I asked how low crude oil can prices fall in a November 6, 2025, Barchart article, where I concluded with the following:

NYMEX crude oil’s price remains above the $55 support level in early November 2025. However, a break below support could trigger a sudden surge of technical sellers, overwhelming buyers, and causing a spike to $50 or lower. Considering the price action in 2020, $40 is not an unreasonable downside target.

Nearby NYMEX crude oil futures were trading at $60.65 per barrel on November 4, and have moved lower to under $58 in late December. While the trend remains bearish, the price has not yet challenged the critical technical support level.

The bearish trend continues, and the reasons for consolidation in 2025

WTI and Brent crude oil futures remain in bearish trends in December 2025.

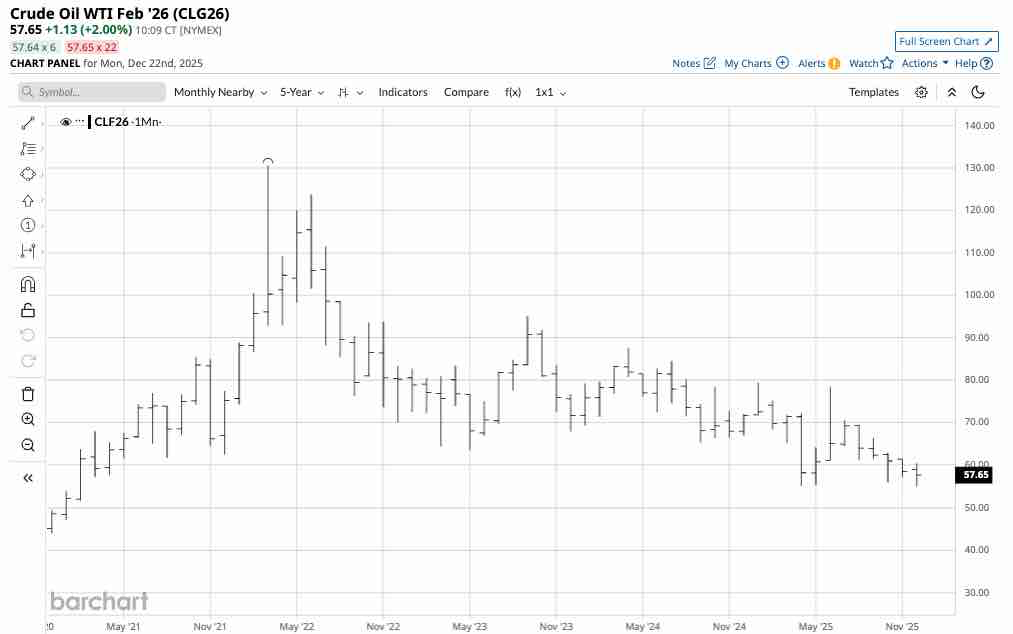

The monthly chart of the continuous NYMEX WTI crude oil futures contract shows that the energy commodity has made lower highs and lower lows since trading at the March 2022 high of $130.50 per barrel. WTI crude oil futures reached a low of $55.12 in April 2025 and traded to a slightly lower $54.89 low in December before recovering to $57.65 per barrel on December 22, 2025, not far above the low and new critical technical support level.

The monthly chart of the continuous ICE Brent crude oil futures contract shows that the Brent benchmark futures has also made lower highs and lower lows since trading at its March 2022 high of $127.99 per barrel. Brent crude oil futures reached a low of $58.39 in April 2025, and were below $61.70 per barrel in December 2025, not far above the low and critical technical support level. Brent futures did not trade below the April 2025 low in December as they reached $58.72 per barrel on December 16, 2025, before recovering.

The following factors have weighed on crude oil prices over the past years and in 2025:

- After reaching the 2022 high, the U.S. released substantial crude oil reserves from its strategic petroleum reserves.

- OPEC+ increased production over the past year as economic weakness in China, a leading crude oil consumer, has weighed on demand.

- In 2025, the Trump administration reversed the previous administration’s energy policies. After four years of inhibiting fossil fuel production and consumption to combat climate change, the current administration has supported a “drill-baby-drill” and “frack-baby-frack” approach to achieve energy independence, limit OPEC+’s, the international petroleum cartel, pricing power, reduce inflation, and increase export revenues through increased production.

- In late 2025, seasonality is weighing on crude oil prices as gasoline demand declines to annual lows during the coldest months.

While crude oil prices are above the critical technical support levels at the April 2025 low, the path of least resistance of prices remains lower.

The factors supporting crude oil prices

The issues that could support crude oil prices over the coming weeks and months are as follows:

- Cooperation between the U.S. and Saudi Arabia, the most influential OPEC member, on geopolitical issues could lead to agreements to keep oil prices stable at over $50 per barrel.

- Geopolitical tensions in the Middle East and Ukraine could trigger sudden price spikes if unexpected hostilities break out.

- Crude oil prices will strengthen seasonally in spring and summer 2026 as gasoline demand increases during the annual driving season.

- The U.S. strategic petroleum reserve remains low at around 412.2 million barrels, compared to pre-2022 levels.

