(NGX25) (NGZ25) (UNG) (KOLD) (BOIL)

"Typhoons & Stratospheric Warming:

How the remnants of historic Alaska Typhoon Halong and stratospheric warming triggered short-covering in the natural gas futures market"

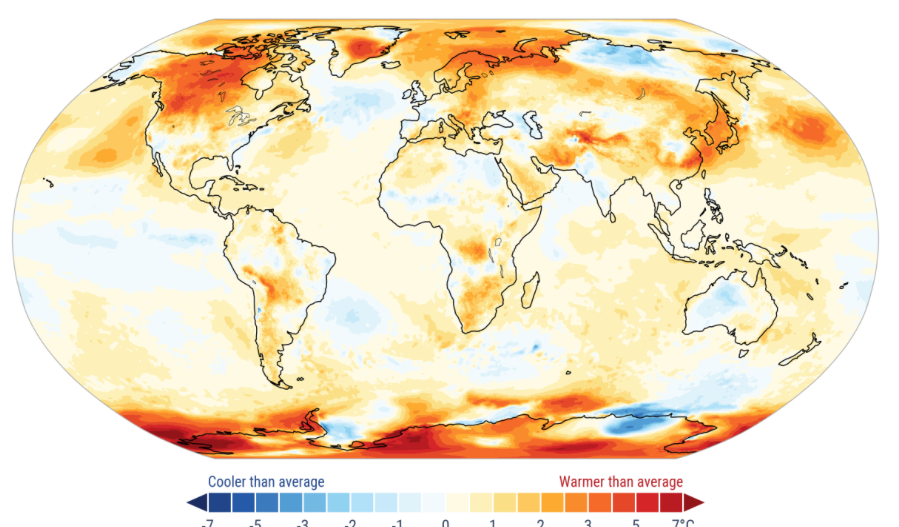

Map source: NOAA

By Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- October 22, 2025

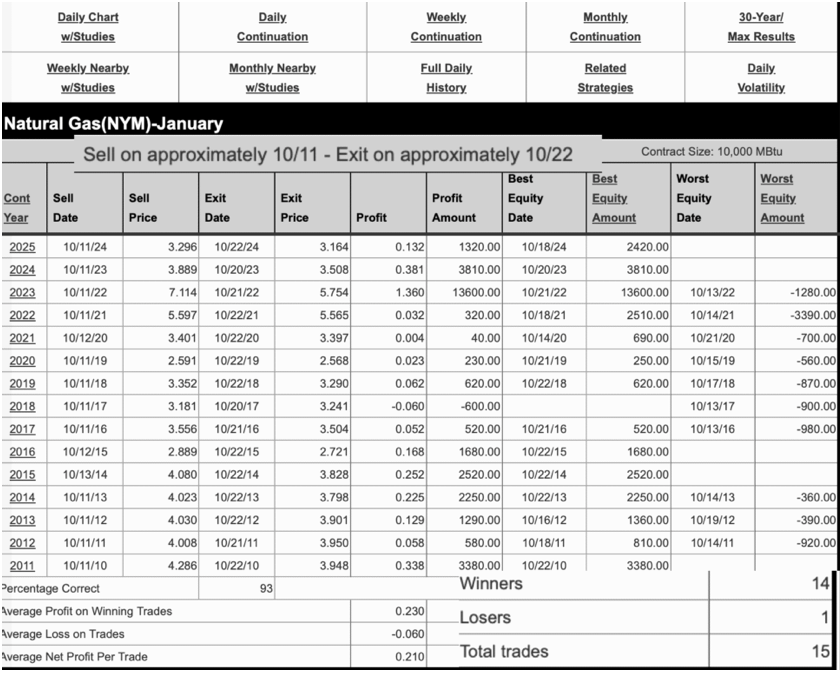

Initially, natural gas prices first rallied in early October due to residual strong late summer demand and several bullish EIA numbers. However, I stuck to my guns that 90% of the time,natural gas prices go lower when October is warm. However, notice that this bearish seasonal tendency often ends around October 22. This is especially true if forecasts change towards colder weather for November.

Table source: Moore Research Center (mrci.com)

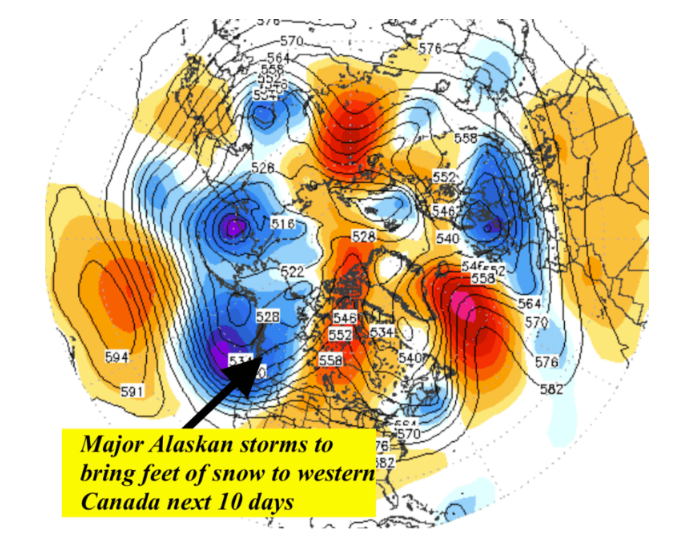

How Ex-Typhoon Halong is affecting Alaska

Indigenous villages in western Alaska are reeling after Typhoon Halong brought hurricane-force winds, flooding, and destruction that swept homes away. At least one life lost, others still missing.

