Artificial intelligence (AI) is rapidly transforming our world, promising to revolutionize everything from human interaction and environmental stewardship to space exploration. This technological revolution, driving us toward what's known as Industry 5.0 (the next phase of industrialization, characterized by human-centric, sustainable, and resilient production through human-machine collaboration), is creating immense opportunities for innovative companies.

Two such companies at the forefront of this AI-powered future are chipmaker Nvidia (NASDAQ:NVDA) and ASML (NASDAQ:ASML), a lithography giant specializing in extreme ultraviolet (EUV) technology. Both have already seen significant growth thanks to the AI boom, but their potential for future returns remains strong.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Which of these top AI stocks is the better buy right now? Let's break down their core value propositions and risk factors to find out.

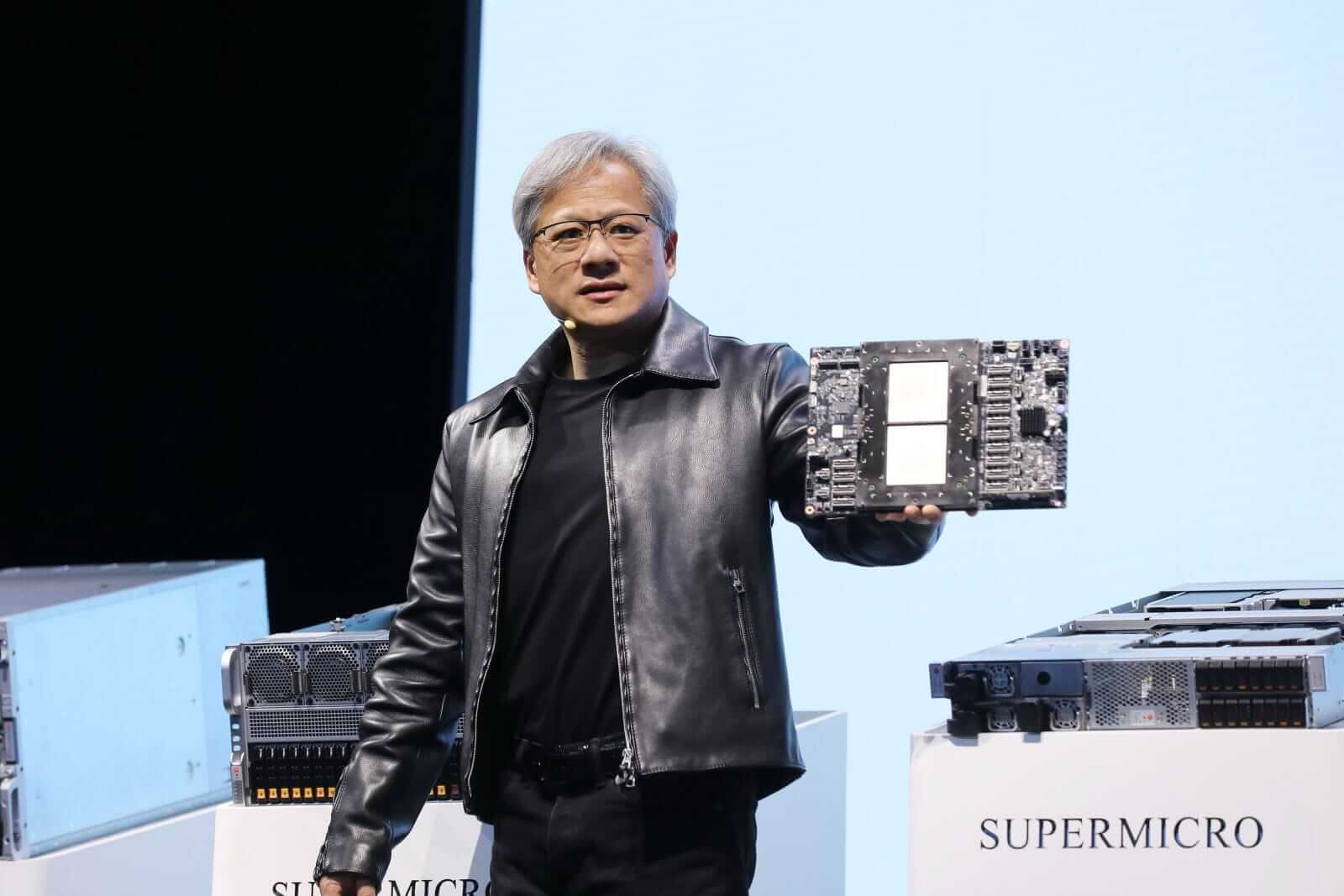

Image source: Getty Images.

Nvidia: The chipmaker making the AI revolution possible

Nvidia is the dominant force in AI hardware, powered by its industry-leading graphics processing units (GPUs) and Compute Unified Device Architecture (CUDA) -- a software platform that enables developers to harness GPU computing power for AI applications. This powerful combination creates a wide competitive moat, though competition from other chipmakers and potential alternative AI solutions pose long-term risks.

Beyond hardware, Nvidia is strategically expanding into AI software and robotics, particularly in healthcare, diversifying its revenue streams and strengthening its position in the broader AI ecosystem. However, the emergence of potentially more efficient AI models like China's DeepSeek and the cyclical nature of its gaming GPU business create uncertainty around near-term demand.

Trading at approximately 30 times forward earnings compared to the S&P 500's (SNPINDEX:$SPX) 24 times, Nvidia's premium valuation reflects its strong position in the AI market. The tech stock also pays a minimal dividend yield of 0.03%, meaning its shares are better used as a growth vehicle rather than an income generator.

In short, Nvidia's value proposition lies in its AI leadership and ongoing ecosystem expansion, with key risks including competition, evolving AI technologies, and gaming market cycles.

ASML: A monopoly at the heart of the AI boom

