The US dollar index continues to trend lower, with headlines talking of how the rest of the world has lost confidence in the United States.

US stock indexes were lower to start the week, though stock index futures were higher pre-dawn.

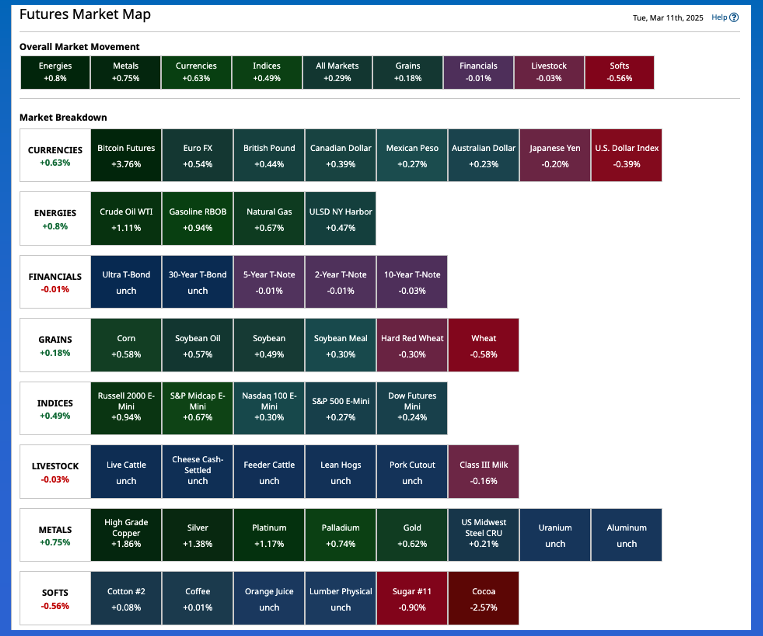

The Grains sector was quietly mixed to start the day.

Morning Summary: I’m going to ruffle some feathers in the industry, intentionally I might add, with the first sentence of this Commentary: The US dollar index ($DXY) is showing signs of some Turnaround Tuesday activity pre-dawn. Okay, now that a certain segment of the industry has spit out its coffee (though it is too expensive to do these days) and my late friend Gary Wilhelmi has done another rotation in his grave, what I’m saying is the greenback is under considerable pressure early Tuesday morning after barely closing higher Monday. A quick check of headlines shows the consistent theme the rest of the world has lost confidence in the United States, not surprising given the constant bluster over trade wars and tariffs (among other things). On the other hand, the Japanese yen (JPYUSD) and euro (EURUSD) have found renewed buying interest, the former going to a new 4-month high already this month with the latter closing in on its 4-month mark. In other news, after US stock indexes posted solid selloffs to start the week, US stock index futures were showing small gains early Tuesday morning. (No, I won’t say it again, but you know.) April gold (GCJ25) has also erased Monday’s $15 selloff, the contract sitting $17 higher pre-dawn.

