With a market cap of $43.3 billion, Entergy Corporation (ETR) is an integrated energy company headquartered in New Orleans, Louisiana. It generates, transmits, and distributes electricity to roughly 3 million customers across Arkansas, Louisiana, Mississippi, and Texas. Entergy operates a diverse power generation portfolio, including natural gas, nuclear, coal, and renewable energy assets.

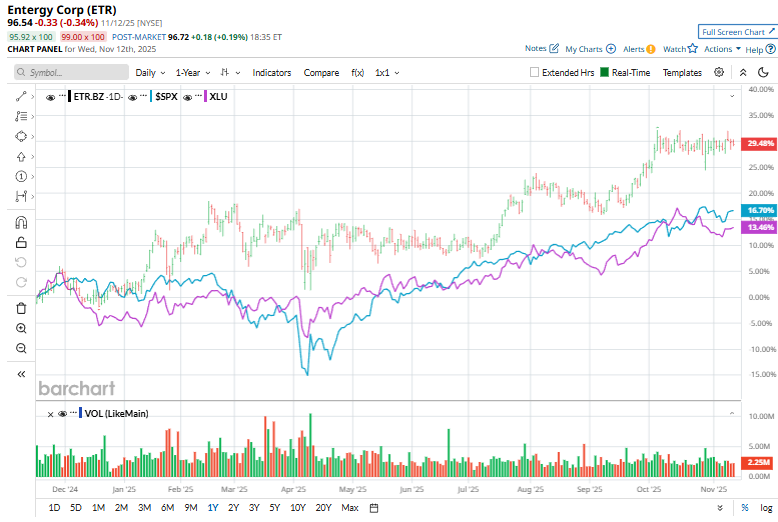

Shares of the utility titan have outperformed the broader market over the past 52 weeks. ETR stock has surged 29.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.5%. Moreover, shares of Entergy are up 18.8% over the past six months, compared to SPX's 17.2% gain.

Looking closer, the power company stock has also outpaced the Utilities Select Sector SPDR Fund's (XLU) 14.6% return over the past 52 weeks and 12.7% rise over the past six months.

Energy posted its third-quarter earnings on Oct. 29, and its shares surged marginally. It reported adjusted earnings of $1.53 per share, up slightly from $1.50 a year earlier, with net income rising to $694 million from $645 million. The utility segment remained the primary earnings driver, supported by higher retail sales and favorable regulatory outcomes. Entergy also narrowed its full-year adjusted EPS guidance to $3.85–$3.95.

For the fiscal year ending in December 2025, analysts expect ETR's EPS to grow 6.9% year-over-year to $3.90. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

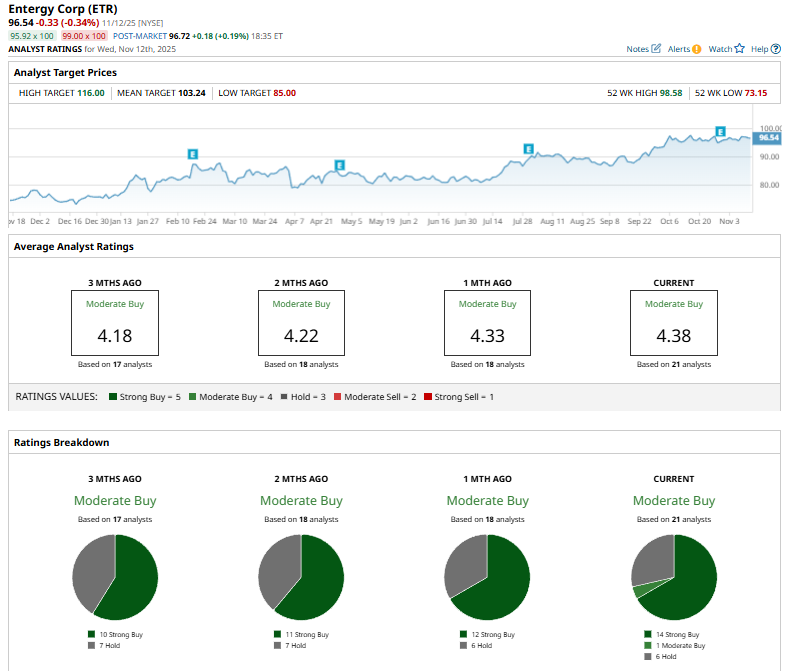

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

This configuration is bullish compared to one month ago, with 12 “Strong Buy” ratings on the stock.

On Oct. 25, J.P. Morgan analyst Jeremy Tonet reiterated a “Buy” rating on Entergy and maintained a $113 price target on the stock.

Its mean price target of $103.24 indicates a premium of 6.9% from the current market prices. The Street-high price target of $116 implies a potential upside of 20.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)