For the second consecutive week (at least), I’m going to address some of the questions that have come in of late. Where last week focused on the difficult question in cattle, “Is the climb to new all-time highs by boxed beef being driven by consumer demand or tight supplies?”, this week’s Column is going to cover the big three questions that have come in of late. Some that didn’t make the cut have to do with Brazil’s 2026 soybean crop, a subject I will be covering over the course of the next Q (quarter, in industry terminology), the next US Federal Open Market Committee move (with the September rolling around in three weeks), and the fate of US stock indexes as the key month of October draws nearer on the horizon. Generally speaking, there is time to think about these queries and others. Given Chaos Theory – an unexpected change at a key time can lead to a different result – it’s difficult to look too far into the future. Therefore, it behooves us to focus on the path immediately in front of us, or the results immediately behind us for the view is clearer.

So, let’s move on to today’s issues.

Question #1: Was the August 1 Cattle on Feed report bearish? No. My good friend and cattle industry insider Kyle Bumsted called me early Monday morning. In his line of work, he talks with folks looking to trade cattle – cash, futures, options – on a daily basis. While many of them are supposedly “hedgers”, I spent enough time as a commodities broker to know what that means: A hedge position is only a hedge until it becomes a speculative position. It is with a great deal of historical (hysterical?) observation I can say the favored of those in the cattle markets is the famed Texas Hedge – being long cash cattle and futures.

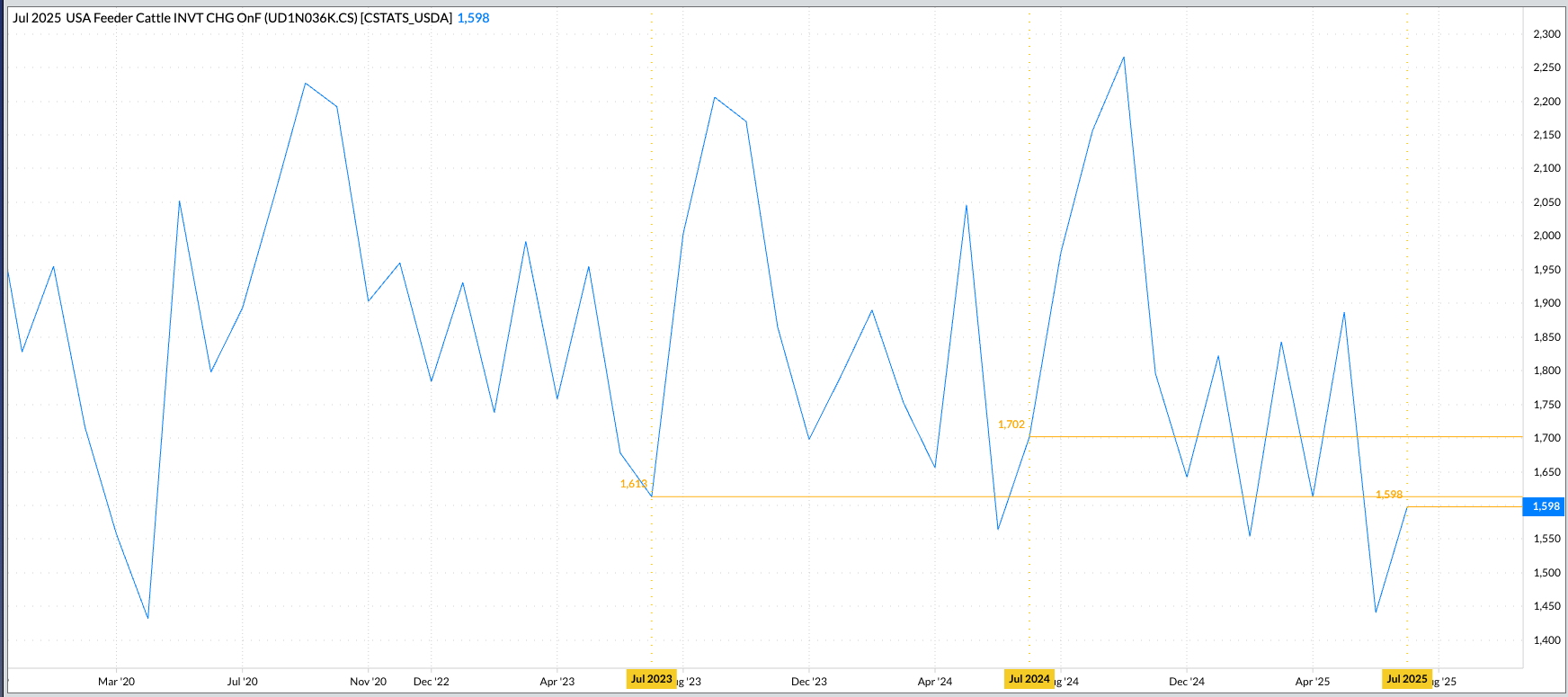

Usually, I find ANY reaction to USDA’s Cattle on Feed reports humorous. Is almost as if those who should know have it wiped from their memory banks that the numbers are at least a month old upon release. The latest round showed marketings and placements that occurred during July, resulting in the number of head still counted in feed yards on Friday, August 1. For the record the report was released on Friday, August 22. It seems the BRACE Industry was squawking about how bearish the placement number of 1.598 million head was. Why? Because it was up 11% from the previous month. Okay. But it’s interesting how this group usually compares to the previous year, which in this case showed July 2025 was down 6% from July 2024 which was down 1% from 2023. In fact, last month’s year-to-year drop in placements was the most since 8% from July 2021 in relation to 2020, the latter coming with a Covid-19 asterisk.

