There are a myriad of upside catalysts investors look to as reasons to buy stocks. Whether it's an earnings beat, or a big announcement, or something like a stock split or index inclusion, there are plenty of reasons why a given stock may be viewed as a buy.

The inverse is also true, and index exclusions (or being taken out of a key index) can be viewed as the kiss of death for companies that many view as blue-chip or ironclad. One such company that's risen to prominence in impressive fashion in recent years is Strategy (MSTR), formerly MicroStrategy. However, concerns around the company being delisted from the Nasdaq have been alleviated, following the key index's announcement of its annual reconstitution of the Nasdaq-100 Index.

According to this reconstitution, other major names, including Lululemon (LULU) and Biogen (BIIB), will be removed, but Strategy survived.

So, Strategy has avoided the proverbial “kiss of death,” whether perceived or real, but investors still have some concerns to pay attention to.

Let's dive into what's driving investor concern in Strategy and whether the company narrowly escaped a delisting or not.

What's the Deal Behind This Delisting Talk?

Strategy's share price has plunged over the course of the past five months, going from a high of around $450 per share to around $165 per share at the time of writing. That's good for a decline of around 63% in the span of just a few months, good enough to knock many companies out of an index. Indeed, seeing a market capitalization decline from around $127 billion to around $46.5 billion today is significant. And considering that Biogen and Lululemon both have market capitalizations around $25 billion still suggests MSTR stock would need to drop around 40% from here to be delisted, if that's the low water mark to be included in this index.

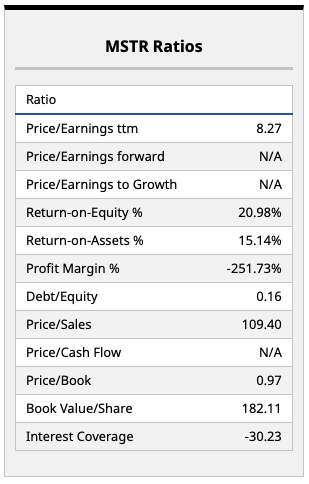

Strategy's underlying fundamentals rely a great deal on the price of Bitcoin (BTCUSD), which has been plunging of late. And while the company's premium to its mNAV (fair market value of its Bitcoin holdings) has declined substantially over the course of this decline, it's also true that the numbers above aren't encouraging.

A profit margin of -250%, driven by continued debt and equity issuances to buy more Bitcoin, has driven concern among some investors that these high debt loads could drive further market capitalization declines. And given the fact that Strategy's return on assets and return on equity numbers have been driven almost entirely by a (previously) surging Bitcoin price, a reversion in this digital asset's upside trend is one that has some investors spooked.

Perhaps the spookiest metric to me, however, is Strategy's price-sales ratio, which remains around 110 times even after a massive drop. This is a valuation that few investors will consider worth investing in, at least those with a penchant for capital preservation and any sort of conservative view around how companies should be valued.

What Do Analysts Think of Strategy's Future?

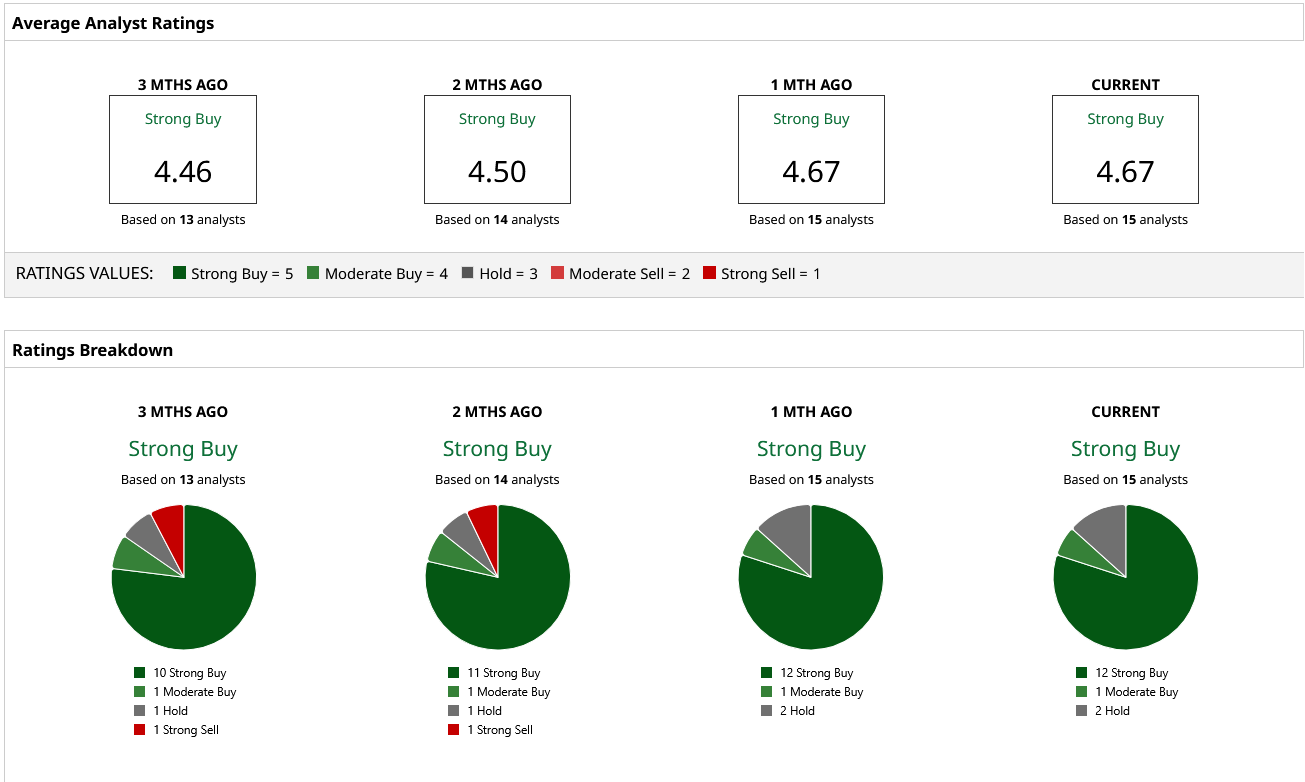

I'll have to admit, I didn't expect to see so many Wall Street analysts hold true to their relatively high targets, many of which were set during the recent run-up in this company's shares. But we only have the data that are available to review, so let's do that.

Currently, MSTR stock is still rated as a strong buy, according to the 13 analysts who currently cover this stock. Even more impressively, the consensus price target for MSTR stock remains over $500 per share. At that price level, this stock has implied upside of around 200% from here.

I'm not so sure whether that will be the case, especially considering if Bitcoin continues on the trend it is on right now. We'll see; that's what makes markets. But in terms of companies at risk right now, I'd say MSTR stock has to be high on most investors' lists.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)