Bellevue, Washington-based T-Mobile US, Inc. (TMUS) is a wireless communications services company that provides voice, messaging, and data services across postpaid, prepaid, and wholesale channels. Valued at a market cap of $253.2 billion, the company is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 23.

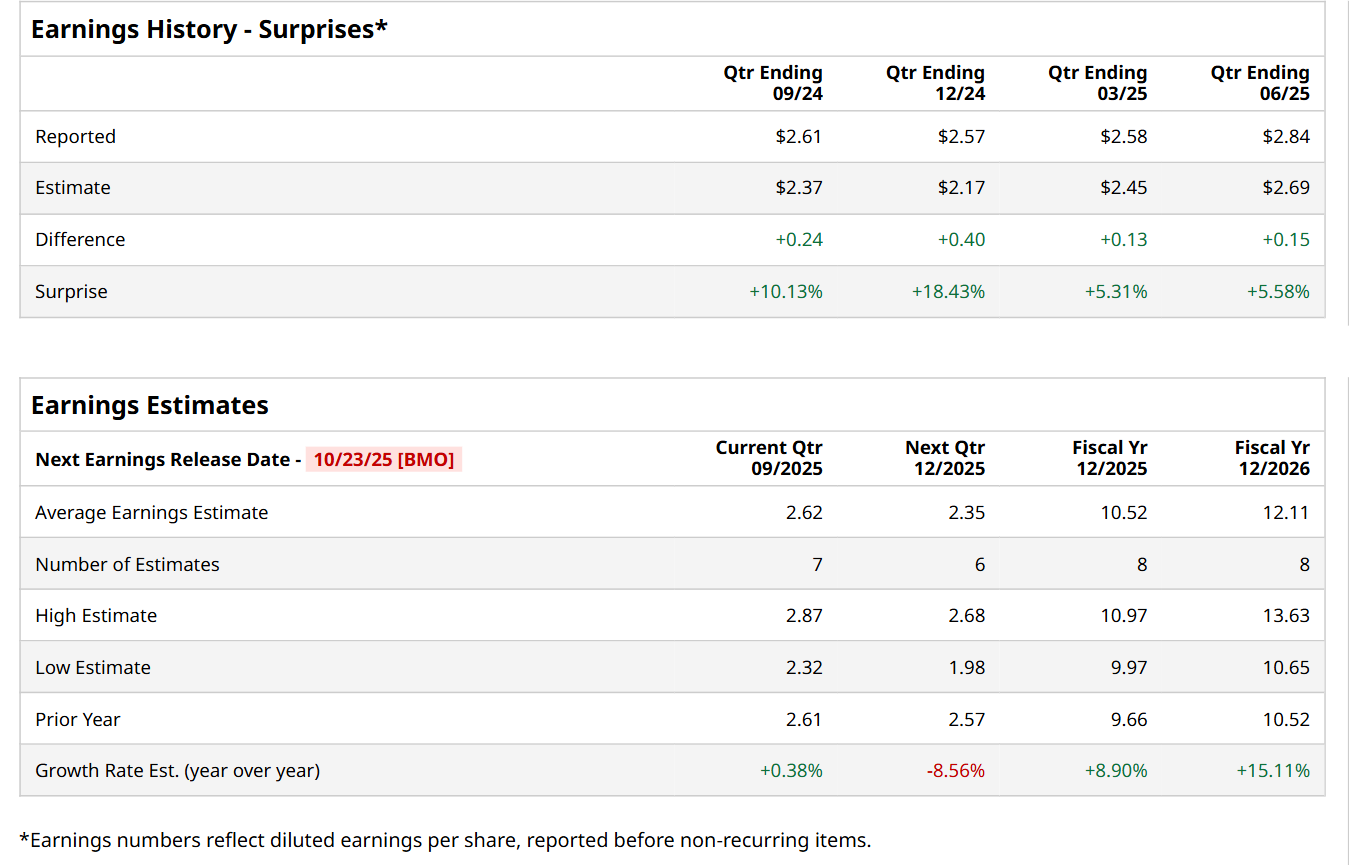

Before this event, analysts expect this telecom giant to report a profit of $2.62 per share, up marginally from $2.61 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.84 per share in the previous quarter topped the consensus estimates by 5.6%.

For the current fiscal year, ending in December, analysts expect TMUS to report a profit of $10.52 per share, up 8.9% from $9.66 per share in fiscal 2024. Its EPS is expected to further grow 15.1% year-over-year to $12.11 in fiscal 2026.

TMUS has gained 8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 17.2% return and the Communication Services Select Sector SPDR Fund’s (XLC) 28.2% rise over the same time frame.

TMUS reported better-than-expected Q2 results on Jul. 23, sending its shares up 5.8% in the following trading session. The company posted record Q2 postpaid phone net and gross customer additions. It also saw industry-leading growth in postpaid net account additions and 5G broadband subscribers. These strong subscriber gains fueled a 6.9% year-over-year increase in its total revenue to $21.1 billion, which came in slightly above consensus estimates. Moreover, on the earnings front, its core adjusted EBITDA improved 6.4% from the prior-year quarter to $8.5 billion, while its EPS advanced 14.1% annually to a Q2 record of $2.84, topping analyst estimates by 5.6%.

Noting this momentum, TMUS raised its fiscal 2025 guidance, now expecting 6.1 million to 6.4 million postpaid net customer additions and core adjusted EBITDA to be between $33.3 billion and $33.7 billion.

Wall Street analysts are moderately optimistic about TMUS’ stock, with a "Moderate Buy" rating overall. Among 29 analysts covering the stock, 16 recommend "Strong Buy," two indicate "Moderate Buy," 10 suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for TMUS is $275.24, indicating a 22.4% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)