ASML is the undisputed leader in lithography equipment, holding a near-monopoly on the crucial extreme ultraviolet (EUV) technology required for manufacturing the most advanced chips. This dominance creates a wide economic moat, driven by substantial R&D investments and deep relationships with key customers like Taiwan Semiconductor Manufacturing (TSMC), Intel, and Samsung, making it incredibly difficult for competitors to emerge.

ASML's machines, while expensive, deliver value to chipmakers by reducing the cost per wafer through increased productivity. The long lifespan of these machines, often exceeding 30 years, generates significant recurring revenue through service contracts and high-margin upgrades, further bolstering ASML's financial strength.

However, ASML's stock trades at a premium to the S&P 500, with a forward earnings multiple of 29.3 times, reflecting its crucial role in the semiconductor industry and the ongoing AI boom. While the stock's dividend yield is a modest 0.95%, the company's growth prospects and dominant market position are the primary drivers of investor interest.

Despite its strong position, ASML faces some risks. The cyclical nature of the semiconductor industry can impact demand for its high-priced equipment. Additionally, increasing geopolitical tensions and potential export restrictions, particularly concerning China, could negatively affect ASML's growth trajectory.

Which stock is the better buy?

While both companies are exceptionally well-positioned in the AI revolution, ASML emerges as the more compelling investment at current valuations. Its monopolistic position in EUV technology makes it essential to all major chipmakers, including Nvidia. This unique market position, combined with its robust recurring revenue model and slightly lower valuation multiple, provides a more balanced risk-reward profile.

Nvidia remains an outstanding company with tremendous growth potential, but its direct exposure to AI market sentiment and gaming cycles introduces more near-term volatility. ASML's fundamental role in semiconductor manufacturing offers a similar tailwind with greater insulation from market swings, making it the better choice for investors seeking AI exposure with a wider margin of safety.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $336,677!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,109!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $546,804!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

George Budwell has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends ASML, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short February 2025 $27 calls on Intel. The Motley Fool has a disclosure policy.