With a market cap of $145.9 billion, Stryker Corporation (SYK) is a global leader in medical technology. The company operates through its Orthopaedics and MedSurg & Neurotechnology segments, offering innovative products ranging from joint replacement implants to advanced surgical, neurovascular, and patient care solutions across more than 75 countries.

Shares of the Portage, Michigan-based company have underperformed the broader market over the past 52 weeks. SYK stock has increased 13.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.5%. Moreover, shares of the company have risen 7.3% on a YTD basis, compared to SPX's 9.2% return.

Looking closer, Stryker stock has outpaced the Health Care Select Sector SPDR Fund's (XLV) 11.2% decrease over the past 52 weeks.

Despite Stryker beating expectations with Q2 2025 adjusted EPS of $3.13 and revenue of $6.02 billion on Jul. 31, shares fell 3.8% the next day as investors focused on weaker-than-expected Orthopedics sales of $2.3 billion, weighed down by a 97.2% decline in spinal implants.

For the fiscal year ending in December 2025, analysts expect SYK’s adjusted EPS to grow 10.8% year-over-year to $13.50. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

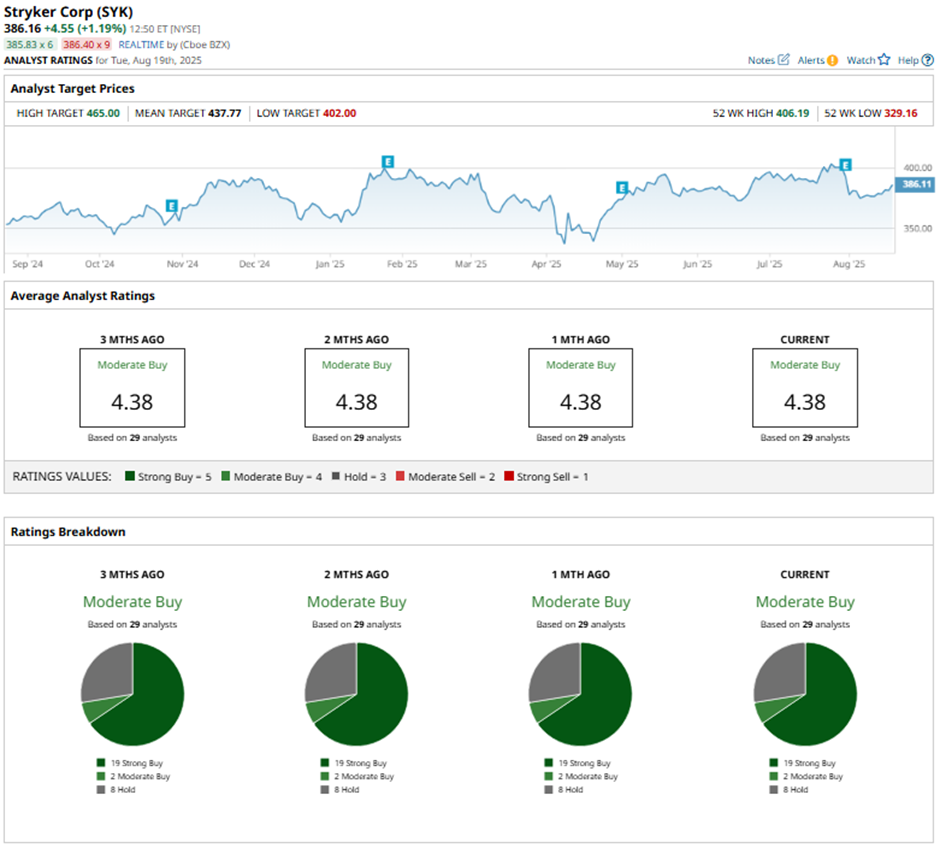

Among the 29 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and eight “Holds.”

On Aug. 1, UBS raised its price target on Stryker to $438 while maintaining a “Neutral” rating.

As of writing, the stock is trading below the mean price target of $437.77. The Street-high price target of $465 implies a modest potential upside of 20.4% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)