/Cintas%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Cincinnati, Ohio-based Cintas Corporation (CTAS) provides corporate identity uniforms and related business services. With a market cap of $74.7 billion, the company sells uniforms and work apparel, as well as entrance mats, restroom supplies, promotional products, document management, fire protection, and first aid and safety services.

Shares of this leading provider of corporate identity uniforms and related services have underperformed the broader market over the past year. CTAS has declined 4.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.7%. However, in 2026, CTAS stock is up 5.3%, compared with SPX’s marginal YTD rise.

Narrowing the focus, CTAS has also lagged behind the State Street Industrial Select Sector SPDR Fund (XLI). The exchange-traded fund has gained about 27.1% over the past year and 13.7% in 2026.

On Feb. 10, Cintas shares rose more than 2% following a Bloomberg report that UniFirst Corp. (UNF) is in active acquisition discussions with Cintas. The potential deal would further consolidate the uniform and workplace services industry, strengthening Cintas’ scale advantages and customer reach while potentially unlocking cost and cross-selling synergies.

For the current fiscal year, ending in May 2026, analysts expect CTAS’ EPS to grow 10.7% to $4.87 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

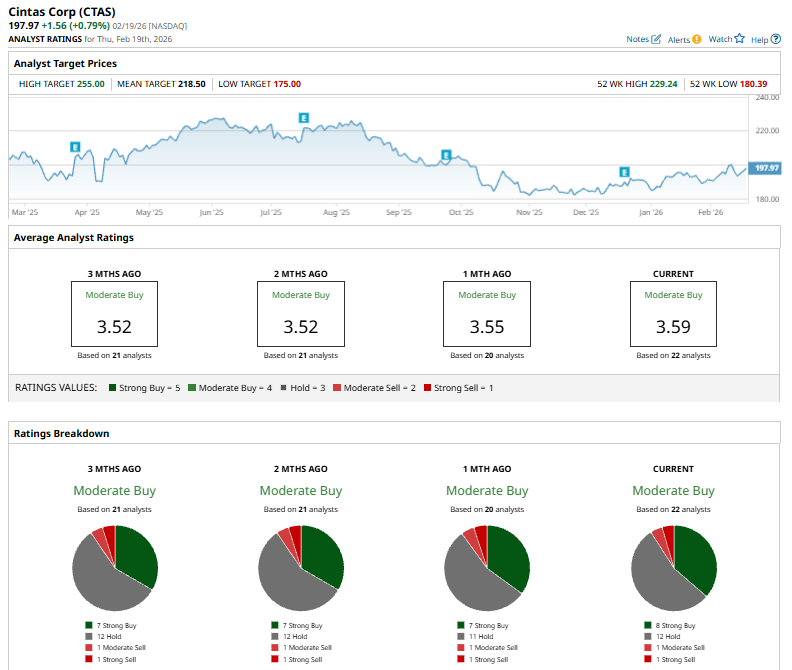

Among the 22 analysts covering CTAS stock, the consensus is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, 12 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

This configuration is bullish than a month ago, with seven analysts suggesting a “Strong Buy.”

On Jan. 14, Wells Fargo upgraded Cintas to “Overweight” from “Equal-Weight” and raised its price target to $245 from $205, naming it a top business and information services pick for 2026. The firm believes the stock’s 2025 multiple compression has created an attractive entry point, with strong fundamentals expected to reassert in 2026, supported by Cintas’ pricing power.

The mean price target of $218.50 represents an 10.4% premium to CTAS’ current price levels. The Street-high price target of $255 suggests a notable upside potential of 28.8%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)