Image source: NOAA

Previous to Halong, the most powerful autumn storm to hit Alaska was Ex-Typhoon Merbok in September 2022. That was the strongest storm to hit the Alaskan coastline in 75 years.

You can see the effects of Ex-Typhoon Halong and the continuation of cold, stormy weather for the next 10 days over Alaska (blue).

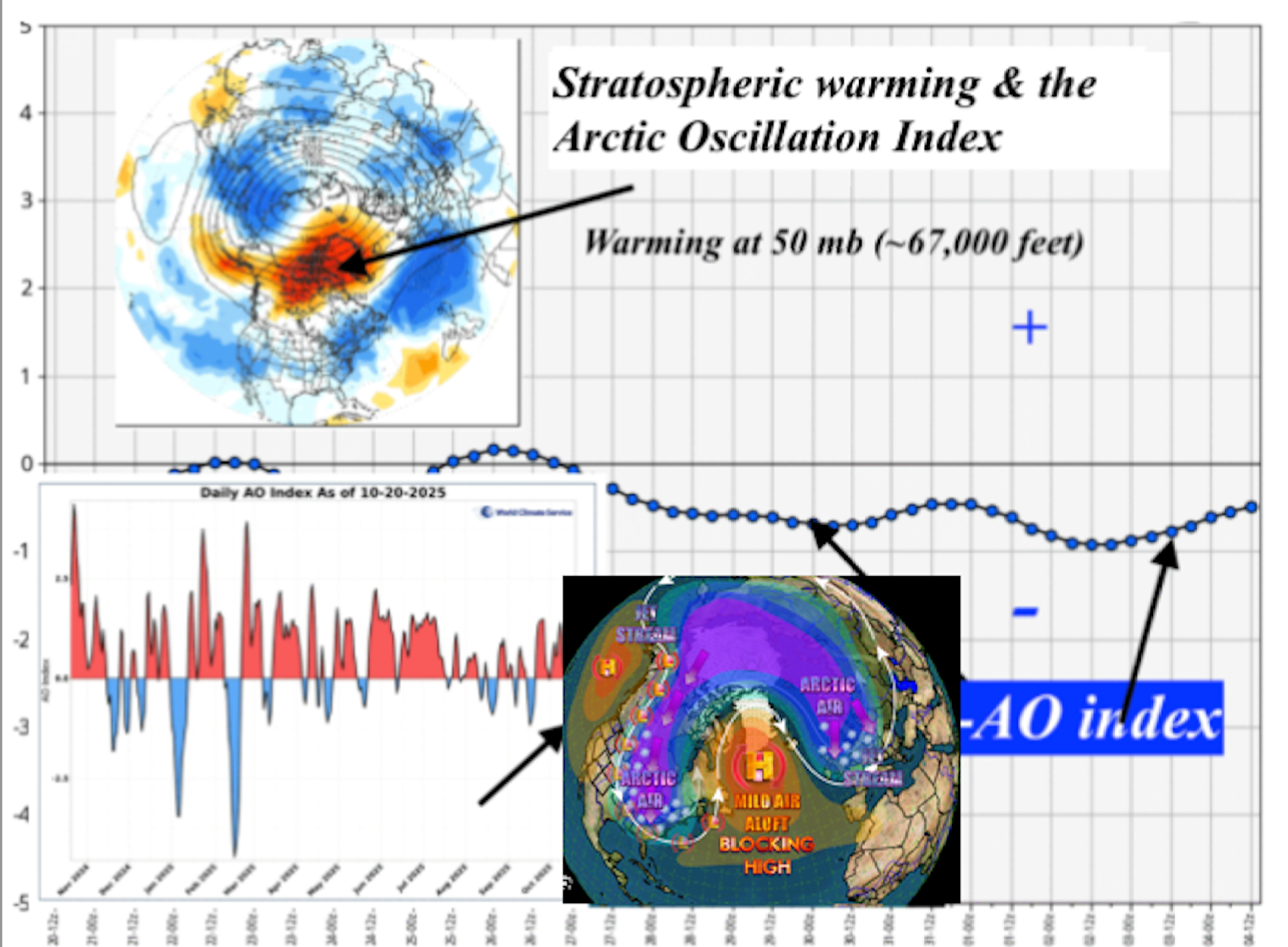

This intense storm was partly responsible for warming up northern Canada and creating what we call a stratospheric warming event at 65,000 feet. This in turn will bring a negative Arctic Oscillation Index in November (-AO).

Pieces of that cold pool are heading east due to the negative AO index and helped spawn a rally in natural gas prices earlier this week.

Map source: StormVistaWxModels

September 2022 was also a La Niña event. Notice (below) how natural gas futures prices reacted that year. Nevertheless, it is dangerous to use just one analog year in predicting global weather patterns and commodity price moves.

Chart source: Moore Research Center (mrci.com)

Natural gas traders are watching very closely for any signs of the Arctic Oscillation Index (AO) remaining negative for November and December. If so, a cold early winter will ensue and natural gas prices will soar later.

However, there are some caveats as many other teleconnections (climatic signals thousands of miles away such as La Niña, Arctic sea ice, etc.), suggest a volatile winter with warm spells as well.

Image sources:

NOAA, StormVistaWxModels, WeatherBell, and WeatherWealth newsletter

https://www.bestweatherinc.com/new-membership-options/

Thanks for your interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)