/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

Alphabet (GOOGL) is a global technology holding company and the parent of Google, YouTube, Waymo, Verily, and other firms. It focuses on internet services, online advertising, cloud computing, artificial intelligence (AI), consumer hardware, autonomous driving, and more, using its conglomerate structure to manage diverse, innovation-driven subsidiaries under one corporate umbrella.

Alphabet conducts business worldwide, with significant operations and revenue across North America, Europe, Asia, Latin America, and other regions through data centers, offices, and sales operations in dozens of countries. Formed in 2015 through a restructuring of Google, the company is headquartered in Mountain View, California. Google itself was originally founded in 1998.

Alphabet Stock Surges

Alphabet stock is trading close to its 52-week high of $328.83, reflecting a strong rerating in 2025. Over the last five days, GOOGL stock is slightly up by about 0.18%, while the stock's one-month gain is roughly 10%. Over the past three months, the performance is about 34%, while the six-month return is an impressive 79%. On a 52-week basis, GOOGL stock is up roughly 73%, far outpacing the S&P 500 Index's ($SPX) approximately 14% gain over the same period.

Alphabet Tops Q3 Results

Alphabet reported third-quarter 2025 results on Oct. 29, showing revenue of about $102.3 billion, its first quarter above the $100 billion mark, up roughly 16% year-over-year (YOY) and ahead of analyst expectations of around $99.8 billion to $99.9 billion. Diluted EPS was $2.87, up about 35% from a year earlier and roughly 27% above consensus estimates near $2.26 per share, helped by strong ad and cloud performance and gains on equity securities. Google Services revenue reached about $87.1 billion while Google Cloud grew roughly 34% to around $15.2 billion, both beating forecasts.

GAAP operating income was approximately $31.2 billion, implying a 30.5% operating margin. Excluding a roughly $3.5 billion European Commission fine, operating income was about $34.7 billion with a margin near 33.9%, as revenue growth outpaced underlying cost increases. Net income rose to about $35 billion, with EPS lifted by roughly $10.7 billion of unrealized gains on non‑marketable equity securities. Free cash flow for the quarter was about $24.5 billion, and Alphabet ended the period with close to $100 billion in cash and marketable securities. Meanwhile, Google Cloud’s backlog climbed to roughly $155 billion, reflecting strong multi‑year AI and cloud commitments.

For the full-year 2025, Alphabet raised its capital expenditure guidance to $91 billion to $93 billion, emphasizing heavy investment in AI compute, data centers, and network infrastructure. Management signaled that demand for AI‑driven cloud services remains ahead of available capacity and that capex will increase further in 2026. Management also cautioned that Q4 advertising growth faces tougher comparisons due to strong U.S. election spending in Q4 2024.

Alphabet Stock Upgraded

Pivotal Research lifted its price target on Alphabet to a Street-high of $400 from $350, reflecting an upside potential of 25% from the current market rate, while reiterating its “Buy” rating on GOOGL stock. The firm cited strengthening multi‑year cloud momentum and accelerating free cash flow. Pivotal described Search as a resilient, high‑margin “cash cow” with meaningful pricing power and a key engine for Gemini AI, with AI expected to drive substantial cost efficiencies in the search business.

Pivotal extended its forecast horizon, raised its assumed cloud revenue compound annual growth rate (CAGR) to reflect share gains, and increased the terminal EBITDA multiple in its discounted cash flow (DCF) from 18x to 18.5x (at an 8% discount rate), resulting in the Street‑high target. It now projects a 2026 to 2030 revenue CAGR of about 11%, EBITDA growth of 14%-plus, and roughly 26% annual growth in free cash flow per share.

Should You Buy GOOGL Stock?

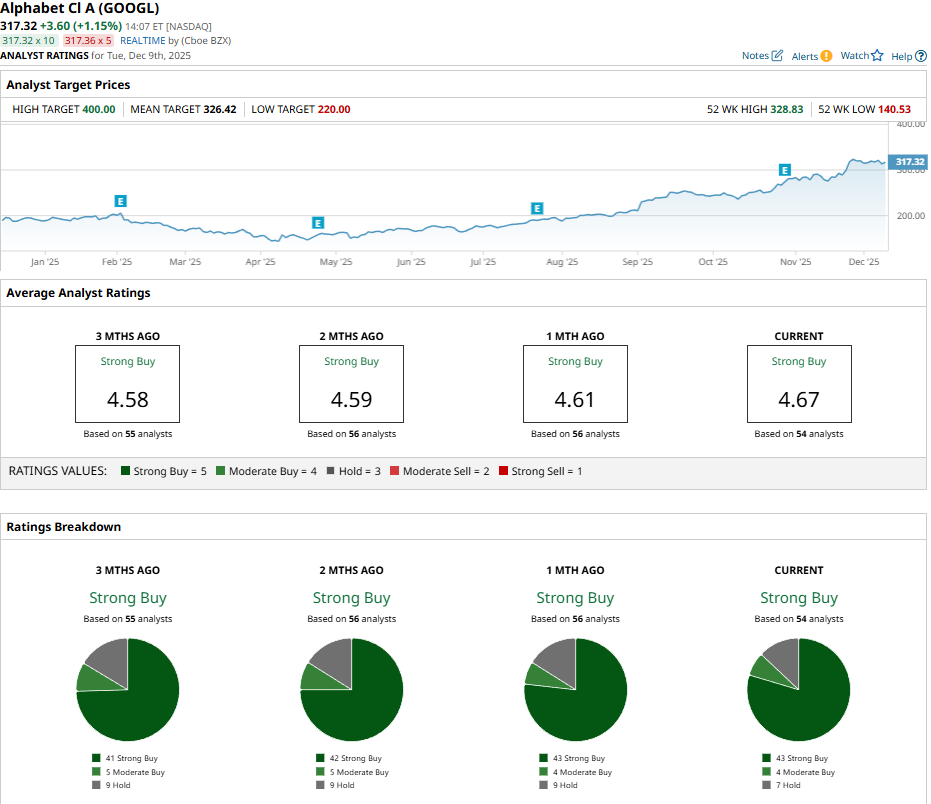

Alphabet, as part of the illustrious “Magnificent Seven,” continues to be a highly rated stock on Wall Street with a “Strong Buy” consensus rating and a mean price target of $326.42. That target reflects potential upside of roughly 2% from the market rate.

The stock has been rated by 54 analysts with coverage, receiving 43 “Strong Buy” ratings, four “Moderate Buy” ratings, and seven “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.