With a market cap of $20.6 billion, Invitation Homes Inc. (INVH) is a real estate investment trust (REIT) that engages in owning, renovating, leasing, and operating single-family residential properties. Based in Dallas, Texas, the company has approximately 85,138 homes for lease, and also manages properties on behalf of others.

Companies worth $10 billion or more are generally labeled as “large-cap” stocks, and Invitation Homes fits this criterion perfectly. The company focuses on providing long-term housing solutions, emphasizing resident satisfaction, operational efficiency, and sustainable community growth.

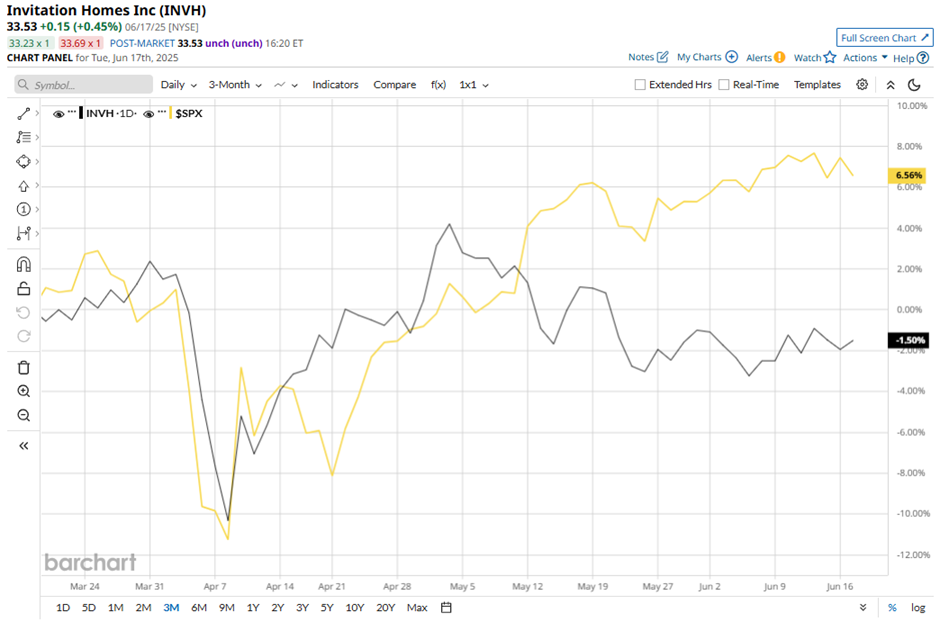

Invitation Homes stock has dropped 11.3% from its 52-week high of $37.80. Shares of INVH have decreased marginally over the past three months, underperforming the S&P 500 Index’s ($SPX) 5.4% increase.

Longer term, shares of Invitation Homes have dipped 5.6% over the past 52 weeks, notably lagging behind the SPX's 9.3% return over the same time frame. However, INVH stock has returned 4.9% on a YTD basis, outpacing the SPX, which has risen 1.7%.

Despite recent fluctuations, the stock has been trading above its 50-day moving average since late February.

Invitation Homes’ stock rose 2.7% following the release of its strong Q1 2025 results on Apr. 30. The company reported revenues of $674 million, up 4.4% year-over-year, exceeding the consensus estimate of $669.4 million. Its core FFO came in at $0.48 per share, marking a 2.1% increase year-over-year and beating analysts’ expectations. Adjusted FFO stood at $0.42 per share, up 2.4% from the prior-year quarter.

Looking ahead to fiscal 2025, Invitation Homes expects core FFO to range between $1.88 per share and $1.94 per share, in line with Wall Street forecasts. It also anticipates joint venture acquisitions between $100 million and $200 million, with AFFO projected in the range of $1.58 to $1.64 per share.

In contrast, rival Essex Property Trust (ESS) has lagged behind INVH stock on a YTD basis, declining marginally. Although shares of ESS have increased marginally over the past 52 weeks, outperforming INVH stock.

Although INVH has underperformed relative to SPX over the past year, analysts are moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 23 analysts covering it, and it is currently trading below the mean price target of $37.69.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)