/Akamai%20Technologies%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $13 billion, Akamai Technologies, Inc. (AKAM) is a Massachusetts-based cloud, cybersecurity, and content delivery company. Initially known for its content delivery network (CDN), Akamai has evolved into a major provider of web and API security, edge computing, and cloud infrastructure solutions. The company serves many of the world’s top streaming, gaming, and financial firms through its global edge network, enabling faster, more secure digital experiences.

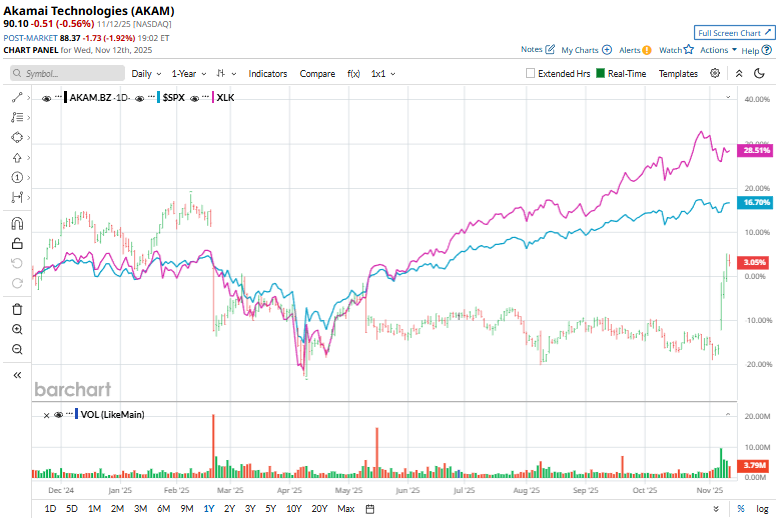

Shares of the cloud services provider have underperformed the broader market over the past 52 weeks. AKAM stock has surged marginally over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.5%. Moreover, shares of Akamai Technologies have decreased 5.8% on a YTD basis, compared to SPX's 16.5% rise.

Looking closer, the stock has also fallen behind the Technology Select Sector SPDR Fund's (XLK) 24.5% return over the past 52 weeks and 26.4% gain in 2025.

On Nov. 6, Akamai reported solid third-quarter earnings, and its shares popped 14.7% in the following trading session. The company delivered revenue of $1.06 billion, up 5% year-over-year, fueled by robust growth in its security and cloud computing segments. Security revenue climbed 10% to $568 million, supported by strong demand for API protection and zero-trust solutions.

Non-GAAP EPS rose 17% to $1.86, and operating margin improved to 31%, underscoring better efficiency and cost control. The quarter also marked the launch of Akamai’s Inference Cloud, a new AI and edge-computing platform powered by NVIDIA Corporation (NVDA) technology, signaling its intent to capture emerging opportunities in AI workloads.

For the fiscal year ending in December 2025, analysts expect AKAM's EPS to dip 5.1% year-over-year to $4.31. The company's earnings surprise history is solid. It beat the consensus estimates in each of the last four quarters.

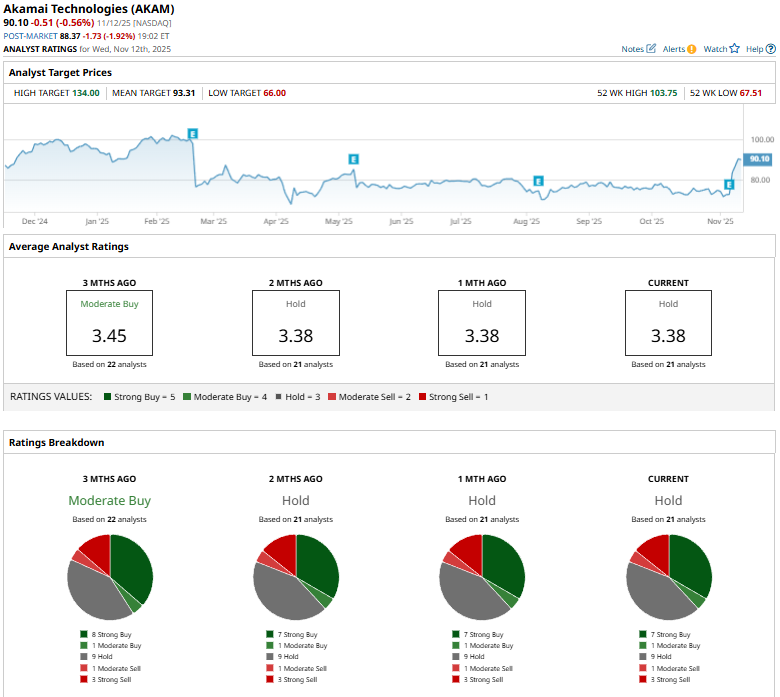

Nevertheless, among the 21 analysts covering the stock, the consensus rating is a “Hold.” That’s based on seven “Strong Buys,” one “Moderate Buy” rating, nine “Holds,” one “Moderate Sell,” and three “Strong Sells.”

The current configuration is bearish than three months ago when the stock had eight “Strong Buy” suggestions.

On Nov. 7, Scotiabank analyst Patrick Colville lowered Akamai’s price target slightly to $94 from $95 while maintaining an “Outperform” rating. He described the company’s Q3 results as “respectable” and noted that Akamai is in a stronger position than a year ago, with limited downside risk at current levels.

Its mean price target of $93.31 indicates a premium of 3.6% from the current market prices. The Street-high price target of $134 implies a potential upside of 48.7% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)