In the past few weeks, robotics stocks have been grabbing attention, and perhaps none more so than iRobot (IRBT). Once just a sleepy maker of home vacuums, iRobot has become a lightning rod for traders. Heavy short interest, big headlines, and sudden bursts of volume have sent the stock soaring.

With shares surging on heavy volume, some investors are beginning to ask a bold question: Can iRobot realistically reach $11 by 2026?

Here’s a closer look at what’s driving the excitement, and what would need to go right for IRBT to hit that mark.

About iRobot Stock

Founded in 1990, iRobot is a consumer robotics company. It pioneered the home cleaning robot market with the Roomba vacuum in 2002 and now sells a range of autonomous cleaning products worldwide. The company has shipped millions of units globally and is a leader in consumer floor-care robotics, though it has faced stiff competition in recent years.

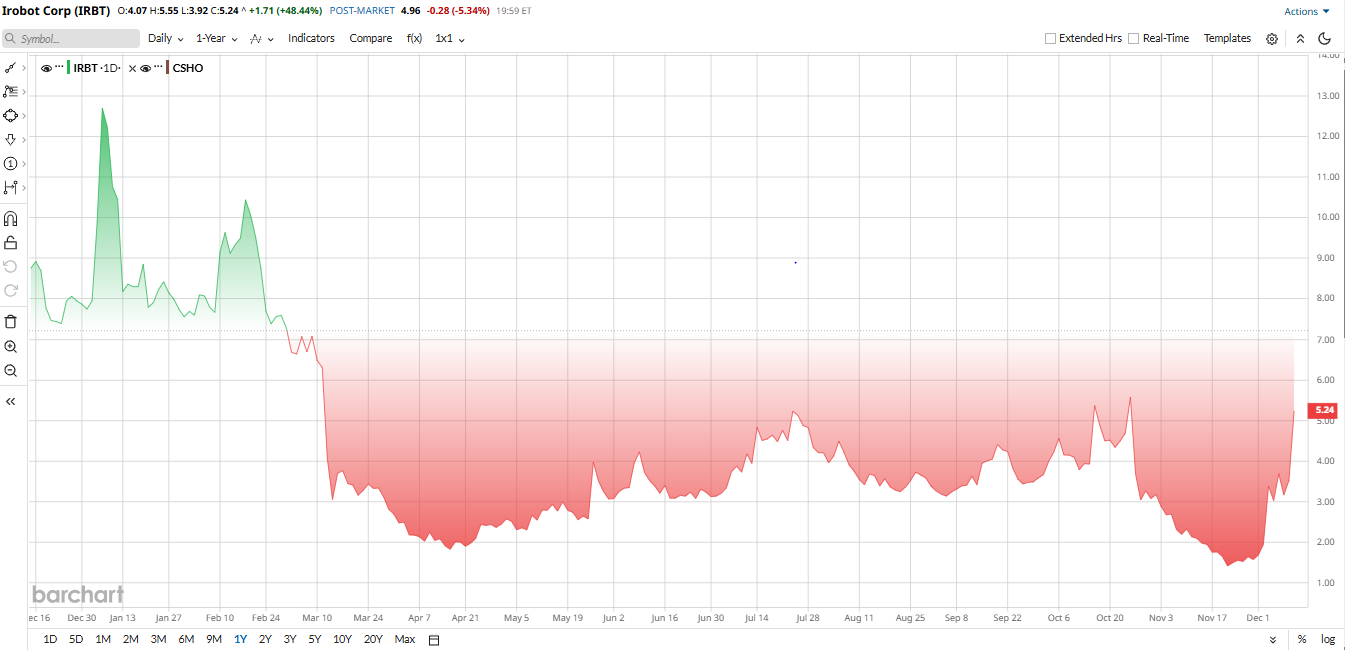

Valued at about $167 million by market cap, iRobot stock has seen sharp swings in 2025. The stock surged more than 67% in the last five days after a report suggested that President Donald Trump’s administration may issue a robotics-focused executive order, a move traders viewed as supportive for domestic firms. Volume spiked to more than 80 million shares, far above normal levels, as heavy short interest of roughly 45% fueled a short squeeze. Despite the rally, the stock is still down 34% year to date (YTD) as the company still faces weakening sales, higher costs, and ongoing pressure from tariffs and product delays.

