/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

Netflix (NFLX) has Wall Street buzzing with one of the most dramatic media deals in recent memory. The streaming company’s decision to acquire Warner Bros. (WBD) following the separation of Discovery Global, in a transaction estimated at $82.7 billion, has inspired excitement, worry, and heated debate within the entertainment industry.

While Netflix management paints the deal as a long-term growth engine, critics warn of regulatory hurdles and industry disruption. Netflix stock is down 15% this month alone and is up just 5.9% year-to-date. For investors, the key question is whether this controversy creates a rare buying opportunity or a reason to stay cautious.

The Most Talked-About Deal

According to the terms of the agreement, Netflix will purchase Warner Bros., including its film and television studios, HBO, and HBO Max. The transaction values Warner Bros. Discovery at $27.75 per share and includes both cash and Netflix shares. It is expected to close within 12 to 18 months of Discovery Global’s planned separation in Q3 2026. This acquisition brings together two entertainment powerhouses. Netflix has vast global reach, a top-tier streaming infrastructure, and a data-driven distribution model. Warner Bros. contributes a century-long legacy of storytelling and some of the most recognizable franchises in entertainment history, including Game of Thrones, The Sopranos, Harry Potter, Friends, The Wizard of Oz, and the DC Universe.

What Netflix Says Investors Should Focus On

Co-CEO Ted Sarandos framed the acquisition as an extension of Netflix’s core mission, which is to entertain the world. Netflix believes that merging Warner Bros.’ extensive catalogue of classics and modern franchises with Netflix originals like Stranger Things, Squid Game, Wednesday, and Bridgerton, will dramatically increase its content richness and worldwide appeal. Management further emphasized that the deal is designed to accelerate Netflix’s “business for decades.” Financially, Netflix expects $2 billion to $3 billion in annual cost savings by year three, with the transaction becoming accretive to GAAP earnings per share by year two.

In the third quarter, Netflix’s revenue increased by 17.2% to $11.5 billion, while diluted earnings increased by 8.7% to $5.87 per share. Netflix expects revenue of $11.96 billion in Q4, marking a 16.7% year-over-year increase, and an operating margin of 23.9%. Netflix expects $45.1 billion in sales and a 29% operating margin in 2025, highlighting its commitment on profitable, scalable growth.

Excluding the impact of the deal, analysts predict Netflix’s earnings to increase by 28% for the full year 2025, before rising another 27.8% in 2026. Financially, Netflix maintains a sturdy balance sheet with $9.3 billion in cash against $14.5 billion in gross debt at the end of Q3. It also generated $2.7 billion in free cash flow and expects to generate around $9 billion for the full year.

What the Deal Means for Netflix Stock

The deal has triggered immediate anxiety across Hollywood, with fears ranging from job cuts to the decline of theatrical releases. In response, Netflix co-CEOs Greg Peters and Ted Sarandos addressed employees directly in an internal memo that later became public. Management emphasized that the merger is “about growth,” not consolidation-driven cuts. They also stated that Netflix has framed the acquisition as a method to sustain jobs, maintain creative ecosystems, and secure a healthy future for film and television production.

This deal is both bold and risky. On one hand, Netflix is gaining unmatched intellectual property, premium brands such as HBO, and a large content library, all of which have the potential to greatly increase member engagement and retention. The projected cost savings and earnings accretion strengthen the long-term financial case. On the other hand, regulatory uncertainty, political scrutiny, and industry pushback pose significant near-term risks. Any prolonged antitrust battle could weigh on market sentiment and delay the expected benefits of the deal.

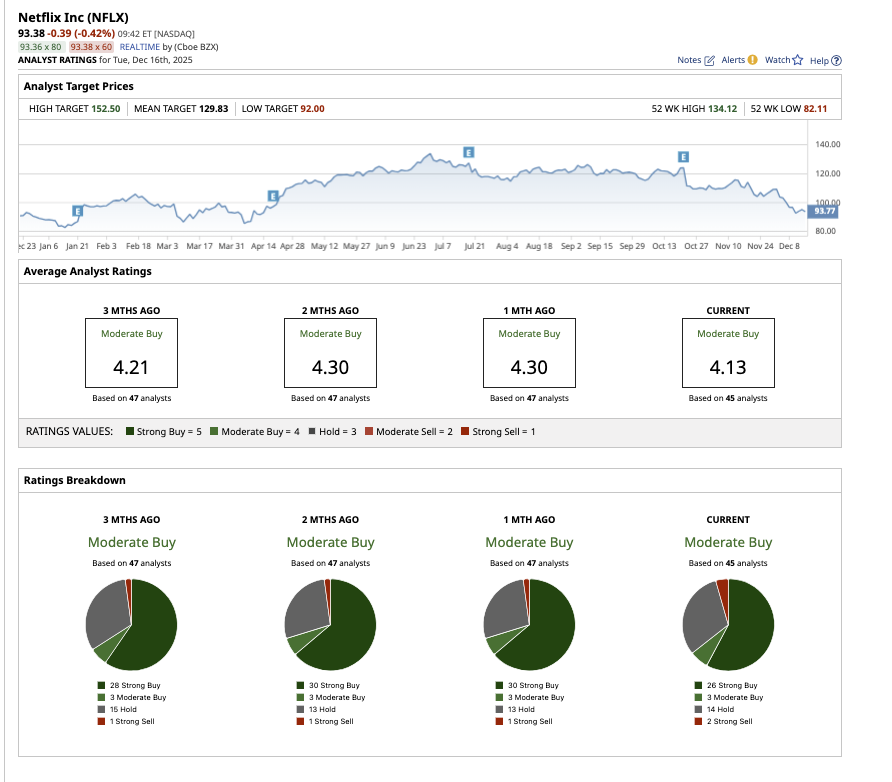

Overall, Netflix stock is a “Moderate Buy” on Wall Street. Of the 45 analysts covering the stock, 26 recommend a “Strong Buy,” three rate it as a “Moderate Buy,” 14 suggest holding, and two say it is a “Strong Sell.” Based on an average price target of $129.83, Wall Street anticipates potential upside of around 39% over the next 12 months. The Street-high estimate of $152.50 indicates the stock could gain as much as 63.3% this year.

For long-term investors who believe in Netflix’s ability to integrate iconic studios, navigate regulatory hurdles, and extract value from world-class content, this controversy-driven dip in the stock presents an attractive entry point.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)