With a market cap of $19.3 billion, Lennox International Inc. (LII) is a global leader in heating, ventilation, air conditioning, and refrigeration (HVACR) solutions. The company designs, manufactures, and markets a wide range of residential and commercial climate control products under well-known brands such as Lennox, Armstrong Air, Heatcraft, and Bohn.

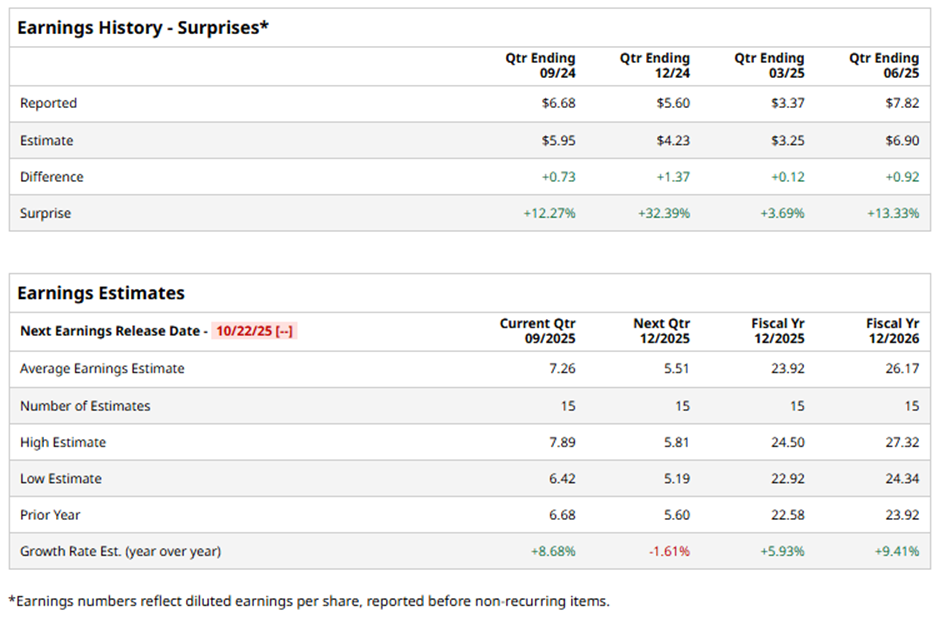

The Richardson, Texas-based company is expected to release its fiscal Q3 2025 earnings results on Wednesday, Oct. 22. Ahead of this event, analysts project LII to report an EPS of $7.26, an 8.7% growth from $6.68 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in the last four quarters.

For fiscal 2025, analysts forecast the heating and cooling systems maker to report EPS of $23.92, up 5.9% from $22.58 in fiscal 2024. Looking forward, EPS is projected to rise 9.4% year-over-year to $26.17 in fiscal 2026.

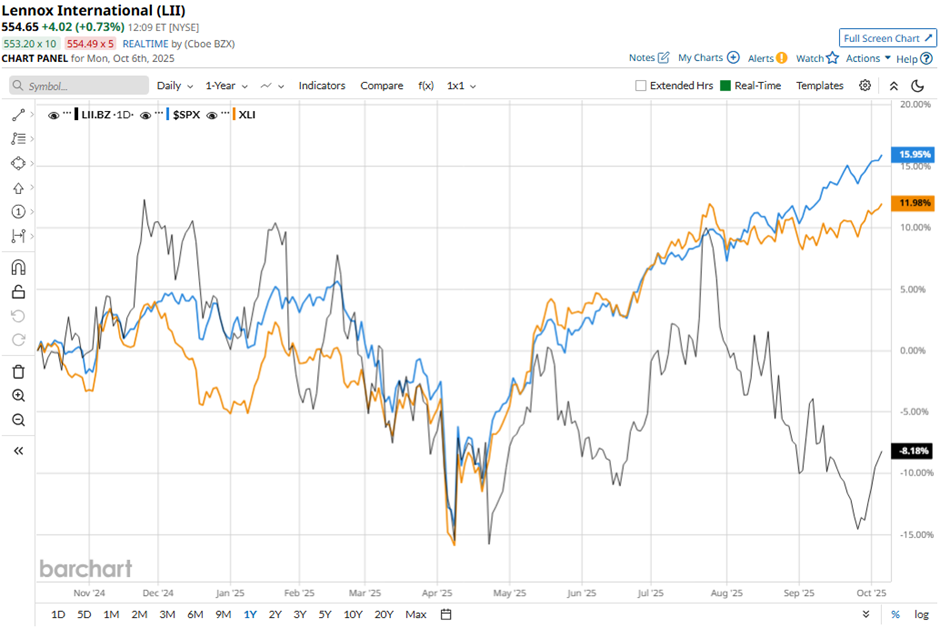

LII stock has declined 6.6% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 17.2% return and the Industrial Select Sector SPDR Fund's (XLI) 14.5% gain over the same period.

Shares of Lennox International jumped 6.6% on Jul. 23 after the company reported stronger-than-expected Q2 2025 results, with revenue up 3% to $1.5 billion and operating income rising 11% to $354 million, driving an EPS of $7.82, well above analyst estimates. Profit margins expanded significantly, with segment margin up 170 basis points to 23.6%, supported by $114 million in mix and price benefits.

Additionally, management raised full-year 2025 guidance, projecting revenue growth of 3% and a higher adjusted EPS range of $23.25 to $24.25.

Analysts' consensus view on LII stock is cautious, with an overall "Hold" rating. Among 18 analysts covering the stock, six suggest a "Strong Buy," seven give a "Hold," one provides a "Moderate Sell" rating, and four have a "Strong Sell." The average analyst price target for Lennox is $652.27, indicating a potential upside of 17.6% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)