Valued at a market cap of $22.9 billion, The Trade Desk, Inc. (TTD) is a leading independent digital advertising technology company. Headquartered in Ventura, California, the company offers a self-service, cloud-based platform that enables advertisers to plan, manage, and optimize digital campaigns across various channels, including display, video, audio, native, and social media.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Trade Desk fits this criterion perfectly. Its focus on transparency, data-driven insights, and cross-channel capabilities positions it as a significant player in the digital advertising ecosystem.

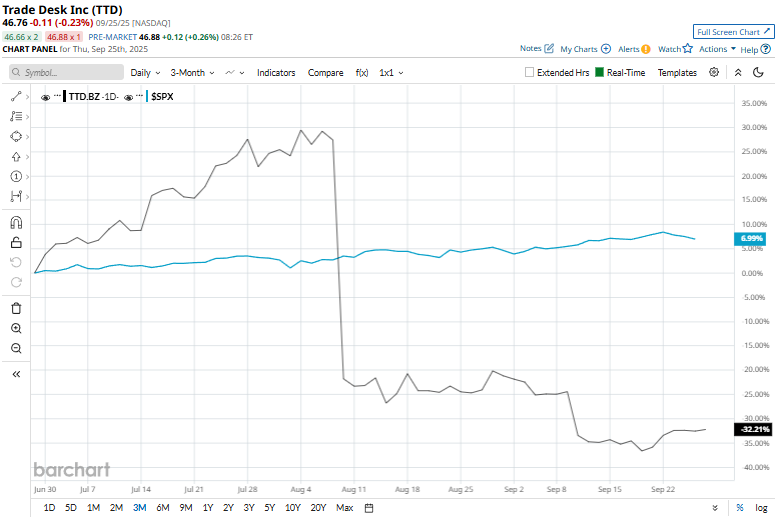

TTD has been on a rough ride, shedding 67% from its 52-week high of $141.53 touched on Dec. 4, 2024. TTD's stock has dipped 33% over the past three months, underperforming the S&P 500 Index ($SPX), which has returned 8.4% over the same time frame.

Over the past year, the stock has plunged 57.8%, lagging the S&P 500’s 15.4% rise. Moreover, on a year-to-date basis, TTD has dropped 60.2% compared with the index’s 12.3% surge.

Technicals paint a similarly bleak picture. The stock has been below its 50-day moving average since mid-August and under its 200-day moving average since mid-February, signaling a prolonged bearish trend.

On September 10, shares of Trade Desk sank more than 11% after Morgan Stanley (MS) downgraded the stock from “Overweight” to “Equal-Weight.” The downgrade reflected the firm’s more cautious stance on the company’s near-term growth outlook, suggesting limited upside potential at current valuations.

Compared to its peer, Omnicom Group Inc. (OMC) has outperformed TTD stock. OMC stock has declined 24.6% over the past 52 weeks and has dropped 11.8% on a YTD basis.

TTD has a consensus rating of “Moderate Buy” from the 38 analysts covering the stock. Additionally, the mean price target of $72.94 indicates a premium of 56% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)