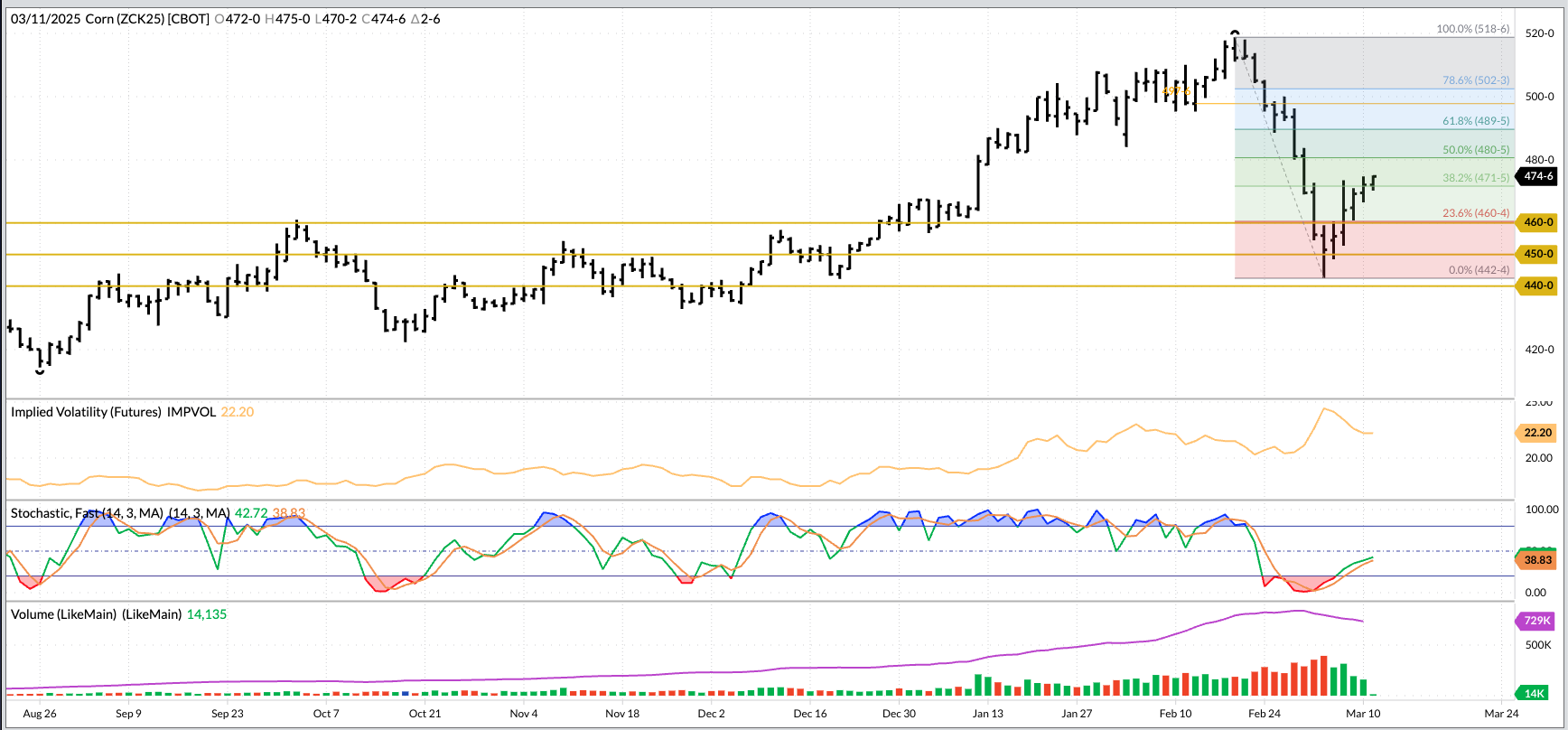

Corn: The corn market was quietly active again overnight as the May issue (ZCK25) posted a 4.5-cent trading range on trade volume of only 12,000 contracts. May rallied as much as 2.75 cents and was sitting 1.5 cents higher at this writing. A look at the overnight trading range shows a low of $4.7025, fittingly enough given corn’s characteristic Round Number Reliance. Technically, for what that’s worth these days, if May is able to extend the short-term uptrend on its daily chart it would look like a Wave B (second wave) of the intermediate-term 3-wave downtrend on its weekly chart. What this tells us is eventually May should take out its Wave A low, last week’s low, of $4.4250. Fundamentally the market is building support, though. The National Corn Index came in Monday evening at $4.3625 putting national average basis at 35.75 cents under May futures as compared to last Friday’s final figure of 37.0 cents under. The previous 5-year (and 10-year) low weekly close for this week is 43.75 cents under May. As for new-crop, the Dec25 issue was showing a gain of 1.0 cent, 0.5 cent off its session high while holding between the lower round number of $4.50 and upper mark of $4.60.

