Down 36% from its 52-week high, Shake Shack (SHAK) is working on a comeback after its third-quarter earnings report.

Last month, Hedgeye initiated Shake Shack as a new short idea, warning of potential 20% downside. Analyst Bennett Cheer cited growing evidence of declining food quality, pointing to the company’s switch from fresh Martin’s potato buns to frozen Rotella’s buns, which are thawed in stores. Cheer argued that this shift and Shake Shack’s move toward a quick-service restaurant (QSR) model could erode the brand’s premium “fine casual” identity and weaken its long-term value.

But before you hit the sell button, let’s dig deeper into whether now is the time to cut bait or hold tight for the rebound.

About Shake Shack Stock

Shake Shack is a fast-casual dining company known for its premium burgers, crinkle-cut fries, shakes, and related menu items. Headquartered in New York, Shake Shack has grown into a multinational chain operating hundreds of locations both domestically and abroad. Shake Shack has a market capitalization of around $4 billion.

Shares have been under pressure lately, slipping from their previous highs. The stock has declined 36% from its 52-week high of $144.65 reached on July 10. SHAK stock has also shed 1% over the past month.

On a year-to-date (YTD) basis, the drawdown is even more substantial, with shares down 29%. Over the past year, SHAK is down by 30%.

SHAK stock is also trading at a substantial premium to its sector peers at 69.9 times forward earnings.

Soft Same-Store Sales Temper Shake Shack’s Q2 Momentum

Shake Shack shares popped following the company’s Q3 earnings release.

Total revenue came in at $367.4 million, up nearly 16% year-over-year. Same-store sales, which had been a concern to analysts, popped nearly 5% year-over-year.

Operating income swung to a positive $18.5 million vs. a loss of $18 million in the year-ago period, and net income also was a positive $13.7 million vs. a loss of $11.1 million in 2024.

The restaurant company opened 13 new company-operated locations in the quarter and seven licensed locations.

Looking ahead, the company expects total revenue for Q4 between $406 million and $412 million, with same-store sales “up low single digits.”

Is this the turnaround that Wall Street has been waiting for?

What Do Analysts Expect for Shake Shack Stock?

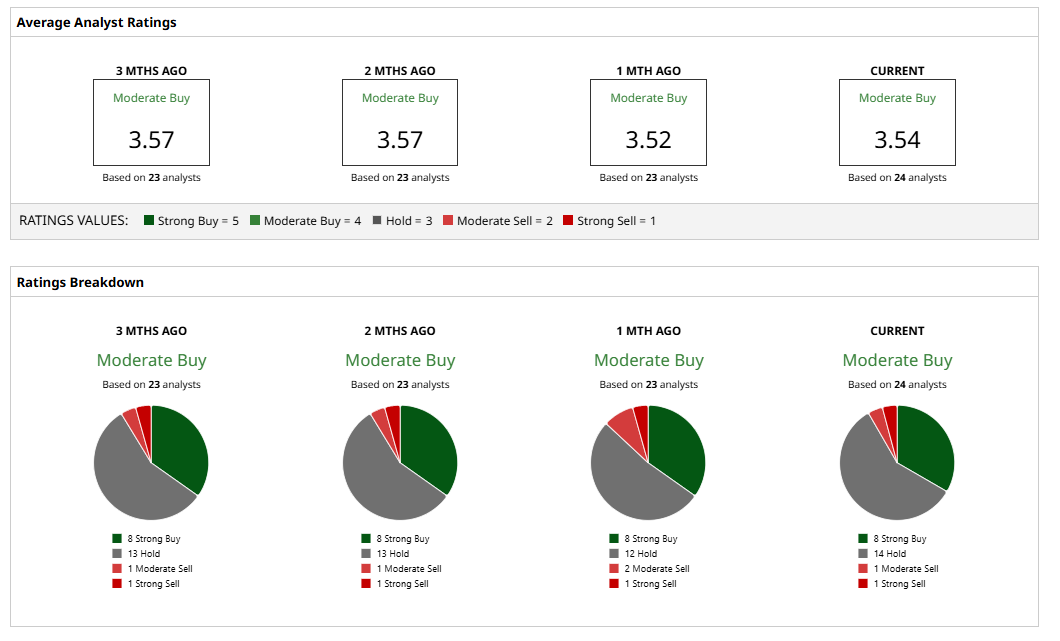

Overall, SHAK stock has a consensus “Moderate Buy” rating. Of the 24 analysts covering the stock, eight advise a “Strong Buy,” 14 analysts are on the sidelines with a “Hold” rating, one gives a “Moderate Sell,” and one suggests a “Strong Sell" rating.

The average analyst price target for SHAK is $116.71, indicating potential upside of 25% from current levels. The Street-high target price of $154 suggests that the stock could rally as much as 69% from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)