Crude oil is a volatile commodity. The lower the price falls, the greater the odds of periodic price recoveries.

The issue that could send them substantially lower

The two issues that could send crude oil prices tumbling from the current level are as follows:

- A break below $58.89 on the nearby NYMEX WTI futures and under $58.39 on the ICE Brent futures could unleash a herd of technical selling, sending crude oil prices to the $50 per barrel level or lower.

- Any significant economic surprises that weigh on U.S. and global growth could cause crude oil prices to suddenly drop.

During the 2020 pandemic, crude oil prices fell to lows, with nearby NYMEX futures dropping below zero because there was nowhere to store the energy commodity as demand evaporated. The price action in 2020 is an example of how the leading energy commodity could react to any financial crisis.

The case for a continuation of price consolidation

In December 2025, bullish and bearish factors are pulling crude oil prices in opposite directions.

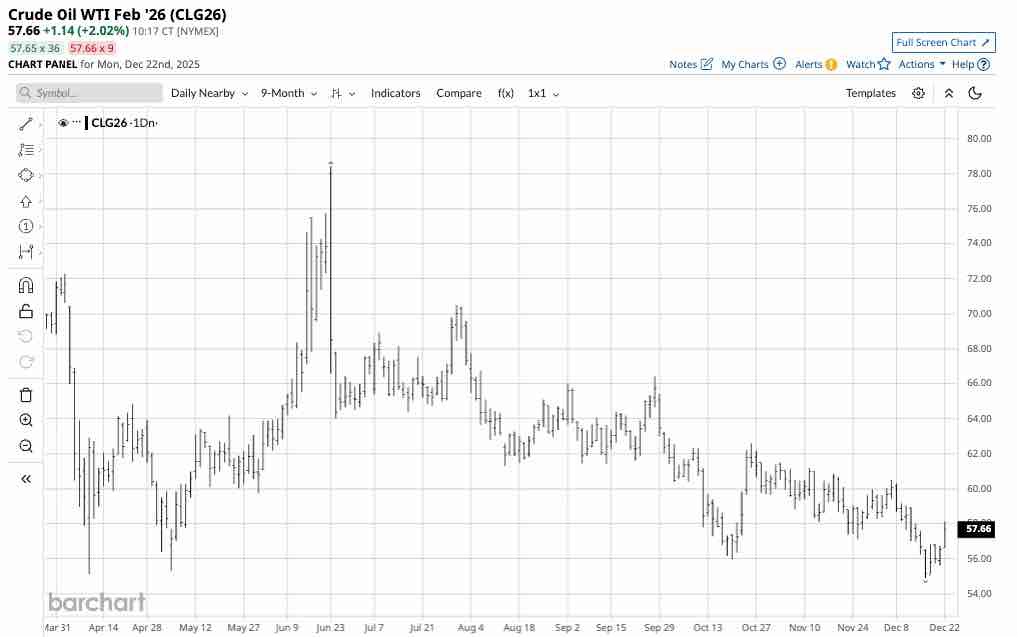

The nine-month daily continuous NYMEX crude oil futures chart illustrates that after the June spike to $78.40 per barrel after the U.S. attacked Iranian nuclear facilities, and since mid-August, crude oil prices have settled into a trading range between $54.89 and $66.42 per barrel, with $60 the energy commodity’s pivot point. Rallies above $60 have been selling opportunities, while dips below have been buying opportunities. However, the short-term chart continues to reflect a bearish bias. Brent crude oil futures have followed a similar consolidation path.

The bottom line is that if the consolidation around the $60 pivot point continues, trading crude oil will be optimal.

UCO and SCO are short-term ETFs that magnify the price action in WTI futures

The most direct route for a risk position in crude oil is through the NYMEX WTI or the ICE Brent futures and options markets. The USO and BNO ETFs track WTI and Brent futures, respectively. These ETFs move higher and lower with crude prices.

The Ultra Bloomberg Crude Oil 2X ETF (UCO) amplifies the price action in NYMEX WTI futures on the upside. At $19.55 per share, UCO had over $365.33 million in assets under management. UCO trades an average of over 2.27 million shares daily and charges a 0.95% management fee.

The Ultrashort Bloomberg Crude Oil -2X ETF (SCO) amplifies the downside price action in NYMEX WTI futures. At $19.48 per share, SCO had over $102 million in assets under management. SCO trades an average of over 1.069 million shares daily and charges the same 0.95% management fee.

If crude oil remains in its current consolidation range into 2026, UCO and SCO are valuable trading tools that can enhance returns. However, the leverage comes at a price: time decay. The options and swaps that create the gearing are wasting assets.

When crude oil prices move contrary to expectations, UCO and SCO will magnify losses. Moreover, if prices remain stable, the leveraged ETFs will lose value due to time decay. Therefore, any risk positions with UCO or SCO require price and time stops to protect capital. It is not appropriate to deviate from stops when crude oil prices move contrary to expectations. However, when prices move in the anticipated direction, increasing profit horizons with commensurate risk-level adjustments can enhance results.

Crude oil prices are stuck in neutral in late 2025. If they remain above the current technical support levels, the consolidation is likely to continue into early 2026.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)