/Motorola%20Solutions%20Inc%20lofo%20on%20display-by%20N_Z_Photography%20via%20Shutterstock.jpg)

With a market cap of $63.3 billion, Motorola Solutions, Inc. (MSI) is a global provider of public safety and enterprise security technologies, offering advanced communications systems, video security, and command-center software. Through its Products and Systems Integration and Software and Services segments, the company delivers mission-critical solutions for government, public safety, and commercial industries worldwide.

Shares of the Chicago, Illinois-based company have lagged behind the broader market over the past 52 weeks. MSI stock has decreased over 23% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.2%. Moreover, shares of the company have declined 17.8% on a YTD basis, compared to SPX's 14.5% rise.

Looking closer, shares of the communications equipment maker have also underperformed the Technology Select Sector SPDR Fund's (XLK) return of 22.9% over the past 52 weeks.

Despite reporting stronger-than-expected Q3 2025 adjusted EPS of $4.06 and revenue of $3.01 billion on Oct. 30, MSI shares fell 5.9% the next day. The company highlighted rising tariff-driven cost pressures, a still-ongoing U.S. government shutdown that could delay federal contract shipments, and issued Q4 guidance implying slower profit growth.

For the fiscal year ending in December 2025, analysts expect MSI's EPS to grow 8.6% year-over-year to $13.82. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

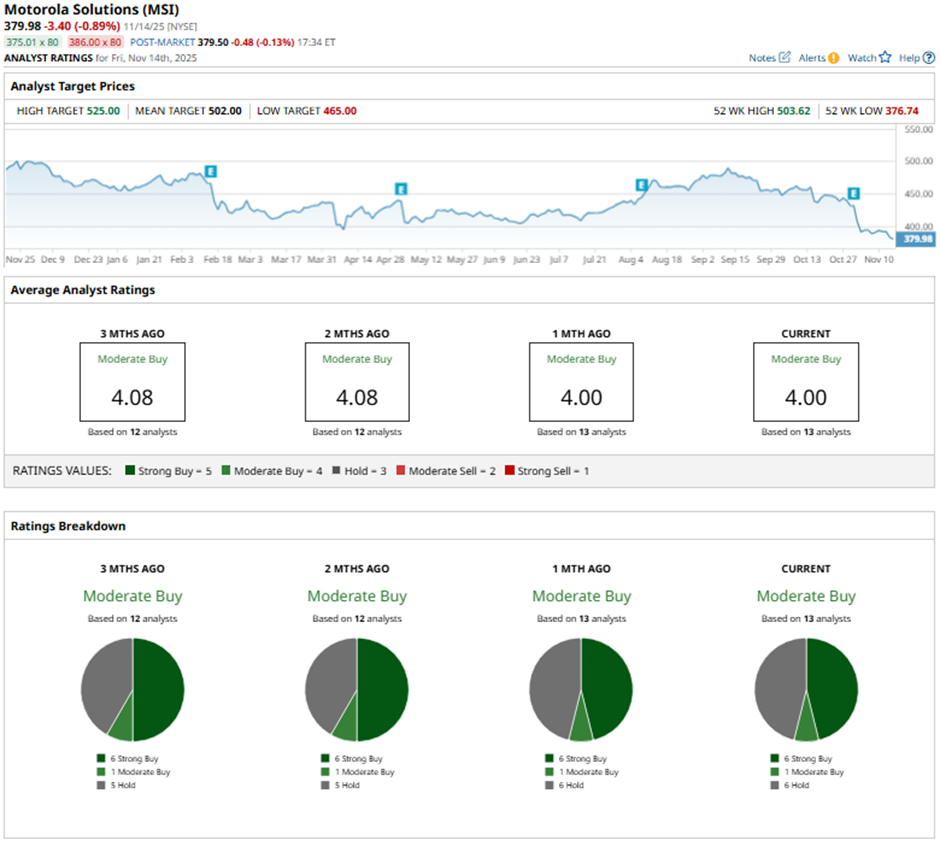

Among the 13 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buys,” one “Moderate Buy” rating, and six “Holds.”

On Oct. 31, Barclays analyst Tim Long cut the price target on MSI to $495 while maintaining an “Overweight” rating.

The mean price target of $502 represents a 32.1% premium to MSI’s current price levels. The Street-high price target of $525 suggests a 38.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)