KLA Corporation (KLAC) is in the limelight yet again after Jefferies identified the chip equipment supplier as one of the top picks in the chip space for the year 2026, alongside industry stalwarts Nvidia (NVDA) and Broadcom (AVGO). This recommendation comes at a juncture where investor interest is rotating away from those with cyclical demand in the chip industry towards those with sustainable demand in AI infrastructure development.

KLAC stock's movement has been positive, breaking past the $1,220 level and rising close to the upper part of the 52-week range. Although the majority of the story regarding AI innovation surrounds GPUs and custom silicon, analysts are pointing to the not-so-visible but crucial firms propelling the innovation of chips. KLA Corporation fits the bill nearly to perfection.

There are also broader trends that work to its favor. The semiconductor sector has been quite volatile over the last six months, but it appears that spending on AI, logic, memory, and packaging has been quite strong. Such a scenario would generally favor companies that offer mission-critical equipment over those that are product-cycle driven.

About KLAC Stock

KLA Corporation (KLAC) is a major supplier of process control solutions, inspection solutions, and yield management solutions to the semiconductor industry. They cater to foundries, logic chipmakers, those involved in DRAM and other memory products, and advanced packaging customers globally. As a company headquartered in Milpitas, in the state of California, KLA has a market capitalization in excess of $150 billion, making it a major part of the industry.

KLAC stock has made a phenomenal performance over the last year. It is up substantially from a 52-week low of $550 and has been trading above $1,220 recently, although a bit short of the 52-week high of $1,284. This is substantially better than the performance of the S&P 500 Index ($SPX).

Valuation-wise, KLA is seen to be at around 35 times trailing earnings, with a multiple of around 34.6 times its forward earnings. Although it does seem a mite expensive in relation to its broader market, it is certainly much more justifiable from a profitability perspective. Its operating margins remain in excess of 30 percent, its return on equity in excess of 100 percent, and its free cash flows are quite robust. Additionally, its price/sales ratio of 13.2 times and price/cash flow ratio of around 32 times indicate that it does command a quality premium.

The company is a dividend payer; however, it is not a dividend-focused company.

KLA Beats on Earnings as AI Complexity Fuels Demand

KLA's most recent update on financial performance came in with the first quarter of fiscal 2026, which ended on Sept. 30, and was a resounding positive on all major counts. The company recorded revenue of $3.21 billion, which is above the range that management guided for. Additionally, both GAAP and non-GAAP EPS figures came in at $8.47 and $8.81, respectively.

The generation of cash remained one of the areas that shone brightest. The company generated operating cash flow of $1.16 billion for the quarter and $4.25 billion for the past twelve months. However, the company generated free cash flow of $1.07 billion for the quarter and $3.88 billion on a trailing basis. The company distributed capital returns amounting to almost $800 million for the quarter and over $3.0 billion for the year.

The fact is that the building out of the AI infrastructure differs structurally from the other semiconductor cycles. This is because the increased complexity of advanced AI chips is directly driving the demand for the inspection and process control solutions offered by the likes of KLA, as explained by the company’s CEO, Rick Wallace.

KLA has also expressed no near-term pressure on demand, and the tone of its comments suggests confidence in its relative revenue growth compared to the semiconductor equipment market for calendar 2025.

What Do Analysts Expect for KLAC Stock?

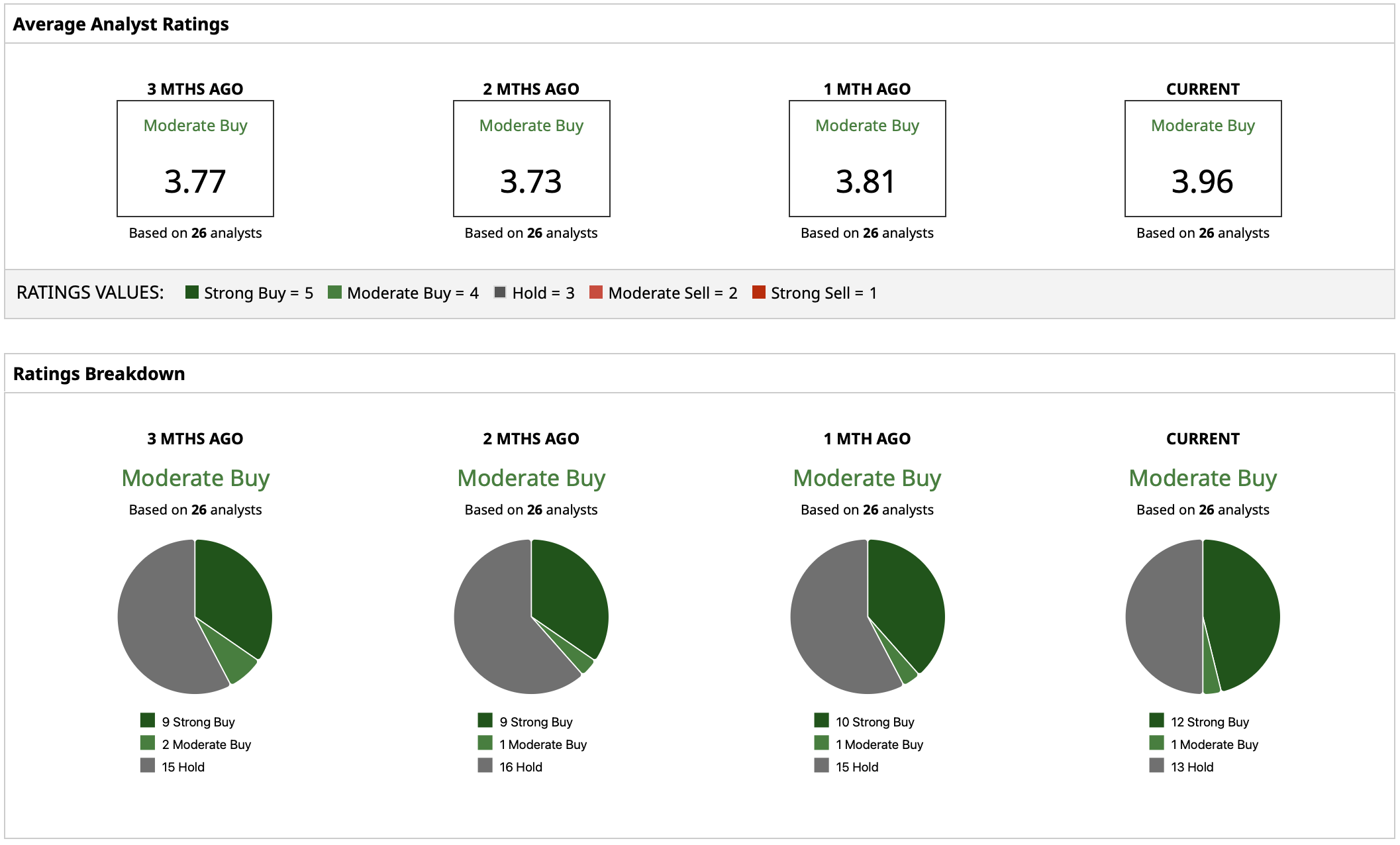

The overall Wall Street sentiment for KLAC stock has been positive. The inclusion of KLA in the list of companies by Jefferies, along with companies like Nvidia and Broadcom, supports the idea that KLAC provides leveraged exposure to AI, independent of end-market demand. KLAC has a “Moderate Buy” rating consensus, and the mean price target of the company is $1,295.17. Using the current price of approximately $1,220 found on the street, the mean price target would provide potential upside of around 6%. The street high price target is provided at $1,500 compared to the lowest target of $870.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)