/Cooper%20Companies%2C%20Inc_%20building%20logo-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $15.8 billion, The Cooper Companies, Inc. (COO) is a global medical device company specializing in contact lenses and women’s health care solutions. Through its CooperVision and CooperSurgical segments, it offers advanced vision-correction lenses as well as fertility, genomics, and contraceptive products.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Cooper Companies fits this criterion perfectly. The company serves healthcare professionals and distributors worldwide.

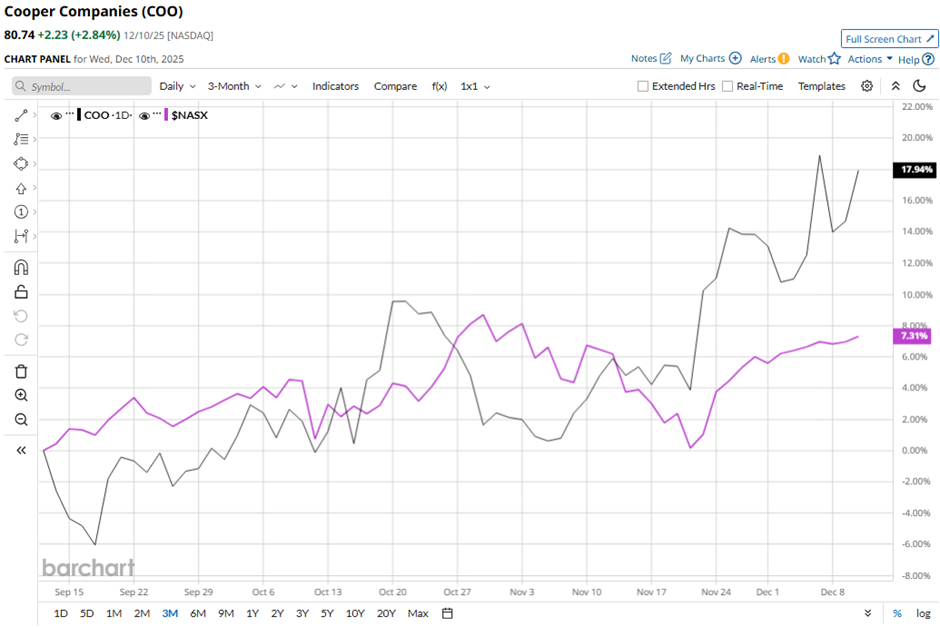

Shares of the San Ramon, California-based company have declined 19.6% from its 52-week high of $100.47. COO stock has soared 19.3% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 8.1% increase over the same time frame.

In the longer term, COO stock is down 12.2% on a YTD basis, lagging behind NASX’s 22.5% surge. Moreover, shares of the surgical and contact lens products maker have decreased 18.5% over the past 52 weeks, compared to NASX’s 20.2% return over the same time frame.

The stock has been trading above its 50-day moving average since October.

COO shares climbed 5.7% following its Q4 2025 results on Dec. 4. The company delivered adjusted EPS of $1.15 and revenue of $1.07 billion, both above consensus. Investors also reacted positively to management’s outlook, including fiscal 2026 adjusted EPS guidance of $4.45 - $4.60 and projected free cash flow of $575 million - $625 million, along with a long-term goal of generating over $2.2 billion in free cash flow from 2026 - 2028.

However, rival Intuitive Surgical, Inc. (ISRG) has outpaced COO stock. Shares of Intuitive Surgical have risen 6.5% on a YTD basis and 3.3% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on Cooper. The stock has a consensus rating of “Moderate Buy” from 17 analysts in coverage, and the mean price target of $89.62 is a premium of nearly 11% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)