The longest shutdown in U.S. history has ended after President Donald Trump signed the funding bill that extends funding until Jan. 30, 2026. The shutdown affected millions, but the impact was particularly hard on the furloughed employees.

In an interview with CNBC, buy-now-pay-later (BNPL) company Affirm’s (AFRM) CEO, Max Levchin, talked about the behavior changes in furloughed employees. “We are seeing a very subtle loss of interest in shopping just for that group, and a couple of basis points,” said Levchin while stressing that the company is not seeing credit stress among these customers.

Affirm Has Outperformed Markets Since 2023

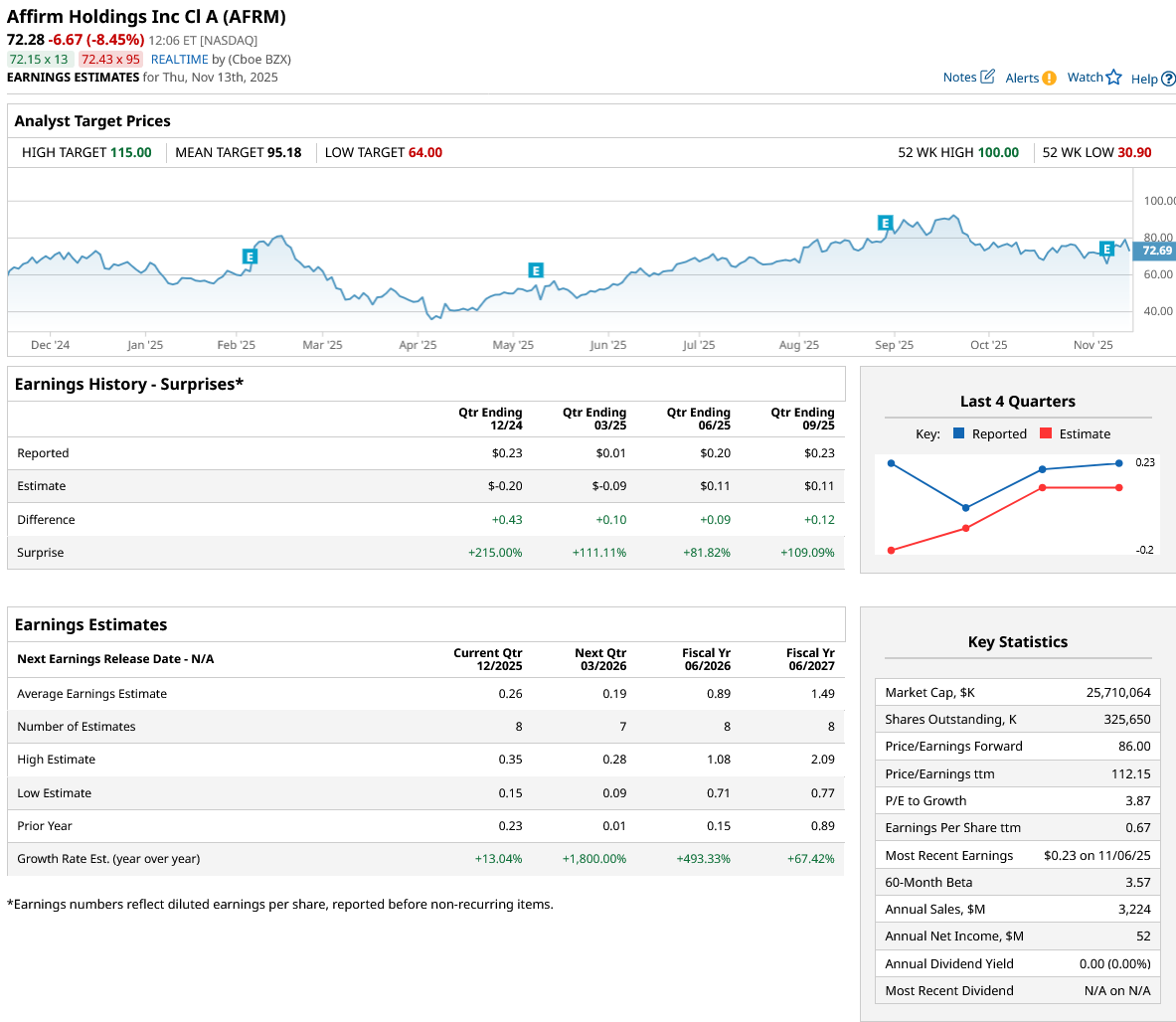

AFRM stock, meanwhile, is up about 20% for the year and looks set to outperform the markets for the third consecutive year. It was, incidentally, the best-performing U.S. tech company in 2023 among all names with a market cap higher than $5 billion, as the stock rose over fivefold that year.