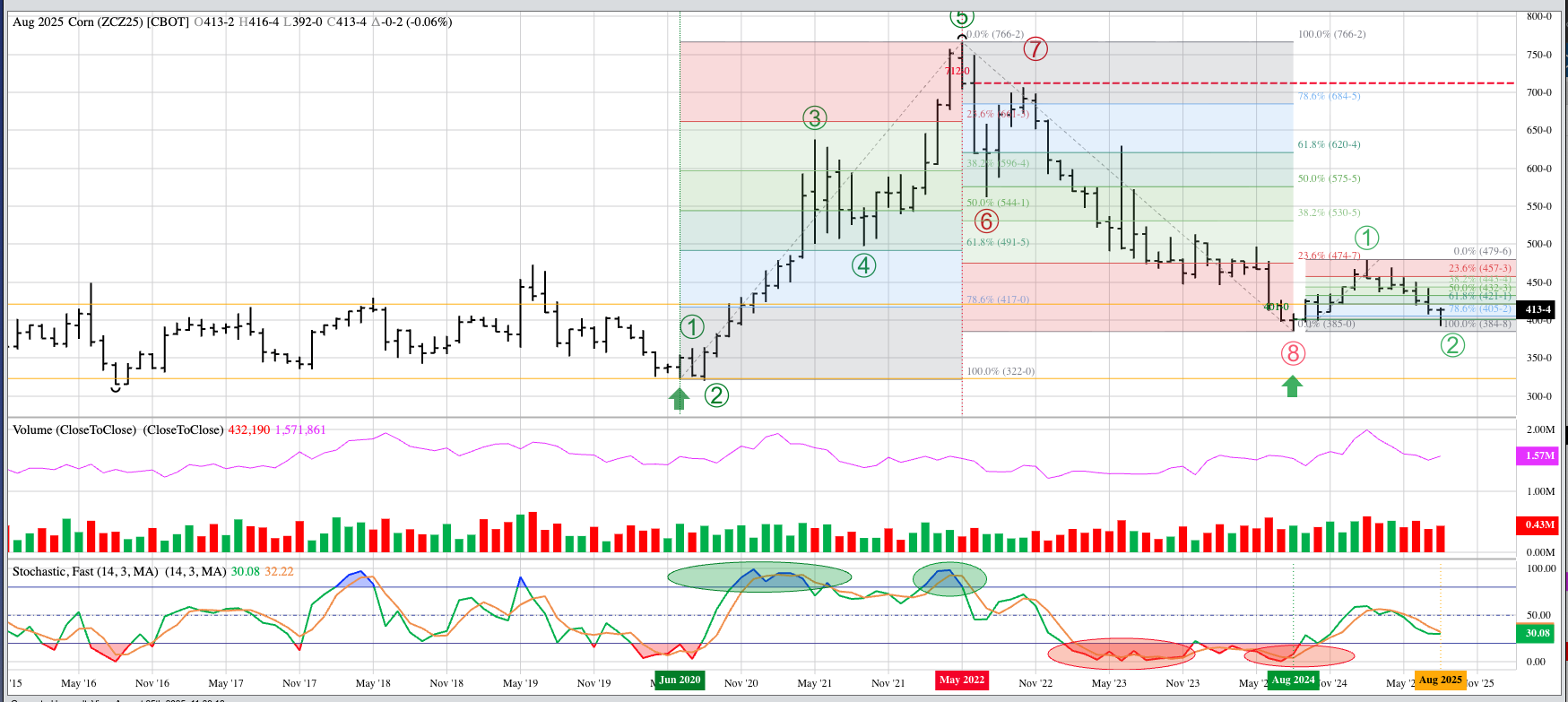

Question #2: Has the December 2025 contract (ZCZ25) bottomed? Yes. We can look at Dec25 from a number of different analytical perspectives:

- Technically

- December corn looks to have moved into a long-term uptrend, or at least a sideways trend, with its August 2024 low of $3.85. Dec25 tested that mark earlier this month with a low of $3.92. All eyes are now on the monthly settlement in relation to the July close of $4.1375.

- Similarly, Dec25 looks to be in the process of establishing an intermediate-term uptrend on its weekly chart. The key will be if it holds the same August low of $3.92 with…

- The short-term trend looking to turn down early this week on Dec25’s daily chart.

- Seasonally

- December corn tends to post a low weekly close the fourth week of August, last week, leading into a seasonal uptrend lasting through the end of November.

- The National Corn Index tends to post a low weekly close the fourth week of September.

- Price Distribution

- The recent low weekly close of $4.0525 put Dec25 in the lower 20% of its 5-year price distribution range, meaning the contract closes at that price or lower only 1 out ever 5 weeks.

