/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

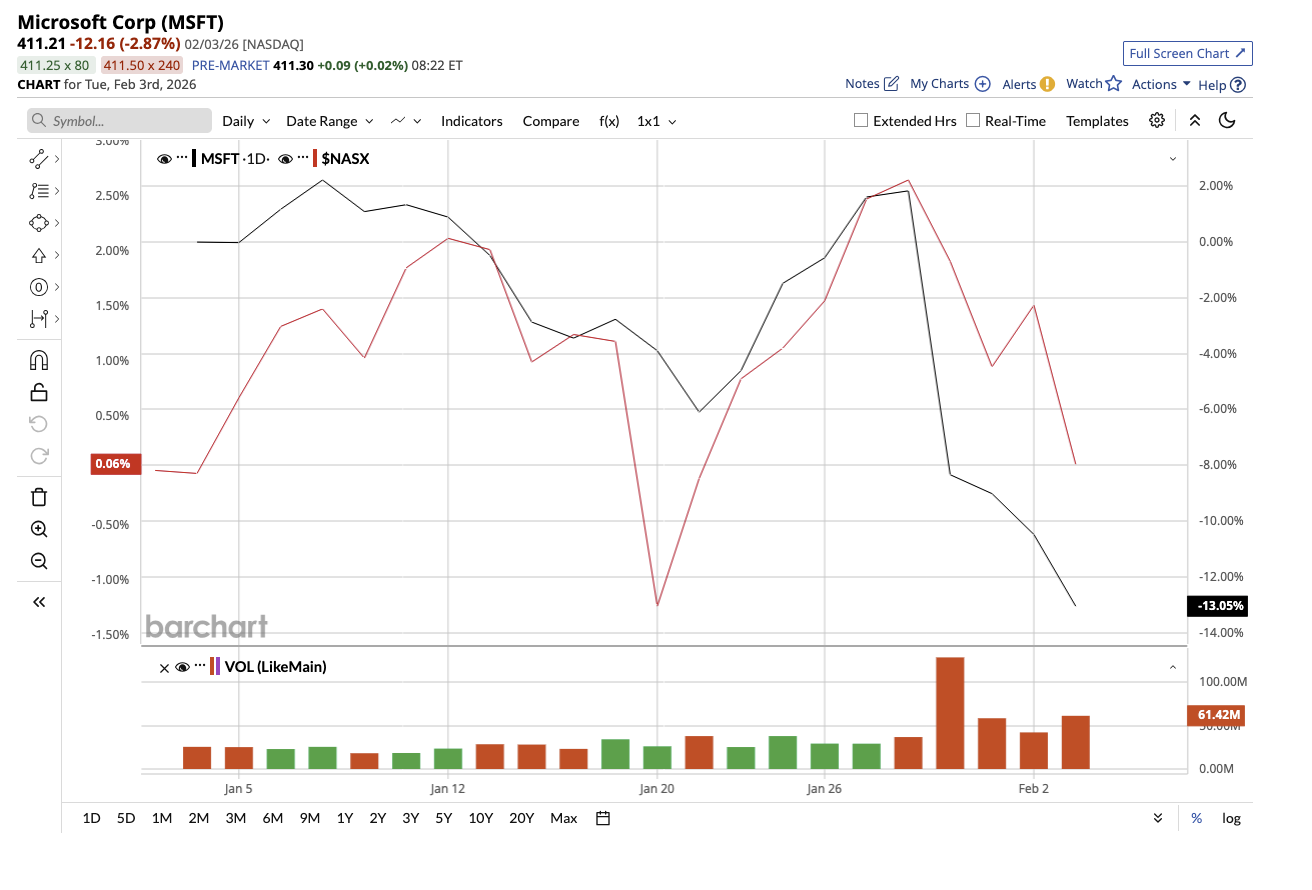

Every earnings season, investors look for proof that legacy tech giants like Microsoft (MSFT) are still a worthy investment for the long term. With its second quarter of fiscal 2026, Microsoft showed that it is still one of the strongest businesses in technology. The company is no longer just a legacy tech giant but a rapidly expanding AI and cloud powerhouse with multiple growth engines firing at once. Valued at $3.05 trillion, Microsoft has dipped 14% so far this year. This could be a good opportunity to grab this AI stock on the dip.

Growth Keeps Rising as AI Strategy Scales

In the second quarter of fiscal 2026, total revenue reached $81.3 billion, up 17% year-over-year (YoY). Earnings per share increased 24% to $4.14, highlighting solid execution in the cloud, AI, and productivity businesses. Operating margins increased to 47% despite significant investments in AI infrastructure. The cloud business surpassed $50 billion in quarterly revenue for the first time, growing 26% YoY. Management stated that cloud demand continues to surpass supply, owing largely to AI workloads and enterprise adoption across industries. Commercial bookings rose 23%, and remaining performance obligations reached $625 billion, providing a massive backlog of future revenue.

CEO Satya Nadella stated that Microsoft is redesigning its global infrastructure to support large-scale AI workloads. In a single quarter, the company added roughly one gigawatt of data center capacity, which included new AI-optimized facilities connected via enhanced networking. Investments in custom chips such as Maya 200 and Cobalt 200 are helping improve performance while lowering the total cost of ownership, positioning Microsoft to scale AI workloads more efficiently than competitors. The company announced new data center investments in seven countries, as well as enhanced solutions for public, private, and national partner clouds.

