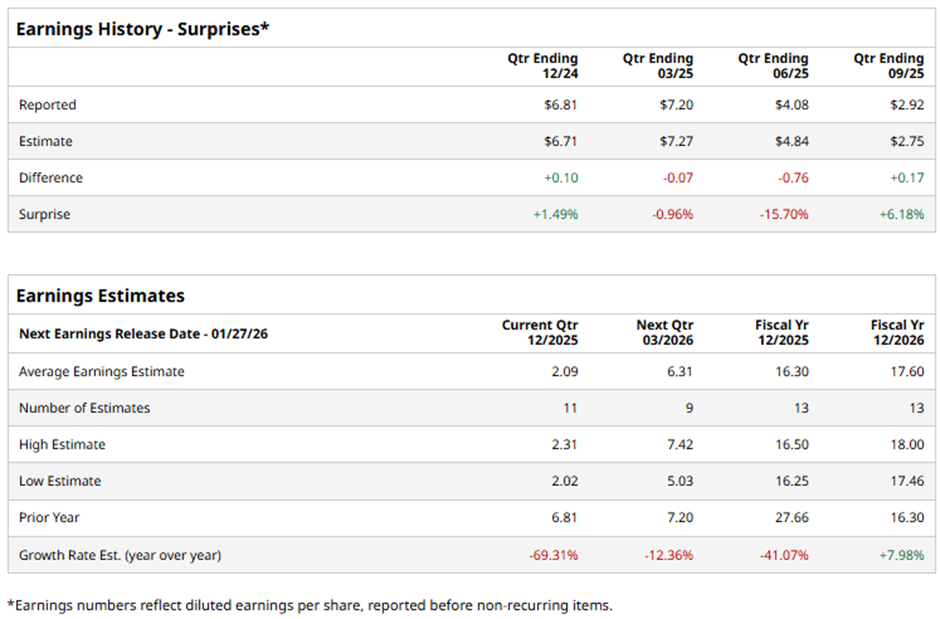

The largest U.S. health insurer is set to deliver its fiscal Q4 2025 results before the market opens on Tuesday, Jan. 27. Ahead of this event, analysts predict UnitedHealth to report an adjusted EPS of $2.09, down 69.3% from $6.81 in the previous year's quarter. It has exceeded Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the Eden Prairie, Minnesota-based company to report an adjusted EPS of $16.30, a 41.1% drop from $27.66 in fiscal 2024. However, adjusted EPS is anticipated to grow nearly 8% year-over-year to $17.60 in fiscal 2026.

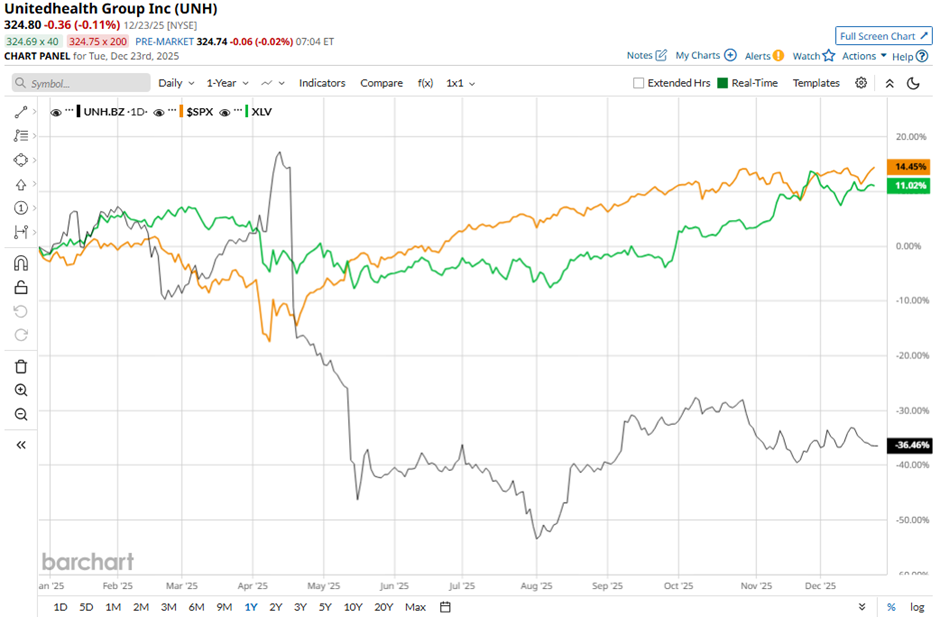

UNH stock has dipped 35.9% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 15.7% gain and the State Street Health Care Select Sector SPDR ETF's (XLV) 11.7% rise over the same period.

Despite reporting weaker-than-expected Q3 2025 revenue of $113.16 billion, shares of UNH rose marginally on Oct. 28 as the company delivered adjusted EPS of $2.92, beating the analyst estimate. Investors also welcomed UnitedHealth’s raised 2025 adjusted profit forecast to at least $16.25 per share, above both its prior outlook and analysts’ expectations. Confidence was further supported by management’s outlook for “durable and accelerating growth” starting in 2026 and its progress in stabilizing costs, including an MCR of 89.9%.

Analysts' consensus rating on UNH stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 25 analysts covering the stock, opinions include 15 "Strong Buys,” two "Moderate Buys,” seven "Holds,” and one "Strong Sell.” The average analyst price target for UNH is $394.91, suggesting a potential upside of 21.6% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)