Visa (V) is making significant moves in the cryptocurrency space, with the stock closing today’s session up more than 2% after Coinbase (COIN) said the company is in talks with Sam Altman's World Network to integrate stablecoin payment capabilities into a self-custody wallet - a strategic move that would potentially enable stablecoin-based payments across Visa's extensive global merchant network.

Today’s gain continues the positive momentum in V stock so far this year, with shares up 9.1% in 2025. That outperforms a decline of about 2% for the broader S&P 500 Index ($SPX) over the same time frame. After today’s advance, the stock is looking to reestablish a foothold above both its 20-day and 50-day moving averages.

Visa’s Strategic Push Into Digital Payments

Visa’s collaboration with World Network aims to transform the World Wallet into a comprehensive financial tool, offering services from foreign exchange to crypto trading. This aligns with broader institutional trends, as 83% of institutions plan to increase their crypto holdings in 2025, indicating growing mainstream acceptance of digital payment solutions.

These strategic moves position Visa at the forefront of the evolving payment industry landscape, particularly as the crypto payments sector sees increased competition and innovation. The fintech company's proactive approach to embracing blockchain technology and cryptocurrency integration suggests a clear vision for the future of digital finance and payments.

Visa’s strategic positioning is further strengthened by its backing of Rain, a global card issuing platform that recently secured $24.5 million in funding led by Norwest Venture Partners. Rain's achievement of Visa Principal Membership status for card issuance across Europe, the U.S., and Latin America demonstrates Visa's commitment to expanding its digital payment infrastructure globally. The timing of these developments is particularly significant, as stablecoin transfers have recently surpassed the combined transaction volume of Visa and Mastercard (MA).

Visa Stock is Buffett-Approved

While legendary investor Warren Buffett has been notoriously shedding equities and hoarding cash in recent quarters, Visa stock still accounts for a solid 1.0% of the Berkshire Hathaway (BRK.A) (BRK.B) equity portfolio.

Notably, the stakes in both Visa and Mastercard were initiated by Berkshire portfolio managers Todd Combs and Ted Weschler, though Buffett has said of the investments, “I could have bought them as well, and looking back, I should have.”

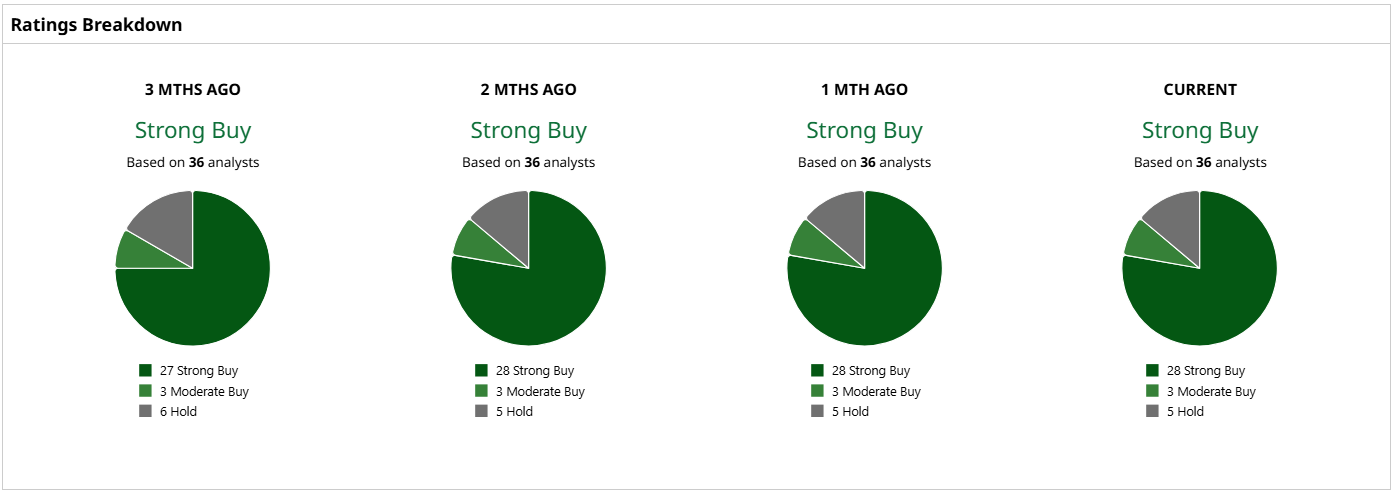

Wall Street analysts have also given Visa a nod of approval, with a consensus rating of “Strong Buy” among the 36 in coverage. The average price target for V stock is $382.76, a premium of 11.3% to current levels.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)