The stock, which plunged into single digits in 2022, rose to $100 in late August following stellar fiscal Q4 2025 earnings. The stock has since fallen below $80 and is in a bear market territory and is down about 9% today. However, the dip from the peaks looks like an opportunity to load up this growth stock for 2026, as its outlook could only brighten following the end of the shutdown.

AFRM Stock Forecast: Analysts Get Bullish

Affirm has proved naysayers wrong, which is aptly reflected in analysts' ratings. The stock, which had a consensus rating of “Hold” at the end of 2023, is now rated as a “Moderate Buy.” Importantly, none of the 27 analysts tracked by Barchart rates the stock as a “Sell.” The analyst fraternity has gradually raised AFRM’s target price, and the mean target price now stands at $95.18, which is over 30% higher than the current price levels.

Affirm Has Been a Success Story

I have generally been bullish on Affirm for quite some time now, even though I have traded in and out of the stock several times. The company has proven its mettle and has been delivering strong topline growth while turning the corner on profitability.

In fiscal Q1 2026, its revenues rose 34% to $933 million, which was well ahead of the $883 million that analysts were projecting. The beat on earnings per share was even spectacular, and the metric came in at 23 cents, which was over twice the consensus estimates. The company also raised its annual guidance and expects its gross merchandise value (GMV) to be over $47.5 billion this fiscal year, versus the previous guidance of $46 billion.

“Beats and raises” have been a recurring theme for Affirm, which, like most other U.S. companies, tends to provide conservative guidance. I would, however, attest to Levchin’s comments that the kind of earnings Affirm has reported are “never an accidental success.” The company has faced several adverse events, in particular from Peloton's (PTON) woes, which was once a major BNPL customer. Affirm also faced competitive pressure as the likes of Apple (AAPL) entered the BNPL industry. However, the company has executed well, and the price action is reflective of that.

BNPL Adoption Is Growing

Affirm’s active customer count has been expanding steadily, and at the end of fiscal Q1, it had 24.1 million active customers, 24% higher than the corresponding quarter in the previous year. What’s better? It was the seventh consecutive quarter that the year-over-year (YoY) growth in members expanded.

The company has been onboarding numerous customers with its 0% APR offering. In such loans, either the manufacturer or the merchant agrees to part with some of their margins to provide the goods at 0% interest rates to buyers. These loans help spur purchases and add to Affirm’s user base and have been the fastest-growing segment for Affirm over the last few quarters—a trend the company expects to continue for now. While these loans are admittedly less profitable for Affirm, they help add to the customer base, and according to the company, many flip over to interest-bearing loans in due course.

The BNPL industry is gaining traction and is seeing an increase in adoption. Affirm is well-positioned to capitalize on the opportunity, and the network effect—where more consumers lead to more merchants and vice versa—is helping the company grow at a brisk pace. Affirm has signed a flurry of partnerships and recently extended its partnership with Amazon (AMZN) until 2031.

The company has also partnered with payment service providers (PSPs), such as Stripe and Apple, which help it expand its market reach. Affirm card is another key pillar of its ecosystem, and active card members rose to 2.8 million at the end of September. Affirm is hopeful of hitting 10 million active cards with an average annual discretionary spend of $7,500.

The BNPL leader has been expanding globally and has launched in the U.K., and has hinted at launching its services in other European countries. These international expansions should help keep Affirm’s top-line growth buoyed.

Along with gaining market share in the fast-growing BNPL market, Affirm has kept a close watch on credit metrics, which have been in check despite the financial strain among lower- and middle-income groups.

Affirm Is a Good Buy for 2026

I believe Affirm is well placed for 2026 for two main reasons. Firstly, the economic situation is quite favorable for Affirm, as while the financial hardship could push more people to opt for BNPL, the situation is not so bad that it would lead to significantly higher delinquencies.

Secondly, falling interest rates are a tailwind for Affirm as they would help it lower its costs of funds and save on interest costs.

From a valuation perspective, while the forward price-to-earnings (P/E) multiple might look elevated at 87x, I am not too perturbed, given the company's high-growth trajectory. Moreover, given its near-impeccable execution in what’s becoming a crowded BNPL industry, Affirm has earned the right to trade at higher multiples. Overall, I remain bullish on Affirm and find the recent fall a good opportunity to add more shares.

On the date of publication, Mohit Oberoi had a position in: AFRM , AAPL , AMZN , PTON . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)