With a market cap of $49.4 billion, Garmin Ltd. (GRMN) is a leading global designer, manufacturer, and marketer of GPS-based navigation and communication devices. The company operates across five segments: Outdoor, Fitness, Marine, Auto, and Aviation, offering a wide range of innovative products and solutions for consumers, businesses, and the aviation industry.

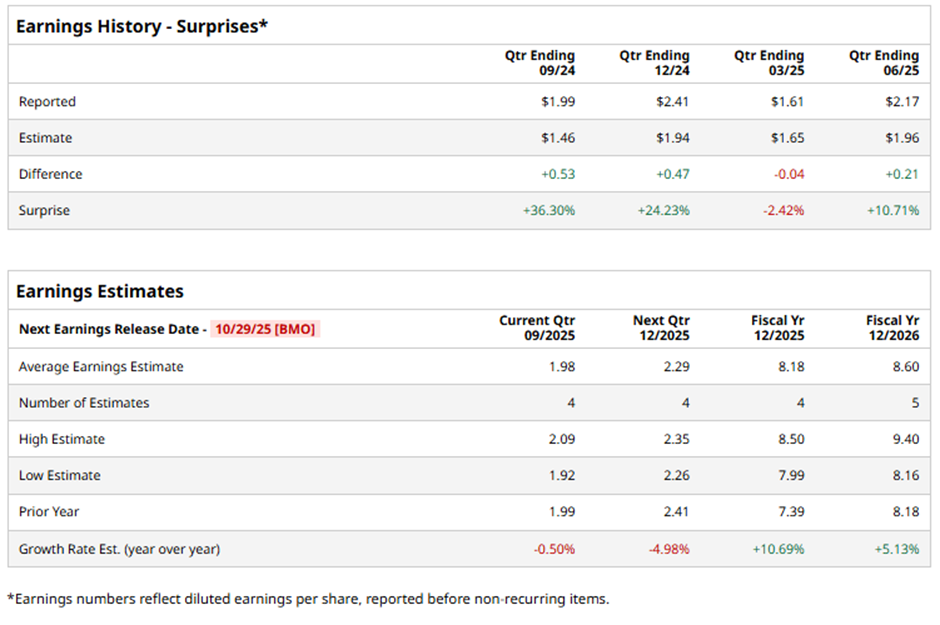

The Schaffhausen, Switzerland-based company is expected to announce its Q3 2025 results before the market opens on Wednesday, Oct. 29. Ahead of this event, analysts expect Garmin to report an adjusted EPS of $1.98, down marginally from $1.99 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect the maker of personal navigation devices to report an adjusted EPS of $8.18, up 10.7% from $7.39 in fiscal 2024.

Shares of Garmin have climbed 53.4% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) nearly 15% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 17.2% return over the period.

Despite Garmin’s better-than-expected Q2 2025 adjusted EPS of $2.17 and revenue of $1.8 billion, shares of GRMN fell 7.4% on Jul. 30. The drop came as its updated full-year guidance, while raised to $8 EPS on $7.1 billion revenue, implied a weaker second half of the year.

Analysts' consensus view on GRMN stock is cautious, with a "Hold" rating overall. Among eight analysts covering the stock, one recommends "Strong Buy," four suggest "Hold," five indicate “Hold,” one "Moderate Sell," and two advise "Strong Sell." As of writing, the stock is trading above the average analyst price target of $220.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)