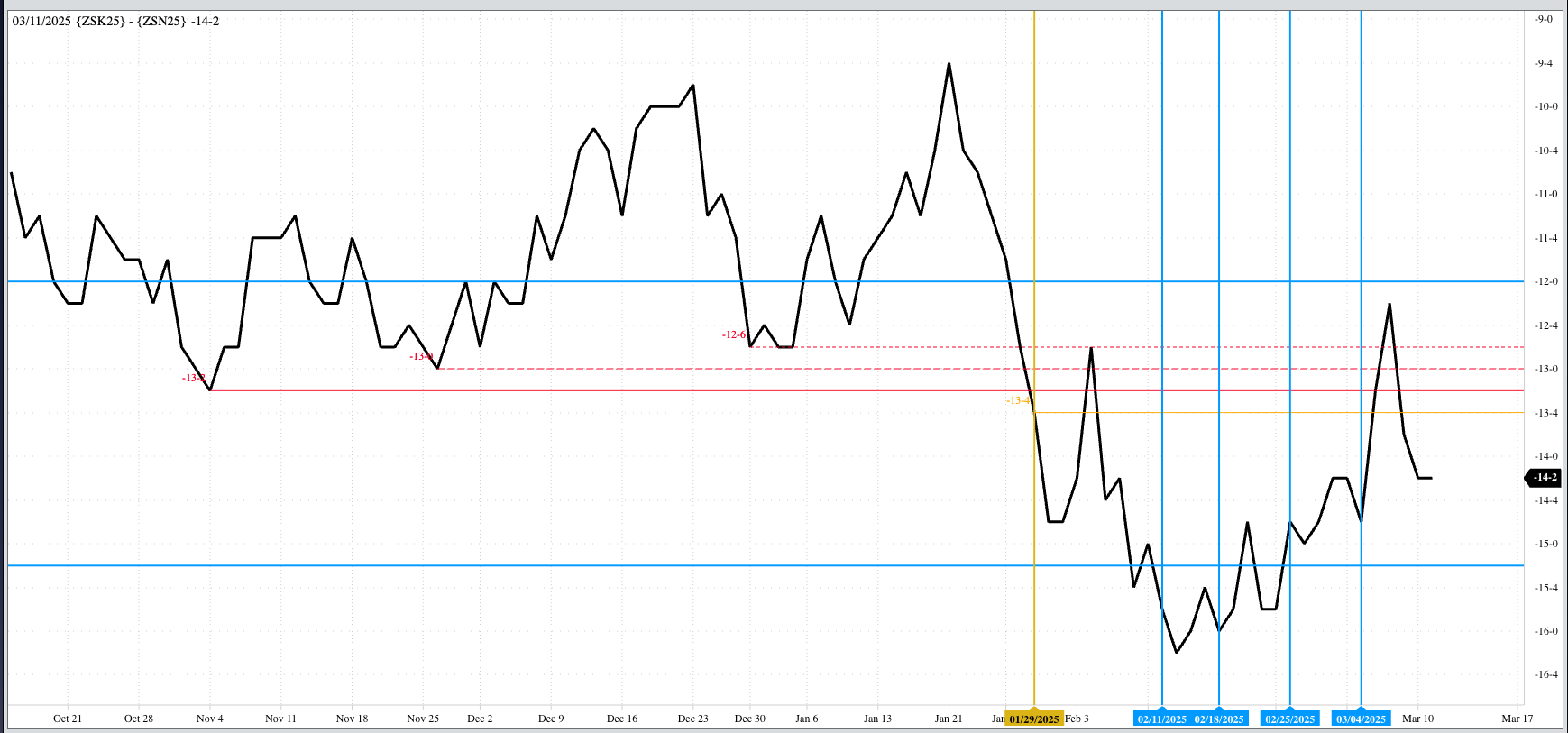

Soybeans: The soybean market was in the green pre-dawn, recovering part of what was lost to open the week. Recall May finished Monday’s session down 11.0 cents while the carry in the May-July futures spread firmed by 0.5 cent indicating pressure came from both noncommercial and commercial traders. However, the National Soybean Index ($CNSI) was calculated at $9.4825 Monday evening, down 10.25 cents from last Friday’s figure meaning national average basis firmed by 0.75 cent. Before we get overly excited, the Index also put available-stocks-to-use at 17.6% as compared to 17.4% at the end of February and 10.6% at the end of March 2024. In other words, the US has ample supplies on hand to meet domestic demand. Technically speaking, the May issue looks to be in a short-term uptrend meaning Watson is likely covering some of its net-short futures position, reported as of last Tuesday near 34,300 contracts, an increase of 23,700 contracts from the previous week. For the record, since last Tuesday’s settlement May had gained 15.0 cents through Monday’s close of $10.14. Over in the new-crop market, Nov25 was showing a gain of 3.75 cents to start the day, one tick off its overnight high.

