Among the top consumer discretionary stocks in the market, Chipotle (CMG) could top many investors' lists. Indeed, in terms of fast casual dining firms available to investors, Chipotle may be one of the best-in-class options to consider right now.

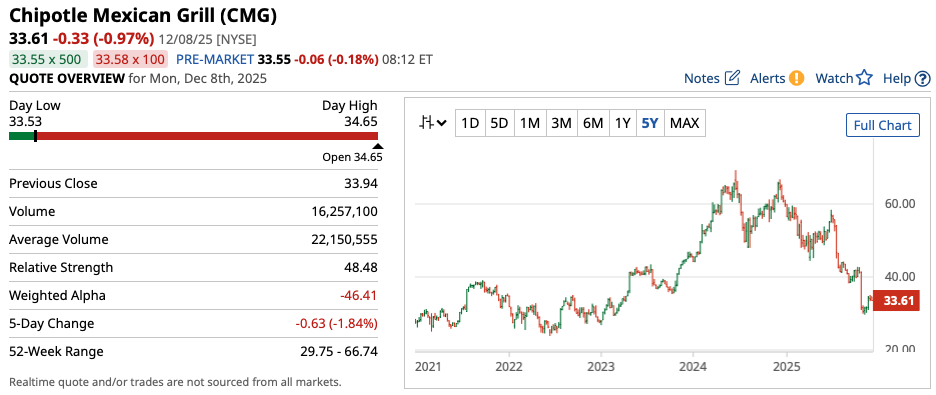

Chipotle's stock chart certainly does not speak to this narrative. Sinking from more than $60 per share a year ago to around $34 per share today, the stock has lost roughly half of its value over the span of the past 12 months. That's compared to a broader market that has continued to grind higher, bolstered by expectations of even greater growth tied to technological innovation (most of which is coming via the artificial intelligence trade).

With that said, a recent report indicates that Chipotle's management team is looking to buy back an additional $1.8 billion of its own stock. With a market capitalization of $45 billion right now, that's a substantial chunk of CMG stock, reflecting a relative yield of around 4% for investors who buy right now.

So, is this the buying opportunity some investors think it is? Let's dive in.

Chipotle's Fundamentals Have Weakened

Once among the highest-margin and fastest-growing quick service restaurant providers in the United States, Chipotle's growth has slowed. We're going to talk about the company's fundamentals below, which are markedly down from what this company was showing just a couple of quarters ago.

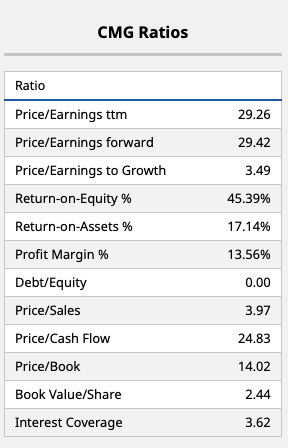

With a gross margin of around 13.6% and solid return-on-equity and return-on-asset numbers, these numbers don't look that bad at first glance. That said, Chipotle's forward price-to-earnings multiple has come down considerably (now trading below 30 times) and, despite this drop, some investors still view the company as relatively overvalued if it can't return to its previous growth rates moving forward. Indeed, a PEG ratio of around 3.5 indicates such a view is likely valid.

Now, some of Chipotle's price action this year can be directly tied to the loss of its CEO to Starbucks (SBUX) in August. This move has reshaped Chipotle's sector, and furthered a rush for talent at the very tops of companies for the best operators to guide firms through difficult periods of time.

I think the big question for investors in Chipotle is whether this additional $1.8 billion buyback will be enough to entice value investors (or perhaps more precisely, growth-at-a-reasonable-price investors) to jump aboard. Without a direct dividend yield, investors are forced to come up with their own expected capital appreciation yield tied to share buybacks, and those are less certain. That said, I'd argue that buying back shares that have dropped 50% in value (particularly by a company with plenty of cash on its balance sheet) could be considered a smart move. But this requires the assumption that Chipotle doesn't have solid places to invest that cash for greater growth, so some investors may take this buyback announcement the wrong way.

What Do Analysts Think About CMG Stock?

There are currently 33 Wall Street analysts covering Chipotle who give CMG stock a consensus “Moderate Buy” rating. With a mean price target of $44.39 for CMG, and given where this stock is trading at current levels, there's some rather juicy potential upside of around 31% from here.

This implied expected return would make plenty of investors happy. And some of this return should arise from the aforementioned buyback addition that Chipotle's management team just announced.

The thing is, growth is the ultimate story when it comes to Chipotle, and the company will have to show that it's moving in the right direction on this front. I'd be a buyer of CMG stock based on its more reasonable multiple and the buyback increase, but I'd also be watching it closely to ensure the fundamentals are moving in the right direction. For those willing to put in the work and manage this position, it could be a very profitable one. But given a lack of broad willingness to do so and the rise of exchange-traded fund (ETF) investing, this may be a tricky stock to play over the near term. That's why companies like Chipotle may be best bought as long-term holds on dips like this. I wouldn't be surprised if we see a resurgence in buying activity on any sort of positive headlines moving forward as a result of other investors thinking the same way.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)