- Fundamentally

- Futures spreads in general are neutral.

- However, the longer-term May-July closed last week covering 33% calculated full commercial carry. This tells us there is some concern by the commercial side regarding available supplies in relation to expected demand.

- Watson

- The latest CFTC Commitments of Traders report (legacy, futures only) showed funds held a net-short futures position of 105,210 contract, a decrease of 28,000 contracts from the previous week. Continued short-covering could strengthen an intermediate-term uptrend, bringing to mind…

- Rule #1: Don’t get crossway with the trend.

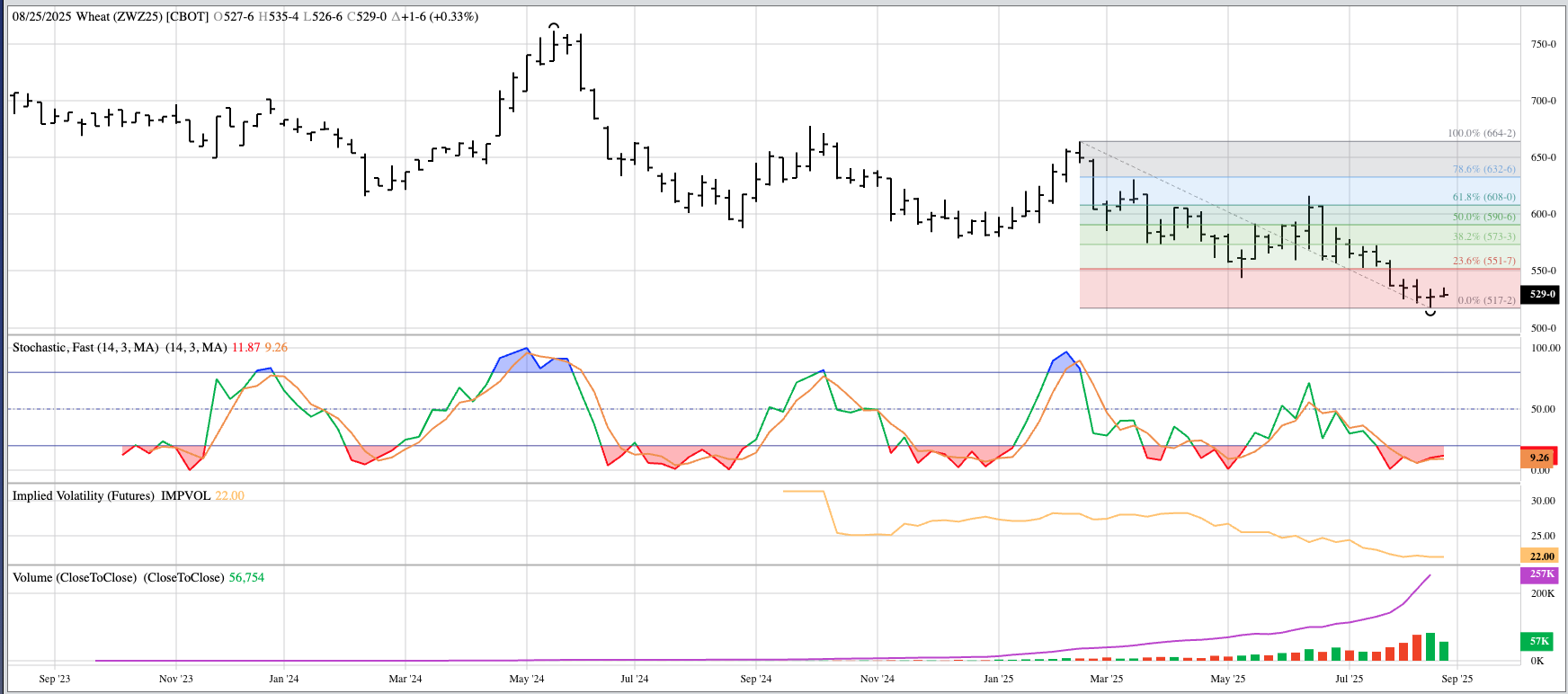

Question #3: Has SRW Wheat turned up? Maybe. I phrased the question this way because SRW is not bullish. Has not been bullish for as far back as I can recall. Yet the December issue (ZWZ25) completed a bullish technical reversal on its weekly chart last week. As I did with corn, let’s take a look at SRW wheat’s various components:

- Technically

- The intermediate-term trend looks to have turned up.

- Watson

- Funds are likely to cover some of the net-short futures position, last reported at 93,620 contracts, an increase of 4,570 contracts from the previous week.

- Why? Because…

- Price Distribution

- Last Friday’s Index ($CSWI) price of $4.48 put it in the lower 25% of its 10-year range.

- Seasonally

- The Index tends to post a low weekly close the fourth week of August, last week, before rallying through the fourth weekly close of May

- Fundamentally

- The SRW wheat market remains neutral-to-bearish

- Basis is bearish

- Futures spreads look to be in a Down Escalator Simulator, meaning the percent of calculated full commercial carry is expected to increase

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)