AI Is Becoming a Massive New Revenue Engine

Management emphasized that AI is still in its early stages but already larger than some of the company’s legacy businesses. The company is building its AI strategy across three layers: infrastructure, agent platforms, and high-value experiences. It described agents as the "next generation of applications." Foundry and Fabric, which enable AI model deployment and enterprise data integration, are gaining traction. Fabric today has over 31,000 clients, generates more than $2 billion in annual run-rate revenue, and increased over 60% YoY, making it Microsoft's fastest-growing analytics platform. The number of customers paying more than $1 million each quarter on Foundry increased by roughly 80%, and over 250 customers are anticipated to process more than one trillion tokens this year.

Furthermore, Copilot is emerging as one of Microsoft’s fastest-growing products. Daily users of the consumer Copilot app nearly tripled YoY, while enterprise adoption surged. Microsoft now has 15 million paid Microsoft 365 Copilot seats, with seat additions up 160% YoY. GitHub Copilot also gained traction, reaching 4.7 million paid subscribers, up 75% YoY. Subscriptions to Copilot Pro Plus grew 77% quarter over quarter, driven by strong demand for AI-powered coding tools.

Microsoft’s core business segments have also benefitted from the integration of AI. Revenue for the Productivity and Business Processes segment reached $34.1 billion, an increase of 16% YoY. Microsoft 365 commercial cloud grew 17%, driven by E5 and Copilot adoption. Dynamics 365 rose 19%, while LinkedIn revenue increased 11%. The Intelligent Cloud segment revenue climbed by 29% to $32.9 billion, with Azure and other cloud services growing 39%. However, revenue for More Personal Computing declined 3% to $14.3 billion, with gaming revenue down 9% and search advertising growing 10%.

Microsoft invested heavily in infrastructure, with $37.5 billion in capital expenditures, two-thirds of which went toward short-lived assets such as GPUs and CPUs. Despite the heavy investments, it returned $12.7 billion to shareholders through dividends and buybacks. For the next quarter, Microsoft expects revenue between $80.65 billion and $81.75 billion, representing 15% to 17% growth. Azure is expected to increase by 37% to 38%, while Microsoft 365 commercial cloud may expand by 13% to 14%. Microsoft anticipates robust cloud and AI growth to continue throughout the fiscal year, despite ongoing substantial investment in data centers, silicon, and AI expertise.

Analysts predict a 16.4% increase in revenue and a 22.8% increase in earnings for fiscal 2026. Revenue and earnings are expected to increase by 15.4% and 12.7% in fiscal 2027. Trading at 21 times forward earnings, Microsoft is a reasonable buy now.

With record cloud revenue, accelerating Copilot adoption, and massive infrastructure investments, the company is positioning itself to capture long-term growth across every layer of the technology stack. Microsoft just proved that it can invest aggressively in the future while still delivering rising cash flows and shareholder returns, highlighting why it remains a must-own stock for long-term investors.

What Are Analysts Saying About MSFT Stock?

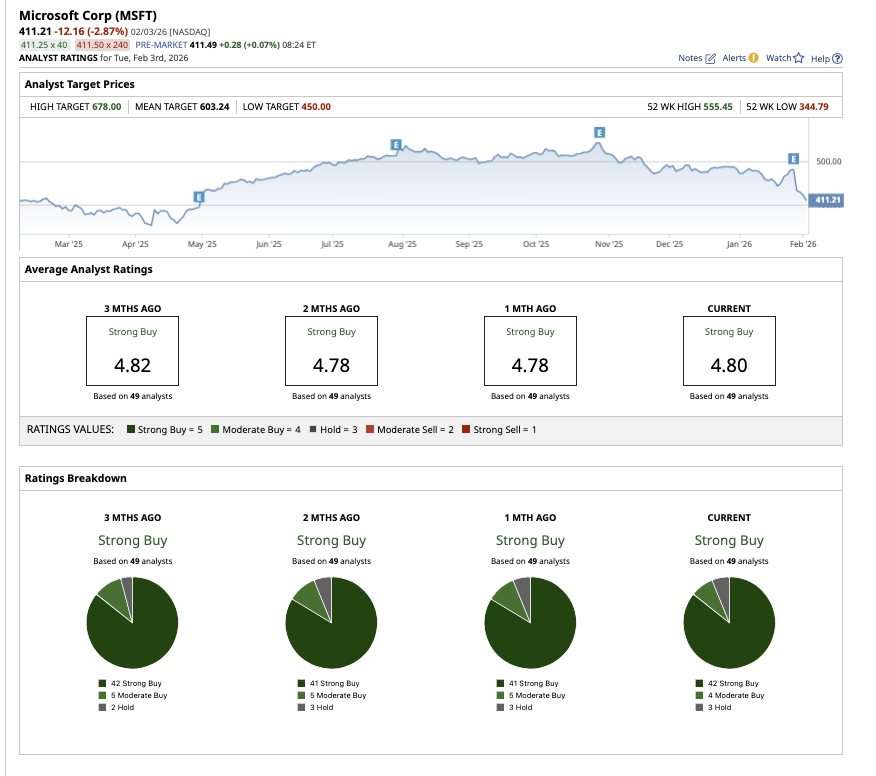

Recently, Citi maintained its “Buy” rating on Microsoft but trimmed its price target to $635 from $660. The firm noted that while Azure delivered a modest beat, CoPilot adoption continues to accelerate, highlighting confidence in Microsoft’s long-term AI-driven growth story. Despite Piper Sandler’s pessimism around software stocks, Microsoft remains the firm’s top pick with an “Overweight” rating and a target price of $600.

Overall, Wall Street is optimistic about MSFT stock, assigning it a consensus “Strong Buy” rating. Of the 49 analysts covering MSFT stock, 42 have a “Strong Buy” recommendation, four suggest a “Moderate Buy,” and three rate it a “Hold.” The average price target of $603.24 implies the stock has 47% potential upside from current levels. The Street-high price target of $678 suggests the stock could rally as much as 65% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)