/Truist%20Financial%20Corporation%20branch%20photo-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Valued at a market cap of $64.2 billion, Truist Financial Corporation (TFC) is one of the largest U.S. regional financial services companies, formed in 2019 through the merger of BB&T and SunTrust. Headquartered in Charlotte, North Carolina, Truist provides a broad range of services including consumer and commercial banking, lending, wealth and asset management, insurance, and investment banking. The company is expected to announce its fiscal Q4 earnings soon.

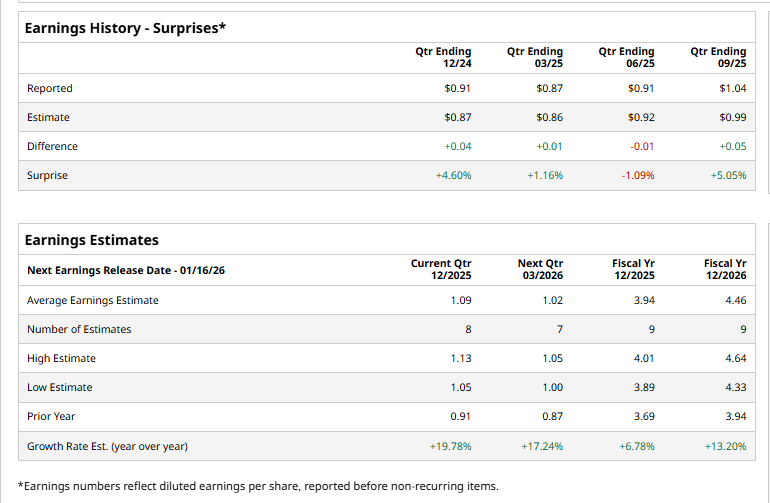

Before this event, analysts expect this bank to report a profit of $1.09 per share, up 19.8% from $0.91 per share in the year-ago quarter. The company has topped Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion. Its earnings of $1.04 per share in the previous quarter surpassed the consensus estimate by 5.1%.

For the current fiscal year, analysts expect TFC to report a profit of $3.94 per share, up 6.8% from $3.69 per share in fiscal 2024. Its EPS is expected to further grow 13.2% year over year to $4.46 in fiscal 2026.

Shares of TFC have gained 15.8% over the past 52 weeks, slightly surpassing the S&P 500 Index's ($SPX) 15.4% rise and the Financial Select Sector SPDR Fund’s (XLF) 14.5% uptick over the same time frame.

\

Shares of Truist rallied more than 3% on Dec. 10 after the bank announced a reduction in its prime lending rate, cutting it to 6.75% from 7%. The move was welcomed by investors as it signals a more accommodative lending environment, potentially supporting loan demand across consumer and commercial segments.

Wall Street analysts are moderately optimistic about TFC’s stock, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, seven recommend "Strong Buy," two indicate "Moderate Buy," 12 suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for TFC is $51.17, implying a 2.5% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)