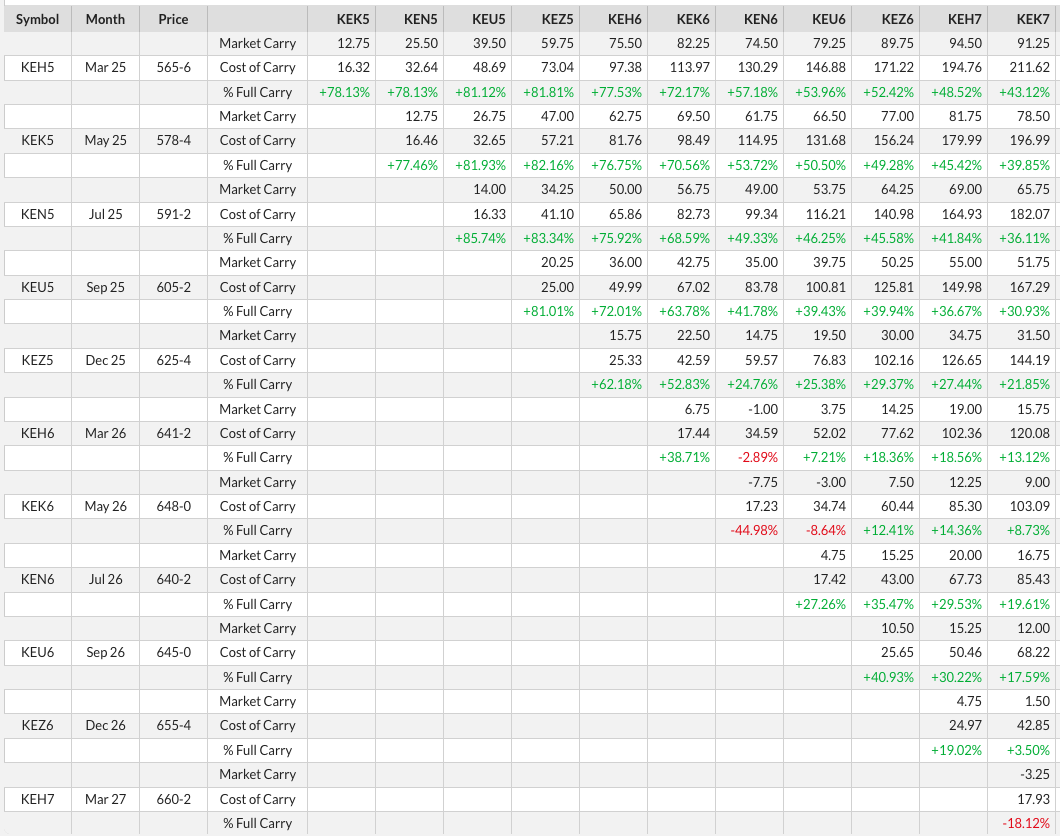

Wheat: The wheat sub-sector was in the red to start the day. Why? There are 3 easy answers to explain the 3 complicated wheat markets: 1) Because all three closed higher Monday. 2) Because both winter markets remain fundamentally bearish. 3) It’s wheat, the markets don’t have to have a reason to do anything day-to-day. I’m not going to spend much time on the old-crop May SRW and HRW contracts, just long enough to say these were down 1.25 cents and 2.5 cents respectively early Tuesday. I’ll quickly turn my attention to new-crop where we see July HRW down 2.25 cents after sliding as much as 4.5 cents overnight on trade volume of less than 1,000 contracts. We have to ask ourselves if a “major” market doesn’t reach 1,000 contracts changing hands, did it even trade? The key takeaway for HRW is Monday’s close saw the July-September futures spread covering 86% calculated full commercial carry while the September-December covered 81%. It was a similar story in SRW where the July issue was sitting 2.75 cents lower pre-dawn on trade volume of less than 3,000 contracts. The same two futures spreads closed Monday covering 73% and 64% respectively. May HRS (MWK25) was down 6.0 cents to start the day.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)