Even with these sharp price swings, IRBT is attractively priced with its EV-sales ratio at 0.7x, a notable discount of 50% compared to the sector. This suggests that the stock is currently undervalued relative to its peers.

iRobot Losses Deepen as Cash Reserves Continue to Shrink

iRobot’s latest quarter highlighted how tough things have been for the company. Revenue came in at just $145.8 million, which is about 25% lower than the same time last year. The slowdown wasn’t limited to one region either. U.S. sales plunged 33%, while EMEA fell 13% and Japan slipped 9%.

Profitability took a hit as well. iRobot reported a net loss of about $21.5 million. Even on an adjusted basis, the company swung to a loss of -$0.23, versus a small profit a year ago.

Cash levels have also seen a heavy drop. iRobot ended the quarter with $24.8 million in cash it even had to tap an additional $5 million in restricted cash.

CEO Gary Cohen didn’t sugarcoat it. He said revenue came in “well below our internal expectations” because of persistent market headwinds, production delays, and unexpected shipping issues. That weaker-than-planned sales performance directly dragged down profitability and drove up cash burn.

Analysts had previously been expecting around $520 million to $550 million in 2025 full-year revenue with sizable losses, but many are now revising those numbers after this disappointing quarter.

Can iRobot Hit $11 by 2026?

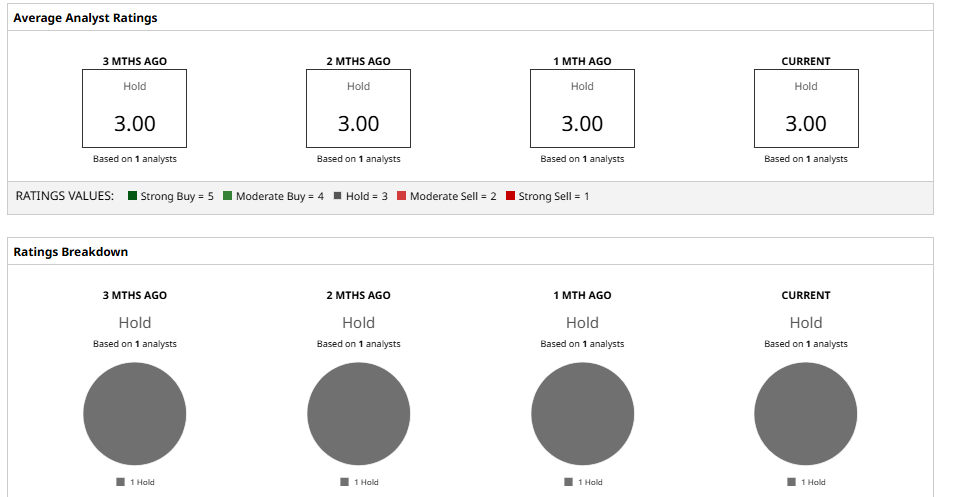

Analysts remain doubtful in light of the recent buzz. The only analyst firm covering the stock, as tracked by Barchart, has a “Hold” rating.

The biggest question is, can iRobot make it to its Street-high target of $11 in 2026? The math isn’t impossible. The previous several sessions witnessed huge gains on volume that surpassed 83 million compared to a daily mean of about 11 million. Such mania, coupled with 45% of its float sold short, provides the justification for a short squeeze that may send share prices much higher than the consensus.

But momentum is not enough to help iRobot cross the finish line. To be realistic at $11, the company will have to translate interest into sales and margins, and that means doing something with AI-driven features and deeper, higher-margin premium smart-home integrations.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)